When the calendar turns over yearly, shoppers discover consolation in numbers: kilos to lose, drinks to not drink, and in 2024 – {dollars} to avoid wasting. Mintel analysis reveals six in ten US adults famous enhancing their funds as one in every of their high three objectives for the following yr, just one proportion level decrease than the variety of adults hoping to enhance their bodily well being. A stronger give attention to funds is sensible, as the share of shoppers who’re financially worse off than a yr in the past has elevated to almost a 3rd of US adults. Regardless that shoppers are resolving to dwell financially more healthy lives, monetary providers establishments have missed the chance to get in on the resolutions dialog.

Regardless of the shift in shopper priorities, well being and wellness CPG corporations are a number of the greatest New 12 months’s decision entrepreneurs. Whereas well being and monetary resolutions could have completely different goals, the rules and techniques for fulfillment usually overlap, highlighting the interconnectedness of non-public well-being.

Monetary providers manufacturers have the chance to study and replace their future seasonal technique by incorporating key parts of profitable CPG decision advertising and marketing. Consequently, manufacturers can maximize the usage of new and pre-existing instruments meant for enhancing monetary well-being.

1. Break objectives into steps

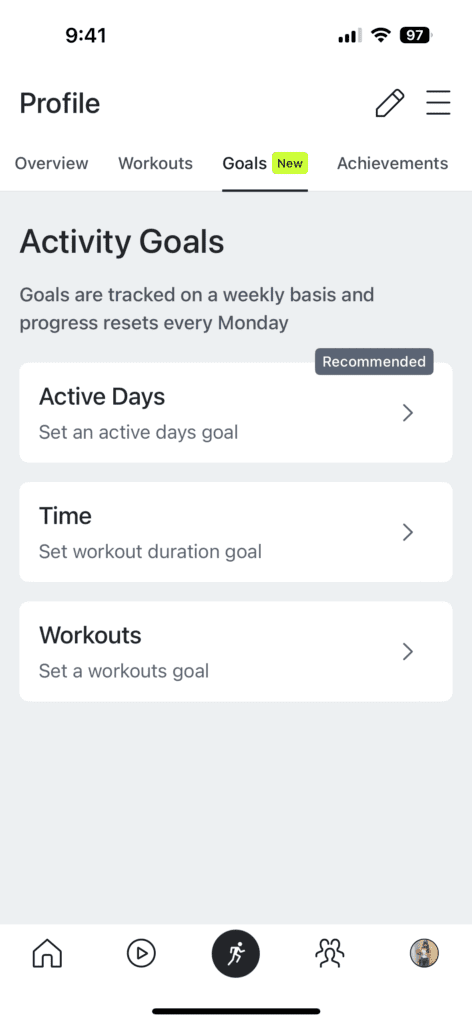

Customers usually lose motivation once they don’t see progress as shortly as they’d like. Mintel’s analysis signifies that sluggish progress is the highest impediment to sustaining a wholesome life-style, which additionally applies to monetary well-being. To fight this, breaking down objectives into smaller, manageable steps will help hold shoppers on observe. For instance, Peloton’s Objectives function lets members set weekly targets by energetic days, exercise length, or variety of exercises, making bigger objectives seem extra attainable

To reinforce monetary goal-setting, incorporate common reminders and the flexibleness to switch objectives primarily based on present achievements. This strategy ensures that objectives stay real looking and adaptable. As an illustration, Walmart+ capitalized on “Quitter’s Day” by reminding clients that it’s not too late to recommit to their goal.

2. Supply the precise instruments

To assist shoppers obtain their New 12 months’s resolutions, CPG manufacturers or retailers usually promote gadgets like water bottles, athleisure, or dietary supplements. That’s precisely what Goal did with its Wellness Jumpstart initiative, the place the retailer featured one product every day in January that may support in well being and wellness objectives. Equally, monetary providers ought to information clients in the direction of the suitable instruments, like playing cards or accounts, to assist their monetary goals, very like a health club membership is essential for marathon coaching.

3. Incentivize progress

Monetary providers manufacturers aren’t any strangers to incentivization, whether or not it’s incentivizing members to avoid wasting or to spend. To strike a stability between the 2, manufacturers can incentivize members to make progress on their private monetary objectives regarding each. This might imply saving in the direction of short-term purchases or reallocating their funds throughout completely different classes.

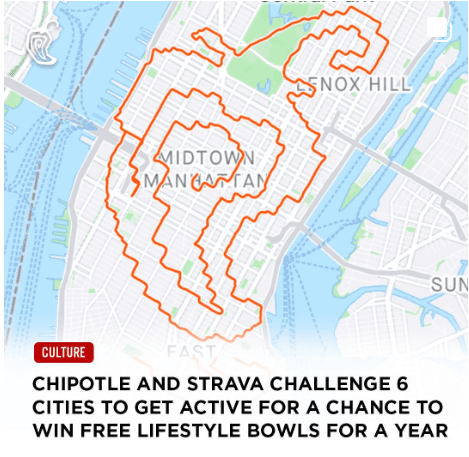

Duolingo is reportedly approaching this technique from a long-term perspective, rewarding customers who hit annual streaks inside its app. Chipotle honed in on the short-term, internet hosting its Chipotle Section Problem Sequence with fitness-tracking app Strava in January that rewarded winners with a free weekly Chipotle bowl for a complete yr.

Take into account how present incentives can apply to purpose setting and the way your present partnerships, reminiscent of streaming providers or airline lounges, can play a task right here.

4. Construct a neighborhood

Customers don’t all the time reply effectively to manufacturers telling them what to do – particularly in relation to their funds. The response to this tweet from Chase in 2019 involves thoughts. However that’s to not say that monetary establishments shouldn’t have a task in shoppers’ monetary objectives; moderately, it underscores how vital it may be to let members do the speaking every so often.

An instance is NBC’s In the present day Present’s Begin In the present day platform, which affords a community-driven strategy to well being and wellness objectives, that includes group actions and shared content material that feels extra like peer assist than company messaging.

What we predict

Monetary providers manufacturers are well-equipped to embrace these alternatives by leveraging their present reward constructions and thought management on monetary well-being. The important thing lies in successfully curating these sources and delivering them once they’re most impactful. Content material hubs will help members in setting, pacing, and monitoring their monetary objectives whereas fostering a neighborhood of like-minded people. And with this work carried out, your members will view you as a essential accomplice to attaining bigger objectives sooner or later.

If you happen to’re fascinated with studying extra about monetary providers or CPG decision advertising and marketing from Mintel Consultancy, please attain out immediately and somebody can be in contact.