A deep evaluation of the present state of automotive and aftermarket gross sales, along with the main developments impacting the business – from the macroeconomic panorama to shoppers’ financial pressures, and the newest areas of innovation-led transformation which are unlocking pockets of progress.

Final yr noticed consumers across the world shopping for 68 million new vehicles, a important bounce in yr–on–yr progress that brings the business nearer to the pre-pandemic benchmark of 73 million purchased in 2019. For 2024, the normal view is that gross sales will attain round 70 million.

This yr’s extra muted progress forecast is attributable to a lot of the pent-up demand from the low-production years of 2020-2022 having now largely been happy, together with the continued financial challenges confronted by shoppers throughout completely different areas.

For instance, APAC is a high-potential region with very low automotive penetration. Final yr, gross sales of latest vehicles there grew by +9%, in keeping with Statista, however expectation for this yr runs at simply +2%, largely attributable to low efficiency forecast for China.

For this yr, then, Europe seems to be to be the area offering biggest progress alternatives, adopted by North America – however, even in these two markets, the speed of progress for brand new automotive gross sales is depressed.

-

Second hand automotive gross sales and automotive aftermarket – 2024 alternatives

Globally, we anticipate to see 36.2 million used automotive gross sales this yr, simply up from 35.9 million in 2023.

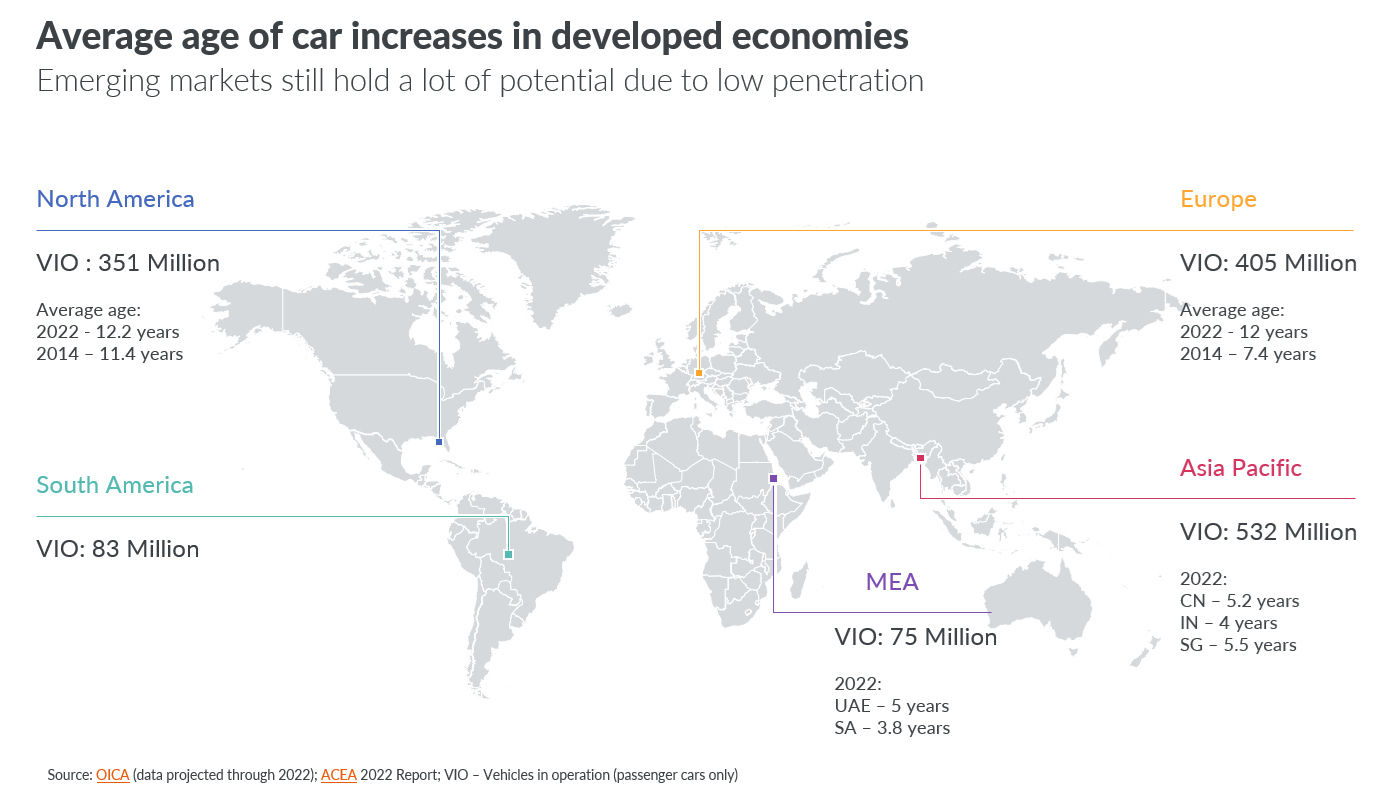

In Europe and North America, the common age of vehicles in operation has elevated from 7.4 years outdated (Europe) and 11.4 years outdated (USA) ten years in the past to 12 years outdated now. That is in keeping with newest information from OICA, the Worldwide Group of Motor Automobile Producers.

With over 750 million passenger vehicles in operation on those two continents, we anticipate to see growing demand for aftermarket merchandise as the upkeep necessities of these older vehicles grows.

