While you try the surging S&P 500 (SPY) on Friday…and just about all June…and heck, just about all yr, it certain appears like a brand new bull market is at hand. Nonetheless, funding veteran, Steve Reitmesiter, factors out “that was then…and that is now”. You’ll want to tune in for his 2nd half of 2023 inventory market outlook, buying and selling plan and high picks. Get the remainder of the story under.

Shares closed on a excessive observe this Friday. This places a bullish exclamation mark on the primary half of the yr!

That’s now…however what occurs later is a little more of a thriller.

Sure, the present pattern might proceed. Or maybe there can be purpose for extra warning within the months forward.

Let’s spend a while at this time to think about what occurs within the 2nd half of the yr so we will craft the very best buying and selling plan to carve income from the market.

Market Commentary

Probably the most full manner for me to share my inventory market outlook and buying and selling plan is by watching the presentation I simply gave for the MoneyShow that covers the next subjects:

- Overview of…How Did We Get Right here?

- Bear Case

- Bull Case

- And the Winner Is??? (Spoiler: Bear case extra probably)

- Buying and selling Plan with Particular Trades Like…

Assuming you watched the video, let me add some extra colour commentary.

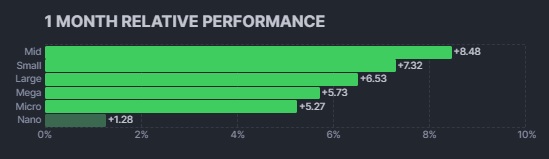

That begins by admitting that the latest worth motion is straight up bullish. Even beforehand famous issues with lack of market breadth are bettering as beneficial properties are lastly making their manner past the tech mega caps within the S&P 500 (SPY) to different shares together with small and mid caps.

Sadly, on the basic entrance I nonetheless see issues as largely bearish. The important thing being the chance of a future recession forming which might beget decrease company earnings and thus decrease inventory costs.

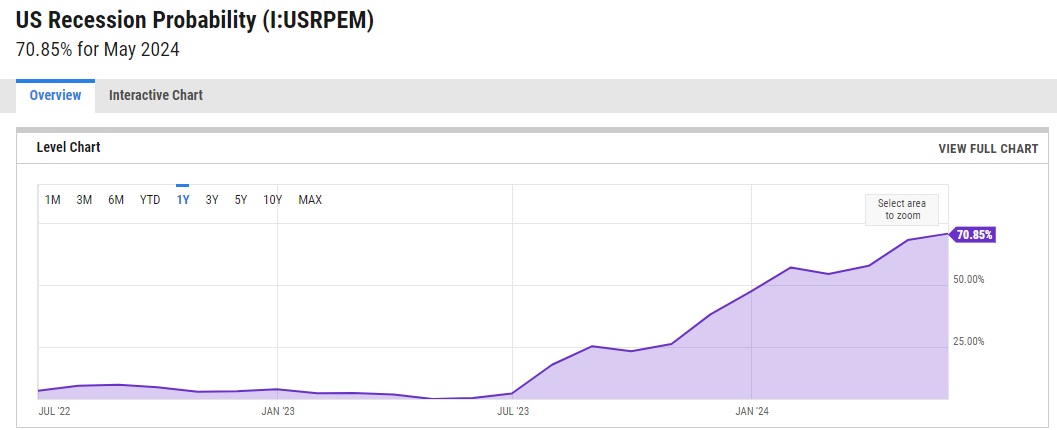

Utilizing the favored recession chance measure the place people evaluate the inversion between the three month & 10 yr Treasuries, that now appears like this at simply over 70% chance of recession by Could 2024:

So how can shares be up this a lot as the long run chance of recession darkens?

This suits in with the “Boy Who Cried Wolf” model of the funding story. Simply substitute “Wolf” with “Recession”.

Buyers are bored with listening to concerning the chance of recession because it retains NOT occurring. At this stage they won’t react UNTIL that recession/wolf is on their doorstep with blood dripping from its fangs. THEN traders will promote shares in earnest. Till that point, it appears to be…”Social gathering on Garth” for traders.

You could have heard a snippet at this time that the Core PCE inflation studying was barely higher than anticipated. Since that is the Fed’s favourite inflation measure it was thought-about the primary catalyst for shares flying increased as soon as once more.

Now the info…

+4.6% yr over yr inflation is certainly higher than the 4.7% studying from final month. However until I’m mistaken, it’s nowhere near the two% goal inflation fee required by the Fed.

Additional, the month over month studying got here in precisely as anticipated at +0.3% which nonetheless factors to the present tempo of improve between +3.6% and 4%. Once more, nonetheless too sizzling.

This explains why the percentages of a fee hike on the subsequent Fed assembly on 7/26 is now as much as 87% chance vs. 72% every week in the past and up from 53% a month in the past. That means this inflation studying doesn’t make anybody assume the Fed will cease placing their foot on the neck of the financial system with future fee hikes.

Please do not forget that on Wednesday, Chairman Powell famous as soon as once more that 2 extra fee hikes are on the menu. This was accompanied by the standard sound bites about extra work to do…and better charges for longer…and please get off your crack pipe if you happen to assume that we are going to decrease charges this yr (OK…that final half was me, not Powell 😉

There’s loads of key financial studies this coming week like ISM Manufacturing, ISM Service and Authorities Employment. Nonetheless, until they SCREAM RECESSION, then I believe traders will stay blissfully ignorant.

No…I’m not saying the bull market will maintain advancing continuous from right here. I’m saying it isn’t prepared for an actual unload till proof of a recession is seemingly irrefutable.

Word that always the top of 1 / 4 ends with a bang adopted by a whimper. That’s the reason I’m not chasing this market. We’ve sufficient available in the market too take part in upside whereas not extending our necks to far lest our heads get chopped off.

I nonetheless assume we now have a gentle case of irrational exuberance which ought to give method to a modest pullback and buying and selling vary to begin July. This could be the logical selection as traders await extra clues to level out the percentages of recession and whether or not that pushes us extra bullish…or again into our bearish caves.

However…who says the market is logical? 😉

For now, a balanced portfolio nearer to 50% invested feels probably the most applicable given the info in hand. We are going to proceed to observe the scenario and make changes as applicable. Simply don’t be too late to react to that recessionary wolf when it begins transferring your manner.

What To Do Subsequent?

Uncover my full market outlook and buying and selling plan for the remainder of 2023. It’s all out there in my newest presentation:

2nd Half of 2023 Inventory Market Outlook >

Simply in case you might be curious, let me pull again the curtain a bit wider on the primary contents:

- Overview of…How Did We Get Right here?

- Bear Case

- Bull Case

- And the Winner Is??? (Spoiler: Bear case extra probably)

- Buying and selling Plan with Particular Trades Like…

- High 10 Small Cap Shares

- 4 Inverse ETFs

- And A lot Extra!

If these concepts attraction to you, then please click on under to entry this very important presentation now:

2nd Half of 2023 Inventory Market Outlook >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Whole Return

SPY shares have been buying and selling at $443.25 per share on Friday afternoon, up $5.14 (+1.17%). Yr-to-date, SPY has gained 16.78%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Steve Reitmeister

Steve is healthier recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Whole Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The publish Is the Bear Market TRULY Useless? appeared first on StockNews.com