Rising a enterprise requires funding capital. When firms are scaling, they want cash to launch merchandise, rent workers, help clients, and broaden operations. This sentiment is true now greater than ever with the collective U.S. enterprise debt to fairness ratio amounting to 92.6% (.93) in Q1 of 2021. The pattern exhibits that companies are rising due to a wholesome stability of debt and fairness.

There are quite a few methods to boost capital, and every could have a unique impression in your firm and the tempo at which you develop. The most typical approach to increase capital is thru both fairness or debt. However what do every of those entail? And the way do they assist what you are promoting’ monetary standing? Nicely, you are in luck, as a result of we’ll have a look on this definitive information to demystifying the debt to fairness ratio.

There are quite a few methods to boost capital, and every could have a unique impression in your firm and the tempo at which you develop. The most typical approach to increase capital is thru both fairness or debt. However what do every of those entail? And the way do they assist what you are promoting’ monetary standing? Nicely, you are in luck, as a result of we’ll have a look on this definitive information to demystifying the debt to fairness ratio.

Debt to Fairness Ratio

The debt to fairness ratio is a measure of an organization’s monetary leverage, and it represents the quantity of debt and fairness getting used to finance an organization’s property. It is calculated by dividing a agency’s whole liabilities by whole shareholders’ fairness.

Leverage is the time period used to explain a enterprise’ use of debt to finance enterprise actions and asset purchases. When debt is the first approach an organization funds its enterprise, it is thought-about extremely leveraged. If it is extremely leveraged, the debt to fairness ratio tends to be larger.

It is very important be aware the debt to fairness ratio will fluctuate throughout industries. It’s because several types of companies require totally different ranges of debt and capital to function and scale.

Key Takeaways

- The debt to fairness ratio compares a company’s liabilities to its shareholders’ fairness and is used to gauge how a lot debt or leverage the group is utilizing.

- Excessive ratios point out to lenders that a company could also be too dangerous to spend money on.

- Traders might select to concentrate on a company’s long-term debt to fairness ratio to identify a lot larger dangers.

- Debt to fairness ratios will fluctuate based mostly on business.

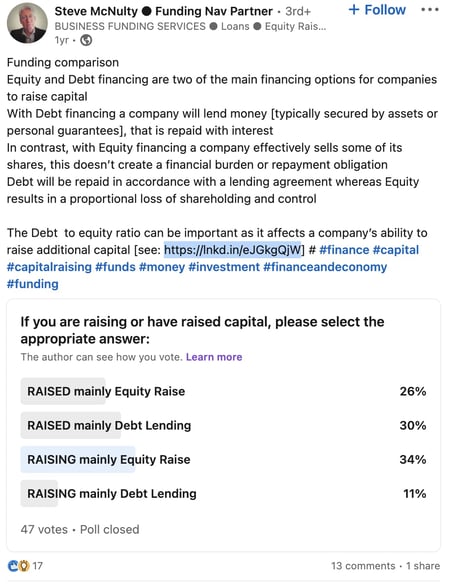

In a LinkedIn ballot performed by Steve McNulty, Associate at Funding Nav, 34% of respondents are at present elevating capital by means of fairness, whereas the vast majority of those that have raised capital prior to now did so by means of debt. Granted, this ballot is proscribed and gained’t converse to all companies, nevertheless it does give us a peek behind the monetary curtain. The attention-grabbing half about McNulty’s findings lies inside the feedback below his ballot. The enterprise homeowners weren’t essentially contemplating the stability between these two kinds of funding and what that stability seems like of their industries.

For instance, an attire firm that requires textiles to create the product, labor to assemble the clothes, warehouses to retailer their merchandise, and brick-and-mortar shops to promote the product to clients is probably going going to hold extra debt than a tech firm that delivers all of its merchandise on-line and doesn’t have to fret about storing bodily merchandise or sustaining a customer-facing bodily area. These issues will significantly impression the debt to fairness ratio of those two firms.

Why is debt to fairness ratio essential?