Tempering that potential income pot for aftermarket gross sales, nonetheless, is the truth that, as soon as their vehicles attain 5 or 6 years’ outdated, individuals change into much less inclined to splash out on their upkeep, and extra possible to decide on funds–friendly quite than premium components.

In Asia Pacific and the Center East, we see a distinct image and set of alternatives. In these areas, the typical age of vehicles sits at round 4 to 5 years outdated. With a rising center class throughout a lot of these areas, and comparatively low automotive penetration, this currents potential for a spike in new automotive gross sales from shoppers wishing to improve their way of life and show their elevated wealth.

Moreover, the truth that individuals listed here are exchanging their vehicles after solely 4 or 5 years currents opportunity for the second–hand automotive market. Not solely is it capable of provide youthful, higher high quality vehicles which ought to drive robust gross sales potential, however we anticipate a enhance to after-market gross sales too, as rising middle-class patrons who might not have felt capable of afford a brand new automotive look to improve their second-hand buy with premium components, tires, and automotive chemical substances.

-

Automotive aftermarket gross sales exhibiting continued progress

The international automotive aftermarket is continuous to develop with gross sales income up +4% final yr, reaching $71 billion. That is on high of a +3% progress already seen in 2022 versus 2021.

Tires, which account for three in each 4 {dollars} spent on aftermarket purchases, grew +4% in comparison with 2022 income, whereas automotive chemical substances (15% of aftermarket income) have been up +6% and spare components up +10%.

This progress is pushed partly by an enhance in premium purchases throughout sections – however that’s not the one issue.

Over the final couple of years, we’ve seen polarization between worth and quantity progress, as the typical worth of things soared, pushed by worldwide high inflation and elevated prices in manufacture and supply. That hole is now closing as costs begin to stabilize, though at excessive ranges.

