Shorting overbought and overhyped oil and oil shares (XLE) with a levered up however decrease price inverse oil inventory ETF (ERY).

Actually, markets total have been risky and chaotic not too long ago. The current push previous 4.5% on the 10-year Treasury yield appears to be the primary catalyst for taking shares decrease and rates of interest increased.

Even oil costs weren’t immune as the worth of crude dropped sharply from over $93 barrel to finish September to beneath $83 barrel to finish the primary week of October.

The siren requires oil going to $130 and even $150 by lots of the specialists proved as soon as once more to be misplaced. Sounded very very like related prognostications again in 2008 when predictions of oil hitting $200 barrel proved wildly fallacious.

Each time the chatter will get this hyperbolic, it’s nearly invariably an opportune time to take a place opposite to the prevailing calls. That is precisely what we did only recently with a short-term bearish commerce in oil shares.

Why We Did It

Each the worth of oil and oil shares (XLE) hit an excessive in mid-September. The chart under reveals the XLE over the previous yr. You possibly can see how as soon as once more shares had reached overbought ranges as highlighted in blue. 9-day RSI was almost 80. Bollinger P.c B was over 100. MACD was at an excessive. XLE was buying and selling at an enormous premium to the 20-day shifting common. Earlier instances all these indicators aligned similarly marked vital short-term tops in XLE.

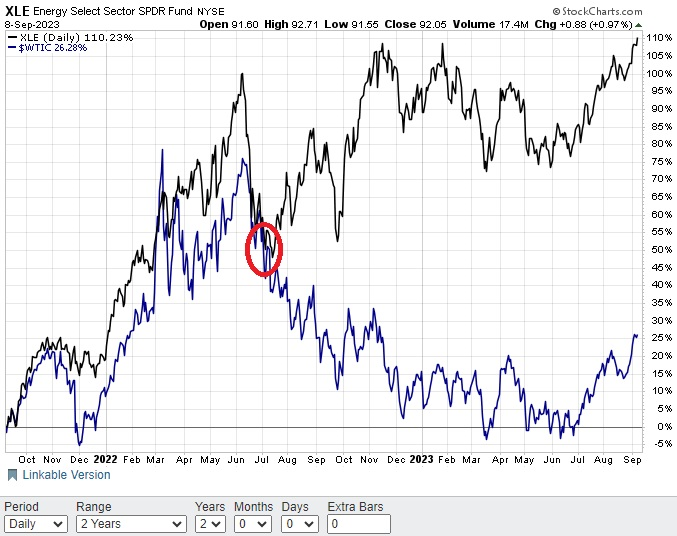

Crude oil costs exhibited related overbought readings. However we selected to quick oil shares as a substitute of oil just because oil shares had had an excellent better rally than oil itself not too long ago. A comparative chart under illustrates that time.

You possibly can see how oil shares (XLE) and oil moved in just about unison till a little bit over a yr in the past. Is sensible since oil and oil shares ought to be pretty nicely correlated. Since then, oil shares have rallied sharply whereas oil itself has truly fallen. Certainly, XLE was up 4 instances as a lot as West Texas Intermediate Crude ($WTIC) over the previous two years.

We anticipated oil shares to start to converge again to grease costs over the close to time period, which is why we selected to quick the shares like ExxonMobil and Chevron that make up the XLE over shorting bodily oil itself.

How We Did It

Somewhat than quick XLE, which may costly and dangerous, we selected as a substitute to make use of an inverse ETF that will increase in worth if XLE falls. The truth is, the inverse ETF we finally chosen will increase at a sooner proportion fee (2 instances) versus the drop in XLE. The ETF we picked was ERY. Description from the Direxion web site proven under:

The Direxion Day by day Vitality Bear 2X Shares seeks each day funding outcomes, earlier than charges and bills of 200% of the inverse (or reverse) the efficiency of the Vitality Choose Sector Index (XLE). There is no such thing as a assure the funds will meet their acknowledged funding goals.

So, we had been capable of purchase ERY at beneath $25 quite than having the margin requirement of shorting XLE of virtually $50 (1/2 the worth of XLE is the preliminary quick requirement). In essence, half the financial dedication. Plus, get twice the potential return (albeit with twice the potential loss). Essential to keep in mind that these levered ETF merchandise are particularly designed for shorter time period investments quite than long term buy-and-hold. This suits our typical commerce time-frame as nicely.

Why We Lined

The chart under reveals ERY over the previous yr. Discover the way it strikes just about in an reverse method to the XLE chart, however to a better magnitude. Whereas oil and oil shares (XLE) hit oversold readings on Thursday, ERY concomitantly obtained to overbought ranges on the similar time.

We went lengthy ERY at $24.02 on 9/11/2023 and subsequently exited the place on 10/5/2023 at $27.50. Web acquire on the commerce was 14.49% with a holding interval of lower than a month.

Evaluate these returns to shorting oil, which dropped simply over 5% in the identical time-frame. Oil shares (XLE) dropped about 7% over that interval.

As anticipated, oil shares did worse than oil. Utilizing ERY as a strategy to leverage up the good points on a drop in oil shares work simply as anticipated with double the acquire.

Not all trades work out this nicely or this rapidly. However for merchants seeking to put the percentages of their favor, combining technical evaluation together with analyzing correlation efficiency, plus utilizing various approaches, can put the percentages in your favor.

On the finish of the day, worthwhile buying and selling is all about percentages, not certainty.

POWR Choices

What To Do Subsequent?

Should you’re in search of the very best choices trades for as we speak’s market, it is best to try our newest presentation Tips on how to Commerce Choices with the POWR Scores. Right here we present you methods to persistently discover the highest choices trades, whereas minimizing danger.

If that appeals to you, and also you wish to study extra about this highly effective new choices technique, then click on under to get entry to this well timed funding presentation now:

Tips on how to Commerce Choices with the POWR Scores

All of the Greatest!

Tim Biggam

Editor, POWR Choices E-newsletter

XLE shares closed at $85.73 on Friday, up $0.51 (+0.60%). Yr-to-date, XLE has gained 0.64%, versus a 13.57% rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Stay”. His overriding ardour is to make the complicated world of choices extra comprehensible and due to this fact extra helpful to the on a regular basis dealer. Tim is the editor of the POWR Choices e-newsletter. Study extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The publish 3 Huge Causes Why We Shorted Oil Shares-How We Did It-And Why We Simply Lined appeared first on StockNews.com