The debt to fairness ratio is an easy formulation to indicate how capital has been raised to run a enterprise. It is thought-about an essential monetary metric as a result of it signifies the steadiness of an organization and its capability to boost extra capital to develop.

As an entrepreneur or small enterprise proprietor, this ratio is used when making use of for a mortgage or enterprise line of credit score.

For traders, the debt to fairness ratio is used to point how dangerous it’s to spend money on an organization. The upper the debt to fairness ratio, the riskier the funding.

To additional make clear the ratio, let’s outline debt and fairness subsequent.

What’s debt?

Debt is an quantity owed for funds borrowed from a financial institution or personal lender. The lender agrees to lend funds to the borrower upon a promise by the borrower to pay again the cash in addition to curiosity on the debt — the curiosity is normally paid at common intervals. A enterprise acquires debt in an effort to use the funds for working wants.

An organization usually wants laborious property to borrow cash from a financial institution or personal lender. A tough asset is a receivable for a services or products delivered that’s acknowledged on the corporate’s stability sheet and exhibits a lender the enterprise is able to paying again the mortgage. If an organization is new or would not have laborious property it is harder to borrow.

What’s fairness?

Fairness is inventory or safety representing an possession curiosity in an organization. Put merely, it is your possession in an asset — comparable to an organization, property, or automobile — after your debt on that asset is paid.

When a enterprise makes use of fairness financing, it sells shares of the corporate to traders in return for capital. To be taught extra about funding choices, take a look at this information to entrepreneurship.

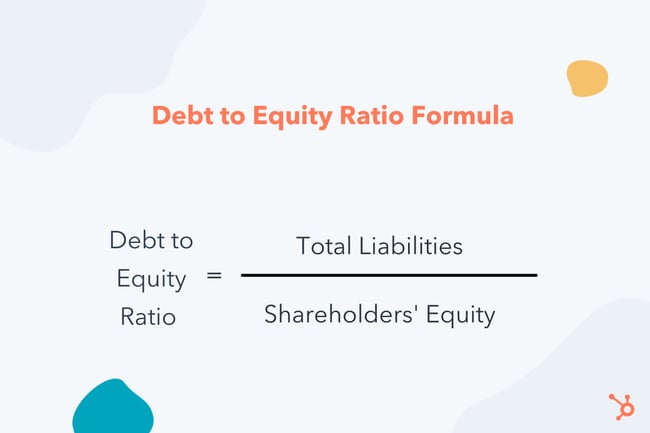

Debt to Fairness Ratio System

Now that we have outlined the debt to fairness ratio, we’ll check out the right way to use it. Under is the formulation to calculate the debt to fairness ratio:

Listed below are the 2 parts that make up the formulation:

- Complete liabilities: Complete liabilities characterize all of an organization’s debt, together with short-term and long-term debt, and different liabilities (e.g., bond sinking funds and deferred tax liabilities).

- Shareholders’ fairness: Shareholders’ fairness is calculated by subtracting whole liabilities from whole property. Complete liabilities and whole property are discovered on an organization’s stability sheet.

Different Debt to Fairness Ratio Formulation to Think about

Relying on what metrics you would like to guage, it’s possible you’ll want to make use of a unique formulation. To match an organization’s short-term liquidity use the money ratio:

Money ratio = money + marketable securities/short-term liabilities

The money ratio is used to guage the flexibility of a company to pay its short-term obligations with money. If the ratio comes out larger than 1, it means the group has sufficient money to cowl its money owed. If lower than 1, the group has extra short-term money owed than money.

Moreover you possibly can choose to make use of the present ratio:

Present ratio = short-term property/brief time period liabilities

The present ratio additionally evaluates a company’s short-term liquidity, and compares its present property to its present liabilities. It evaluates a company’s capability to pay its money owed and obligations inside a 12 months.

Quick-term debt can embody wages, funds to suppliers,or short-term notes payable. Quick-term liabilities are thought-about much less danger as a result of they’re usually paid inside a 12 months.