-

Automotive tire developments: growth shifting to rising economies

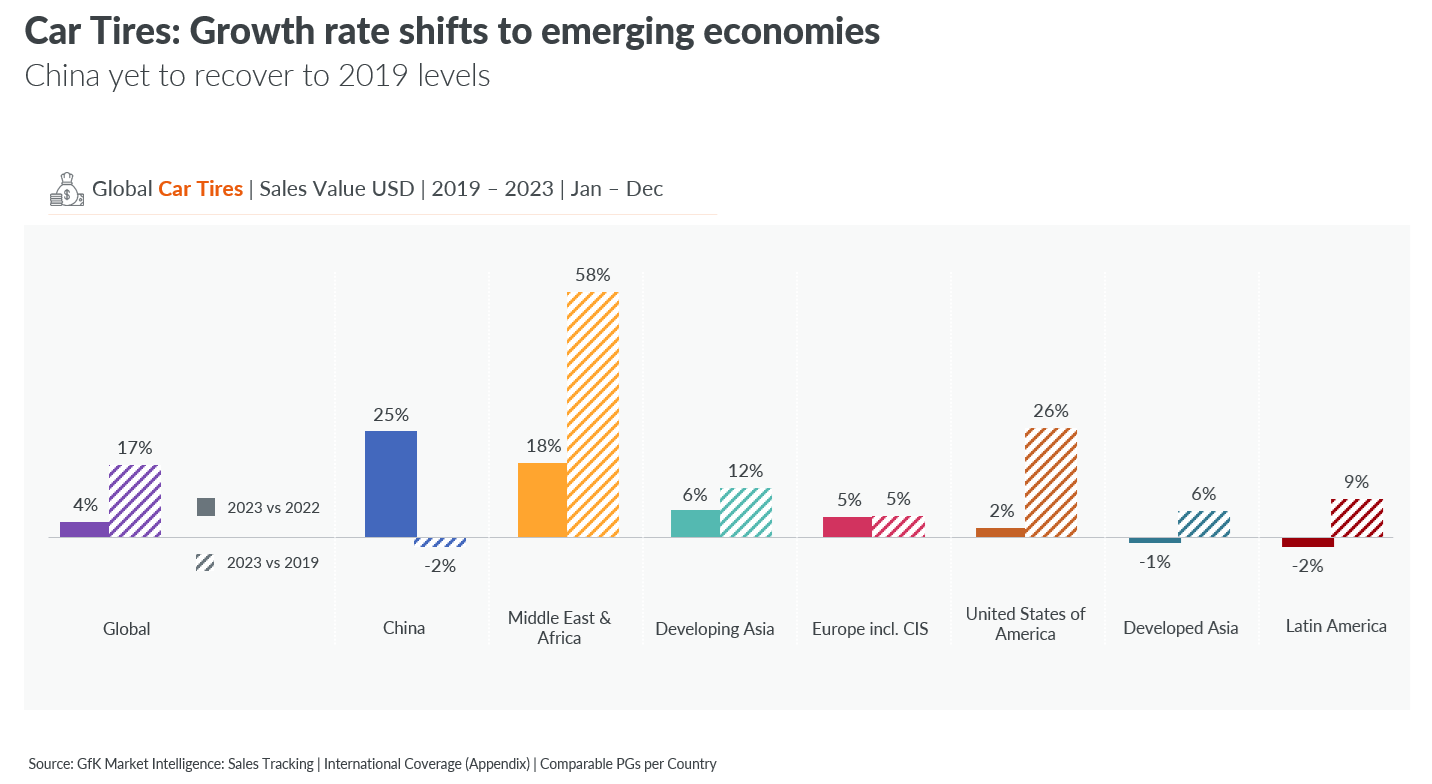

From a regional share perspective, Europe and US are the largest areas in income throughout the automotive aftermarket business. their gross sales of automotive tires final yr, each markets proceed to develop steadily, though at a slower fee than earlier than, with 2023 delivering +5% progress in Europe and +2% in US.

The 2 quickest rising areas for automotive tires are China and the Center East and Africa. China recorded an superb +25% progress, yr on yr, with potential to develop nonetheless additional this yr, because the market has not but get welled to its pre-pandemic 2019 ranges. The Center East & Africa area can be one of many excessive potential progress markets, continuing to register robust progress yr on yr.

Developing Asia was simply forward of Europe by way of progress – standing at +6%, whereas the Developed Asia and LATAM areas each confirmed a slight decline in income. These final two markets have robust headwinds, nonetheless, because of the excessive progress charges witnessed in 2022 setting difficult baselines.

