Alibaba’s income mannequin has enabled them to turn into not solely China’s main e-commerce firm but additionally a outstanding participant within the world market. This text will dissect Alibaba income mannequin, discover its totally different income streams, and delve into its development and success.

Alibaba’s Enterprise choices

Alibaba’s enterprise mannequin is structured round totally different segments as a part of their various product and repair choices. These segments serve totally different markets and have totally different monetization methods.

Alibaba

Alibaba.com is the corporate’s business-to-business (B2B) platform that connects consumers and suppliers globally. This platform primarily caters to massive companies concerned in substantial buying and selling by way of amount and worth. Alibaba.com has been notably useful in offering Chinese language producers and suppliers with a platform to promote their services and products internationally.

The corporate additionally supplies extra providers alongside the availability chain for imports and exports, corresponding to customs clearance, VAT refund, commerce financing, and logistics. As well as, they’ll pay for premium choices like boosted website visibility and an infinite variety of product listings.

Taobao

Thought to be the jewel in Alibaba’s crown, Taobao is the corporate’s most in depth website. This consumer-to-consumer (C2C) platform facilitates small entrepreneurs in providing their merchandise to a worldwide viewers.

On Taobao, each consumers and sellers pay no charges to make purchases or gross sales. The location operates equally to Google in that it returns outcomes primarily based on the consumer’s key phrases and that companies pay to be featured extra prominently than their opponents. Every vendor’s success price is displayed on the location utilizing a novel grading system.

Tmall.com

Tmall.com serves as a portfolio of high-end manufacturers. This platform is designed for China’s prosperous center and higher lessons who’re keen to spend on top-quality merchandise.

Tmall options over 3700 product classes and has greater than 500 million month-to-month energetic customers. Tmall supplies its distributors with analytics that present data, together with visitors, pageviews, and scores from clients.

In Q3 FY 2022, the ecommerce division (contains Alibaba, Taobao and Tmall) totaled $27.0 billion. Nearly 71% of the corporate’s general income and nearly all of its adjusted EBITA come from this division.

Cainiao

Cainiao is Alibaba’s home and worldwide one-stop logistics service and provide chain administration answer. This section addresses the various logistic wants of retailers and shoppers.

The Cainiao division noticed a 15.1% YoY development in income to $2.1 billion in Q3 FY 2022. An adjusted EBITA lack of $14 million was recorded for the division, which is a lower of greater than two and a half occasions from the adjusted EBITA loss reported for a similar quarter a 12 months in the past. Greater than 5% of whole company income comes from this division.

Cloud Computing

Alibaba’s cloud section, Alibaba Cloud, gives a whole suite of cloud providers globally, together with database, storage, community virtualization, safety, administration and software, huge information analytics, and different providers.

The cloud division’s Q3 FY 2022 gross sales of $3.1 billion was up 20.4% year-over-year. After reporting a deficit in the identical statistic a 12 months in the past, it earned a revenue of $21 million this time round. About 8% of general gross sales and a minor share of adjusted EBITA comes from this division.

