The massive information this week got here from the Fed, with a pause within the charge hike cycle together with hawkish language from the FOMC (larger charges to come back). Nonetheless, after a quick pullback in shares, the S&P 500 (SPY) and different markets have gotten again to their bullish methods. We’ll get again to that in a bit, however the excellent news for us is bullishness can solely assist our portfolio. Regardless of the uncorrelated nature of a few of our smaller holdings (when it comes to market cap), a rising tide tends to carry all boats. Learn on for extra….

(Please take pleasure in this up to date model of my weekly commentary initially printed June 15th within the POWR Shares Beneath $10 publication).

As anticipated, the Fed determined to not elevate charges on the June FOMC assembly. This comes on the heels of an even bigger anticipated drop in CPI. The favored inflation measure got here in at 4%, which was down considerably from 4.9% within the earlier month.

The obvious easing of inflation could also be one cause the Fed was snug not elevating charges this time round.

Nonetheless, the FOMC wasn’t shy about being hawkish with its language. There’s almost a 70% probability of 1 / 4 level charge hike in July. Furthermore, the central financial institution made it clear they’ve numerous work left to do earlier than they get to the inflation quantity they like.

Nonetheless, the warnings from the Fed made little distinction to the inventory market. After a quick pullback within the main indices, shares rebounded by the tip of Fed Day. And on Thursday, the S&P 500 (SPY) climbed one other 1.2%.

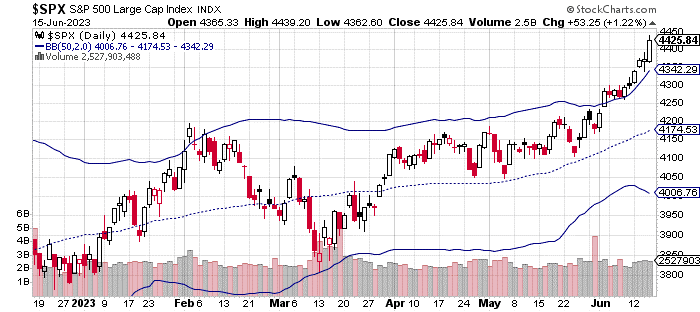

You possibly can see within the chart above, the SPX (S&P 500 index) is clearly above the two-standard deviation higher barrier.

Volatility has elevated a bit, so the breach is a bit much less egregious than it could have been per week in the past. That being stated, I’d count on some imply reversion subsequent week because the shopping for subsides.

That’s to not say shares gained’t preserve going up on common. The truth is, at this level, I’d be stunned by any significant selloffs for the subsequent month or so.

Nonetheless, as I usually say, imply reversion is an actual factor and in some unspecified time in the future the market will transfer again in direction of its imply worth.

Within the meantime, the economic system continues to chug away. Retails gross sales additionally beat expectations this week (climbing 0.3% in Might) as shoppers proceed to buy regardless of larger than regular inflation.

The Fed has an attention-grabbing scenario on its palms. Do they wish to take an opportunity torpedoing the economic system? Or, ought to their focus be totally on reducing inflation?

We’ll see how issues play out, however I’d count on a pair extra charge will increase this yr earlier than we’re ready to carry regular (and ultimately see decrease charges). We could also be caught with larger charges for an additional yr or so at this charge.

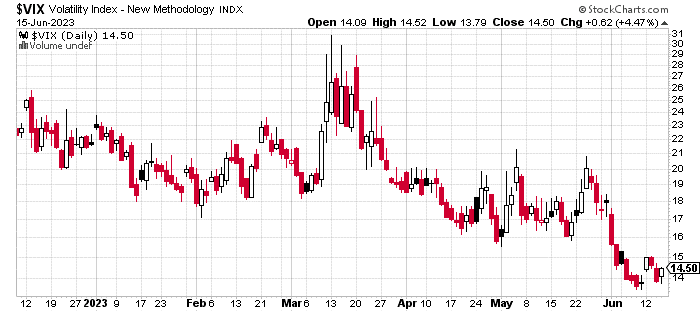

Volatility moved a bit larger earlier than the Fed announcement nevertheless it fell again down beneath 15 on Thursday. All indicators level in direction of a continued low volatility regime for the summer time buying and selling months. You possibly can see the VIX motion within the graph beneath.

Outdoors of some sudden information gadgets, I wouldn’t count on any vital improve within the VIX degree till we method the July FOMC assembly.

Have in mind, the July 4th vacation is main journey season and there isn’t more likely to be a lot volatility round that interval.

What To Do Subsequent?

The above commentary will allow you to recognize the place the market goes. However if you wish to know the perfect shares to purchase now, then please take a look at my new particular report:

3 Shares to DOUBLE This 12 months

What provides these shares the proper stuff to turn into massive winners, even on this difficult inventory market?

First, as a result of they’re all low priced corporations with essentially the most upside potential in at the moment’s unstable markets.

However much more essential, is that they’re all high Purchase rated shares based on our coveted POWR Scores system they usually excel in key areas of progress, sentiment and momentum.

Click on beneath now to see these 3 thrilling shares which might double or extra within the yr forward.

3 Shares to DOUBLE This 12 months

All of the Finest!

Jay Soloff

Chief Development Strategist, StockNews

Editor, POWR Shares Beneath $10 Publication

SPY shares closed at $439.46 on Friday, down $-3.14 (-0.71%). 12 months-to-date, SPY has gained 15.35%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Jay Soloff

Jay is the lead Choices Portfolio Supervisor at Buyers Alley. He’s the editor of Choices Ground Dealer PRO, an funding advisory bringing you skilled choices buying and selling methods. Jay was previously knowledgeable choices market maker on the ground of the CBOE and has been buying and selling choices for over twenty years.

The put up Studying Between the Traces of the Newest FOMC Assertion appeared first on StockNews.com