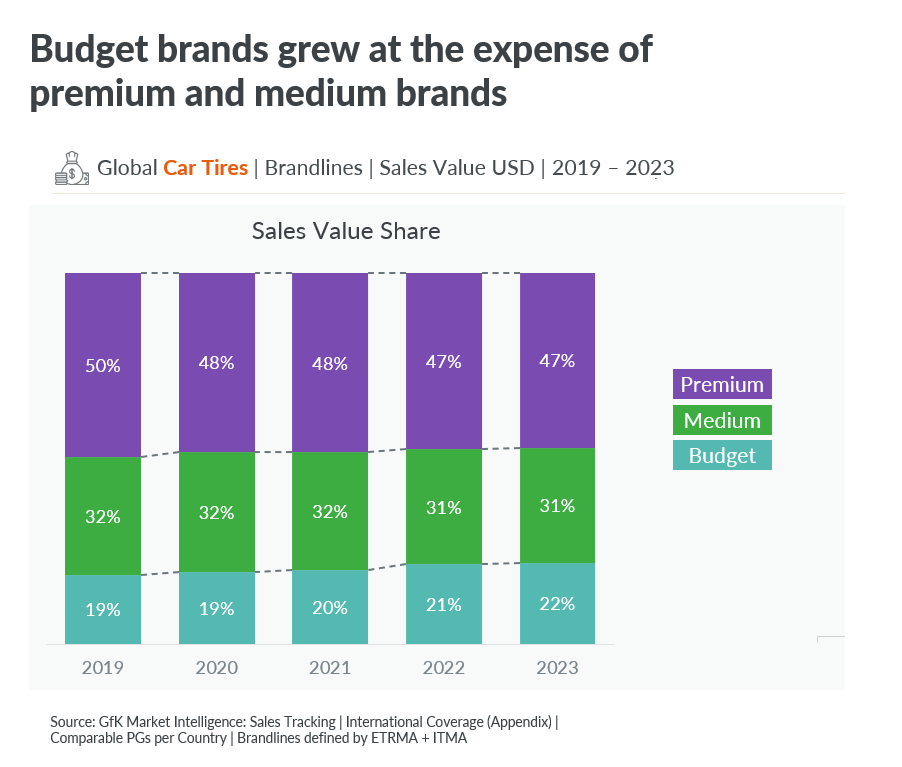

Bigger manufacturers dropping share to funds manufacturers

Globally, the unit share of automotive tires bought by smaller manufacturers has elevated from 29% to 33%. It’s honest to imagine that that is pushed by shoppers shifting to decrease priced manufacturers as their family budgets have been squeezed final yr.

Given the numerous distinction within the worth between premium, medium or funds model tires, funds choices stay a really economical selection for the shoppers – particularly as the typical value of funds model tires decreased very barely final yr, whereas medium and premium model tires rose.

This growth of funds manufacturers by way of market share is not confined to cheaper price segments. Funds manufacturers are additionally providing an increasing number of SKUs even in higher-finish tire segments, however at higher costs than the large manufacturers. instance – tires with 18-inch-plus rims value an common 137 US {dollars} for a funds model, versus 237 {dollars} for a premium model.

Regional variations in progress of funds model tires

Globally, tire gross sales for funds manufacturers grew +6% final yr, whereas premium and medium manufacturers noticed round 3% progress. Nonetheless, there are regional variations on this pattern.

In Europe, medium manufacturers noticed the strongest progress, adopted by budget manufacturers, and with premium manufacturers showing significantly weaker efficiency. This circles again to the pattern we see of European drivers preserveing their vehicles longer and being much less inclined to spend cash on premium components as soon as they cross 5 or 6 years outdated.

LATAM, funds manufacturers grew an enormous +19%, whereas premium declined by –7% and medium manufacturers additionally noticed important decline. This polarization in gross sales can be seen in the MEA and APAC areas, the place premium and funds each grew extra than medium manufacturers.

In the US market, nonetheless, we’re seeing clear premiumization, because of two key elements. The primary is an economic system that is doing higher, and the second is the import restrictions positioned on (usually cheaper) Chinese language manufacturers attributable to the geopolitical scenario between the 2 nations.