Debt to Fairness Ratio Instance

As an instance a software program firm is making use of for funding and must calculate its debt to fairness ratio. Its whole liabilities are $300,000 and shareholders’ fairness is $250,000.

This is what the debt to fairness ratio would appear like for the corporate:

Debt to fairness ratio = 300,000 / 250,000

Debt to fairness ratio = 1.2

With a debt to fairness ratio of 1.2, investing is much less dangerous for the lenders as a result of the enterprise is just not extremely leveraged — which means it isn’t primarily financed with debt.

How will you inform what your debt to fairness ratio ought to be? We’ll go over that subsequent.

What is an effective debt to fairness ratio?

An excellent debt to fairness ratio is round 1 to 1.5. Nonetheless, the perfect debt to fairness ratio will fluctuate relying on the business as a result of some industries use extra debt financing than others. Capital-intensive industries just like the monetary and manufacturing industries typically have larger ratios that may be higher than 2.

A excessive debt to fairness ratio signifies a enterprise makes use of debt to finance its development. Corporations that make investments massive quantities of cash in property and operations (capital intensive firms) typically have the next debt to fairness ratio. For lenders and traders, a excessive ratio means a riskier funding as a result of the enterprise won’t be capable of produce sufficient cash to repay its money owed.

If a debt to fairness ratio is decrease — nearer to zero — this typically means the enterprise hasn’t relied on borrowing to finance operations. Traders are unlikely to spend money on an organization with a really low ratio as a result of the enterprise is not realizing the potential revenue or worth it might achieve by borrowing and growing operations.

What ought to companies with good debt to fairness ratios do subsequent?

Companies with good debt to fairness ratios are people who fall inside the usual vary for his or her industries. These firms are seemingly in a interval of constructive development supported by balanced financing from each debt lenders and fairness shareholders.

Though an organization with debt to fairness ratio seems good on paper financially, it’s essential to know that this fiscal metric is a snapshot that doesn’t inform your entire story of how a enterprise is utilizing capital as a software to scale. So, don’t get too comfy when this quantity is constructive. As an alternative, flip your consideration to your long-term debt to fairness ratio as this has an impression on what you are promoting’s monetary well being, too. Think about funding any long-term development plans with long-term debt relatively than short-term financing in an effort to stabilize your pecuniary image.

What’s a detrimental debt to fairness ratio?

A detrimental debt to fairness ratio happens when an organization has rates of interest on its money owed which are higher than the return on funding. Unfavourable debt to fairness ratio may also be a results of an organization that has a detrimental web price. Corporations that have a detrimental debt to fairness ratio could also be seen as dangerous to analysts, lenders, and traders as a result of this debt is an indication of economic instability.

An organization can expertise a detrimental debt to fairness ratio for plenty of causes, together with:

- Taking over extra debt to cowl losses as an alternative of issuing shareholder fairness.

- Expensing intangible property, comparable to logos, that exceed pre-existing shareholder fairness values.

- Making massive dividend funds that exceed shareholders’ fairness.

- Experiencing monetary loss in durations following massive dividend funds.

When any of those conditions happen, they may sign an indication of economic misery to shareholders, traders, and collectors.

What do you have to do when you’ve got detrimental debt to fairness ratio?

If what you are promoting has a detrimental debt to fairness ratio, you may need a tough time discovering financing sooner or later as a result of quantity of debt you already use to fund your organization. The reply to this isn’t to leap into extra fairness financing as this will trigger points with the operations of what you are promoting. Extending extra fairness to new shareholders could cause your organization to pursue a unique route as a contingency of accepting their financing.

As an alternative, if you wish to decrease your debt to fairness ratio, you would possibly prioritize repaying the debt you owe earlier than rising what you are promoting additional. Test CSIMarket for debt to fairness ratio requirements in your business to see how yours compares to these of different companies.