Alibaba Monetization strategies

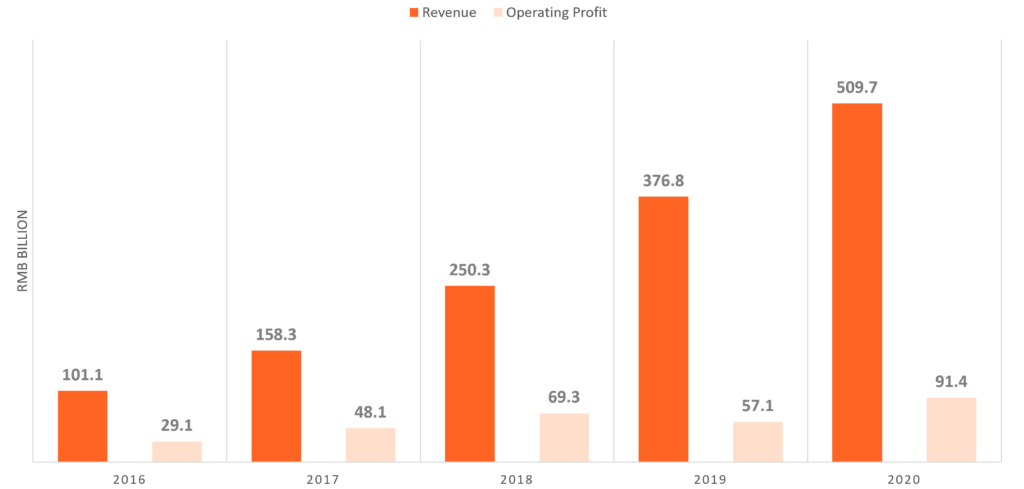

Alibaba’s monetary outcomes have proven a mixture of development and challenges. As an illustration, within the third quarter of the 2022 fiscal 12 months, the corporate reported a 9.7% YoY rise in income to $38.1 billion. Nonetheless, its web revenue attributable to unusual shareholders fell by 74.3% to $3.2 billion throughout the identical interval.

Alibaba’s enterprise mannequin generates income primarily from three avenues: on-line advertising and marketing providers, commissions on transactions, and membership and value-added providers.

On-line Advertising and marketing Providers

Alibaba gives numerous on-line advertising and marketing providers. These embrace pay-for-performance advertising and marketing, show advertising and marketing providers, the Taobaoke program, and placement providers. Sellers pay advertising and marketing charges to accumulate consumer visitors and promote their services or products.

All Gold Provider members should meet strict standards as a way to keep their elite standing. Third-party credit score reporting corporations additionally conduct a radical authentication and verification course of.

Commissions on Transactions

Along with on-line advertising and marketing providers, sellers on Tmall and Juhuasuan additionally pay a fee primarily based on the gross merchandise quantity (GMV) of transactions settled by Alipay. Alibaba additionally earns income from commissions on transactions over AliExpress.

Membership and Worth-Added Providers

Alibaba generates substantial income from membership charges and value-added providers. These embrace the sale of China TrustPass memberships on 1688.com and gold provider memberships on Alibaba.com, each of which permit wholesalers to host premium storefronts. Alibaba additionally gives value-added providers corresponding to product showcases and different enterprise options.

Key Takeaways from the Alibaba Income Mannequin

Listed below are a few of the key takeaways from the Alibaba Income Mannequin and the monetization strategies they use:

Numerous Income Streams: Alibaba income mannequin is very diversified, with revenue derived from numerous sources corresponding to e-commerce, cloud computing, digital media, and leisure. This diversification mitigates dangers related to dependence on a single income supply.

Ecommerce Dominance: Majority of Alibaba’s income comes from its e-commerce companies, together with platforms like Taobao and Tmall. These platforms generate income by promoting and transaction charges from sellers who use these platforms to succeed in shoppers.

Development of Cloud Computing: Alibaba’s cloud computing section, Alibaba Cloud, has emerged as a big income supply. It supplies numerous providers like information storage, analytics providers, machine studying, and plenty of extra to varied companies, thereby producing revenue.

Digital Media and Leisure: Alibaba income mannequin additionally contains digital media and leisure providers like video streaming platform Youku Tudou and music streaming service Xiami, producing income by subscription and promoting.

Buyer-Centric Strategy: Alibaba’s major concentrate on buyer expertise and satisfaction has performed an instrumental function in its income development. By providing a variety of merchandise at aggressive costs by their custom-made smartphone apps, it has efficiently attracted and retained a big buyer base.

Cross-Border E-commerce: Alibaba has expanded globally, particularly specializing in cross-border e-commerce. It permits worldwide manufacturers to promote their merchandise to China’s huge client market, thus incomes transaction charges and boosting its income.

Knowledge-Pushed Technique: Alibaba makes use of information analytics to know client conduct higher, enabling it to supply customized buyer experiences and enhance its providers. This data-driven technique has helped Alibaba improve consumer engagement and, consequently, its income.

Conclusion

Alibaba income mannequin and monetization methods are a testomony to its revolutionary and forward-thinking strategy to enterprise. The corporate’s various income streams, starting from on-line advertising and marketing providers to cloud computing, mirror its capacity to adapt to altering market dynamics and client preferences. Crucially, Alibaba has harnessed the facility of information to deepen its understanding of its huge buyer base, enabling it to ship options that meet its evolving wants.

Alibaba’s continued dedication to innovation and diversification, balanced with a radical comprehension of its clients, underscores its potential for sustained development. Alibaba’s story reaffirms the significance of repeatedly evolving and adapting in at the moment’s fast-paced digital financial system, and exemplifies the facility of a well-designed and well-executed income mannequin.