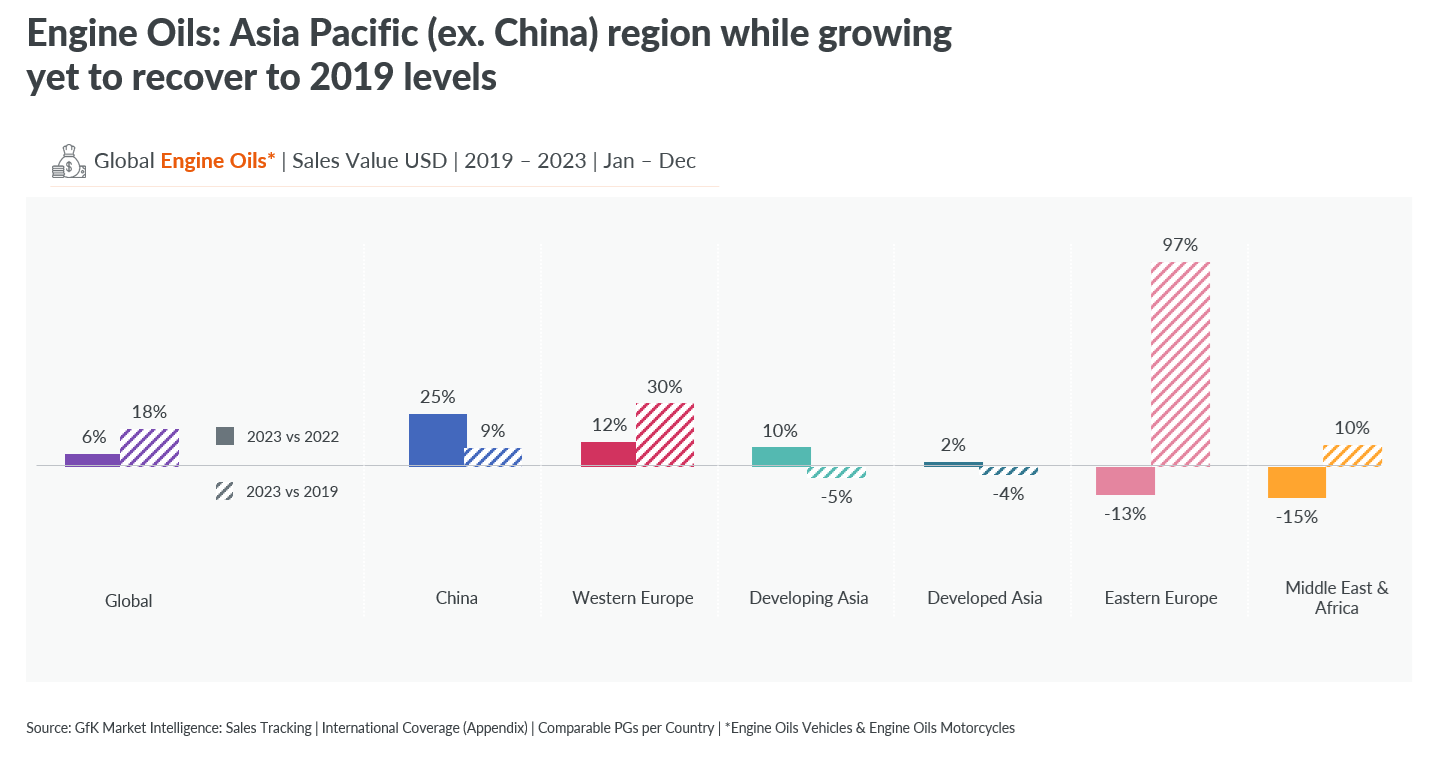

International income from gross sales of engine oils for each bikes and vehicles grew +6% final yr, led by China (+25%), Western Europe (+12%) and Growing Asia (+10%). Japanese Europe and Center East and Africa each confirmed declining income for engine oils.

In the Center East and Africa, the decline additionally represents the excessive baseline from final yr, in addition to the forex volatility (in native forex, progress there’s constructive), and the ambition of some nations on this area to have a lot greater deal with E-mobility.

dditional issue impacting these areas contains the native evolution of mobility, with cheaper choices reminiscent of “journey hailing” being notably standard in areas reminiscent of Southeast Asia and India.

Funds shopping for carries via into engine oils.

Smaller manufacturers have significantly elevated their share of each income and quantity of engine oil gross sales, rising from 42% market worth in 2022 to 48% now. So, whereas the whole class gross sales income has elevated, those positive aspects are largely being seen in the lengthy tail, or manufacturers with smaller market shares in comparison with the market leaders.

