The enjoyable of the 2023 bull rally is over. Now we’re in a extra unstable interval the place what occurs subsequent for the S&P 500 (SPY) isn’t so clear. That’s the reason 43 yr funding veteran Steve Reitmeister shares his newest market outlook, buying and selling plan and high picks on this contemporary commentary under.

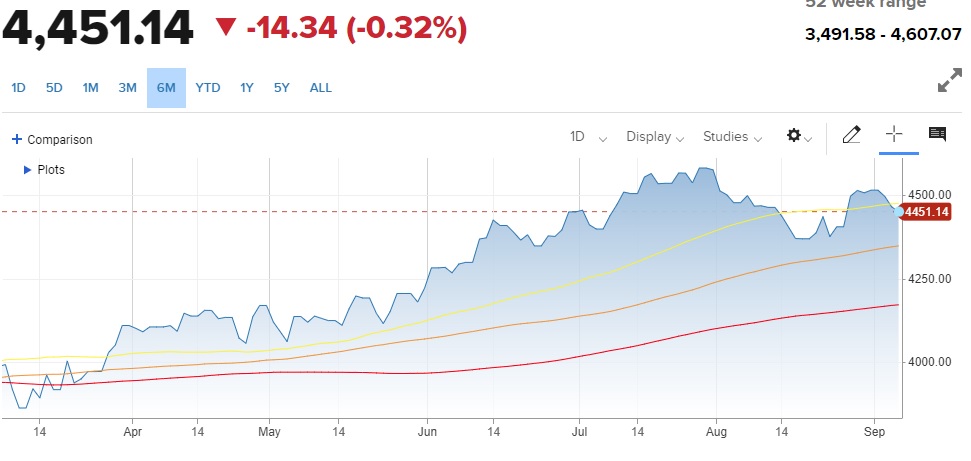

My expectation of a buying and selling vary forming is taking part in out proper on schedule. That being the place resistance was discovered at 4,600 for the S&P 500 (SPY) which was just too excessive after an overextended bull run.

However, there was no want for shares to unload greater than 5%. Thus, help was discovered simply above the 100 day transferring common presently at 4,344.

Shifting Averages: 50 Day (yellow), 100 Day (orange), 200 Day (crimson)

In a buying and selling vary state of affairs, the market is overly vulnerable to every new headline. In the future that blows bearish…and the very subsequent day gloriously bullish.

In brief, nearly each transfer inside a buying and selling vary is meaningless noise. And thus ought to largely be ignored.

That’s as a result of the VAST MAJORITY of the time, the market breaks out of the vary in the identical course it was going earlier than the vary fashioned. Within the present case meaning we should always break larger out of this vary until there’s really a menace to the bullish thesis.

That might require that the preponderance of the proof begins to point out that the percentages of a recession have drastically elevated. That’s presently not true.

What’s true is that we discover that the latest financial knowledge is a bit higher than anticipated. Usually that’s superior information that has shares spiking larger.

Sadly, that isn’t so superior when the Fed is fearful about lingering excessive inflation not fading away shortly sufficient. Merely acknowledged…

The extra strong the economic system seems to be > the stickier excessive inflation turns into > the extra doubtless the Fed raises charges even larger > the extra they threat making a recession as a substitute of sentimental touchdown

Certainly, the not too long ago improved financial image has additionally elevated the percentages of a Fed fee hike on the November or December conferences. Only a month in the past solely 28% odds have been positioned one other 25 foundation level from the Fed. As for right this moment that’s now as much as 46%. This once more explains the inventory market weak spot this week.

Let me be clear…The improved knowledge for ISM Companies and Jobless Claims this week, that sparked the latest unload, does enhance the percentages of extra fee hikes. However as Goldman Sachs predicts, the percentages of a brand new recession forming within the subsequent 12 months continues to be solely round 25%. Meaning we’re more likely to have a mushy touchdown which retains the long run bullish thesis in place.

At this stage traders are doubtless going to react strongly to different upcoming financial occasions coming into the 9/20 Fed Fee determination. The roll name of experiences consists of:

9/13 Shopper Value Index

9/14 Producer Value Index, Retail Gross sales & Jobless Claims

9/20 Fed Fee

Notice that proper now most traders expect the Fed to hit the pause button on charges at this September 20th assembly. The important thing for traders is specializing in what Powell says at his press convention. That can present their intentions for future conferences. Once more, the percentages for a fee enhance in November or December is getting ever nearer to 50%.

Buying and selling Plan and Subsequent Steps

No one is aware of when this buying and selling vary will finish. However doubtless it will likely be earlier than the vacations when the seasonal good tidings assist to create a Santa Claus rally.

Thus, it will be significant look previous the daily fluctuations to understand that the long run image continues to be bullish. This makes it smart to make use of significant dips within the vary to purchase the perfect trying shares.

Which shares are these?

Extra on that within the subsequent part…

What To Do Subsequent?

Uncover my present portfolio of seven shares packed to the brim with the outperforming advantages present in our POWR Scores mannequin.

Plus, I’ve added 4 ETFs which are all in sectors nicely positioned to outpace the market within the weeks and months forward.

That is all primarily based on my 43 years of investing expertise seeing bull markets…bear markets…and every part between.

In case you are curious to be taught extra, and need to see these 11 hand chosen trades, then please click on the hyperlink under to get began now.

Steve Reitmeister’s Buying and selling Plan & Prime Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Complete Return

SPY shares have been buying and selling at $444.98 per share on Friday afternoon, up $0.13 (+0.03%). Yr-to-date, SPY has gained 17.23%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Steve Reitmeister

Steve is best recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Study extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The publish Why Are Shares Weak Once more? appeared first on StockNews.com