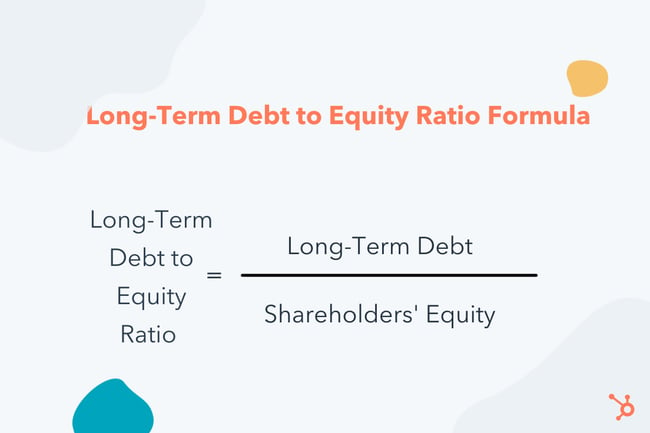

Lengthy-Time period Debt to Fairness Ratio

The long-term debt to fairness ratio exhibits how a lot of a enterprise’ property are financed by long-term monetary obligations, comparable to loans. To calculate long-term debt to fairness ratio, divide long-term debt by shareholders’ fairness.

As we lined above, shareholders’ fairness is whole property minus whole liabilities. Nonetheless, this isn’t the identical worth as whole property minus whole debt as a result of the fee phrases of the debt also needs to be taken under consideration when assessing the general monetary well being of an organization.

Quick-term debt consists of liabilities that might be paid in below a 12 months. Lengthy-term debt consists of liabilities that may take a 12 months or extra to mature. Let’s stroll by means of an instance.

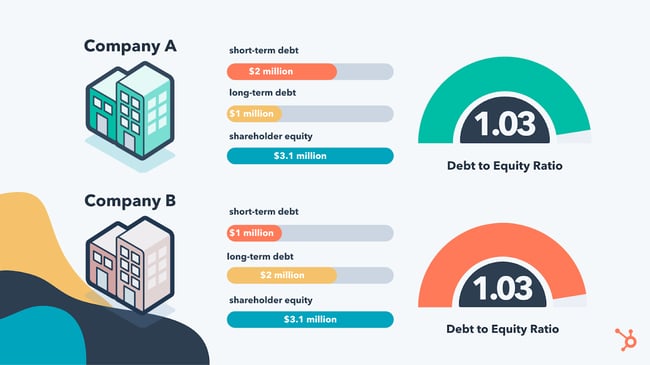

Firm A has $2 million in short-term debt and $1 million in long-term debt. Firm B has $1 million in short-term debt and $2 million in long-term debt. Each firms have $3 million in debt and $3.1 million in shareholder fairness giving them each a debt to fairness ratio of 1.03.

Nonetheless, as a result of short-term debt is renewed extra typically, having higher short-term debt in comparison with long-term debt is taken into account dangerous, particularly with fluctuating rates of interest. With this in thoughts, Firm B could be thought-about much less dangerous as a result of it has extra long-term debt, which is taken into account extra steady.

This is a reference that will help you bear in mind the long-term debt to fairness ratio formulation.

Examples of long-term debt embody mortgages, bonds, and financial institution debt. Similar to the usual debt to fairness ratio, investing in a enterprise is riskier if it has a excessive ratio.

Utilizing Debt and Fairness to Scale Your Enterprise

Debt generally is a four-letter phrase to small and scaling companies, nevertheless it doesn’t must be. When used appropriately, debt can present traders and lenders that you just’re utilizing the assets obtainable to what you are promoting in an effort to understand a constructive return on funding.

The debt to fairness ratio is a worthwhile software for entrepreneurs and traders, and it exhibits how a lot a enterprise depends on debt to finance its purchases and enterprise actions in relation to the fairness it makes use of for a similar functions. This ratio is fluid throughout industries, so examine the requirements to your firm as you start financing huge tasks and development methods.

Editor’s be aware: This submit was initially printed in October 2018 and has been up to date for comprehensiveness.