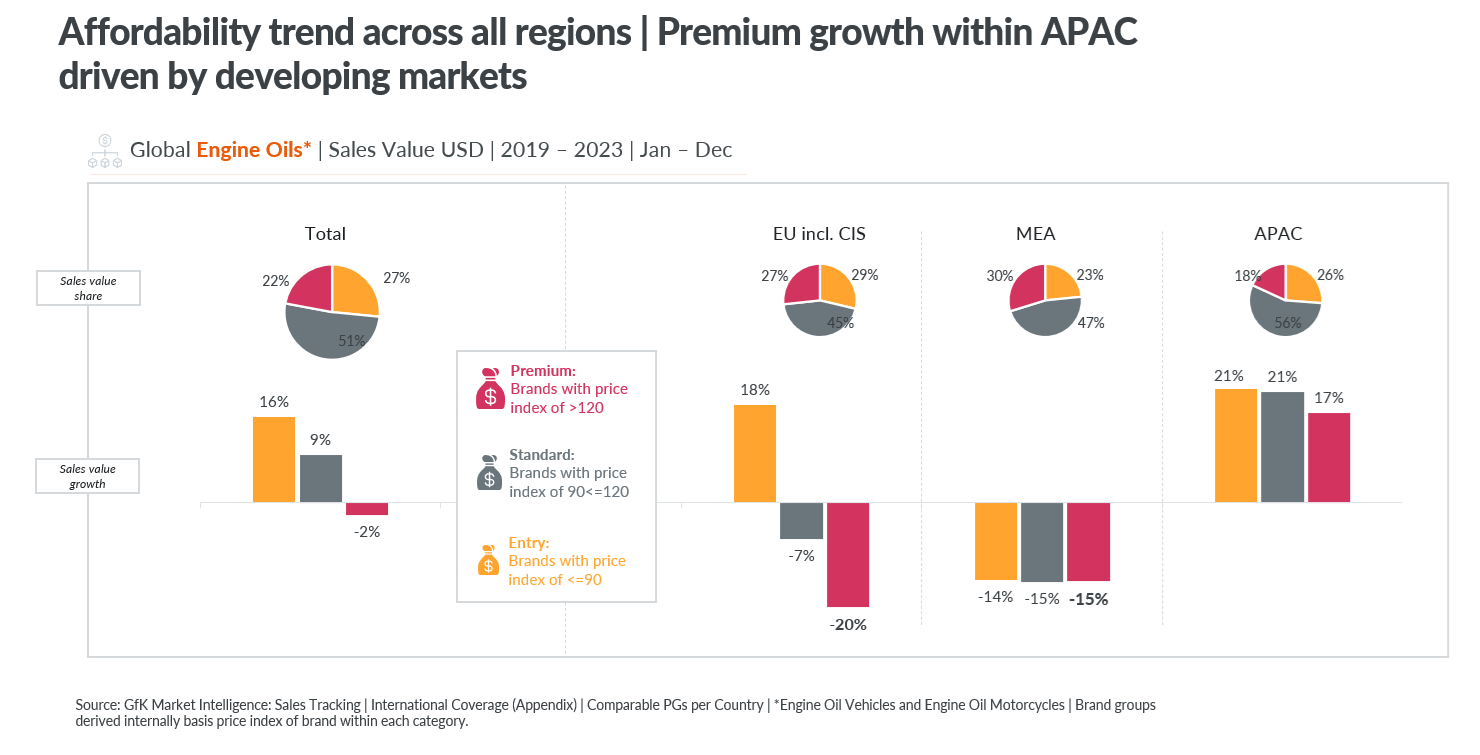

Globally, engine oils noticed a +16% enhance in the gross sales worth of entry manufacturers in comparison with +9% of ordinary manufacturers, whereas premium model gross sales declined by –2%. That affordability pattern is seen throughout all areas. with the entry–degree manufacturers doing a lot better than the remainder.

APAC is the one area exhibiting constructive progress for engine oils, and this is pushed by the creating markets reminiscent of Developed Asia, the place funds manufacturers have been the one part that grew.

Our forecast is that this pattern with continue via 2024, with shoppers looking for reasonably priced choices for all upkeep merchandise – particularly as they preserve their vehicles longer in markets reminiscent of Europe and the USA. The chance for market leading manufacturers comes when shoppers buy a brand new automotive or face a important problem with the present product they’ve used.

-

Automotive innovation outlook

For the automotive business, like others, there are three forces that drive innovation: consumer demand, legislation / regulation, and manufacturer push.

Over the past couple of years, we have now seen automotive innovation specializing in 6 themes:

- Safety

- Convenience

- Performance

- Design

- Sustainability

- Business fashions.

Wanting on the applied sciences that can affect or allow improvements within the automotive business, AI continues to be the excitement phrase. Immersive know-how is enabling enhancements in shopper expertise and cclinging the way in which shoppers work together with their vehicles. The Web of Issues, for instance, is being built-in into automobile know-how to drive transformation throughout design, manufacturing, operations and upkeep, whereas cloud computing is enabling automakers to remotely monitor automobile efficiency and predict upkeep wants.

Electrical automobiles additionally proceed to develop in each the patron and business spheres. In 2021, EVs accounted for 12% of all gross sales in 2021, rising to 21% in 2023 and are expected to hit 25% this yr. Three markets dominate these gross sales – China (over 50% of share of world gross sales final yr), Europe and the US – with different nations tailing fairly far behind. From a shopper perspective, EVs are extra of an aspirational or standing image product, with the key attraction being much less about their eco-positioning and extra about the extent of tech integrated in these vehicles that allows them to do extra than simply drive. This focus means we’re seeing conventional tech manufacturers turning into more and more and influential within the automotive sector.

, then, shall be related, autonomous, shared and electrical. It’s going to, nonetheless, take a very long time to achieve that future, attributable to challenges reminiscent of market readiness, gradual implementation to change into mainstream, and excessive manufacturing prices resulting in excessive promoting costs.

To optimize the success of their innovation technique, producers should preserve a laser-sharp monitoring of their viewerss, and align exactly with their evolving lifestyles, wants, aspirations and limitations.