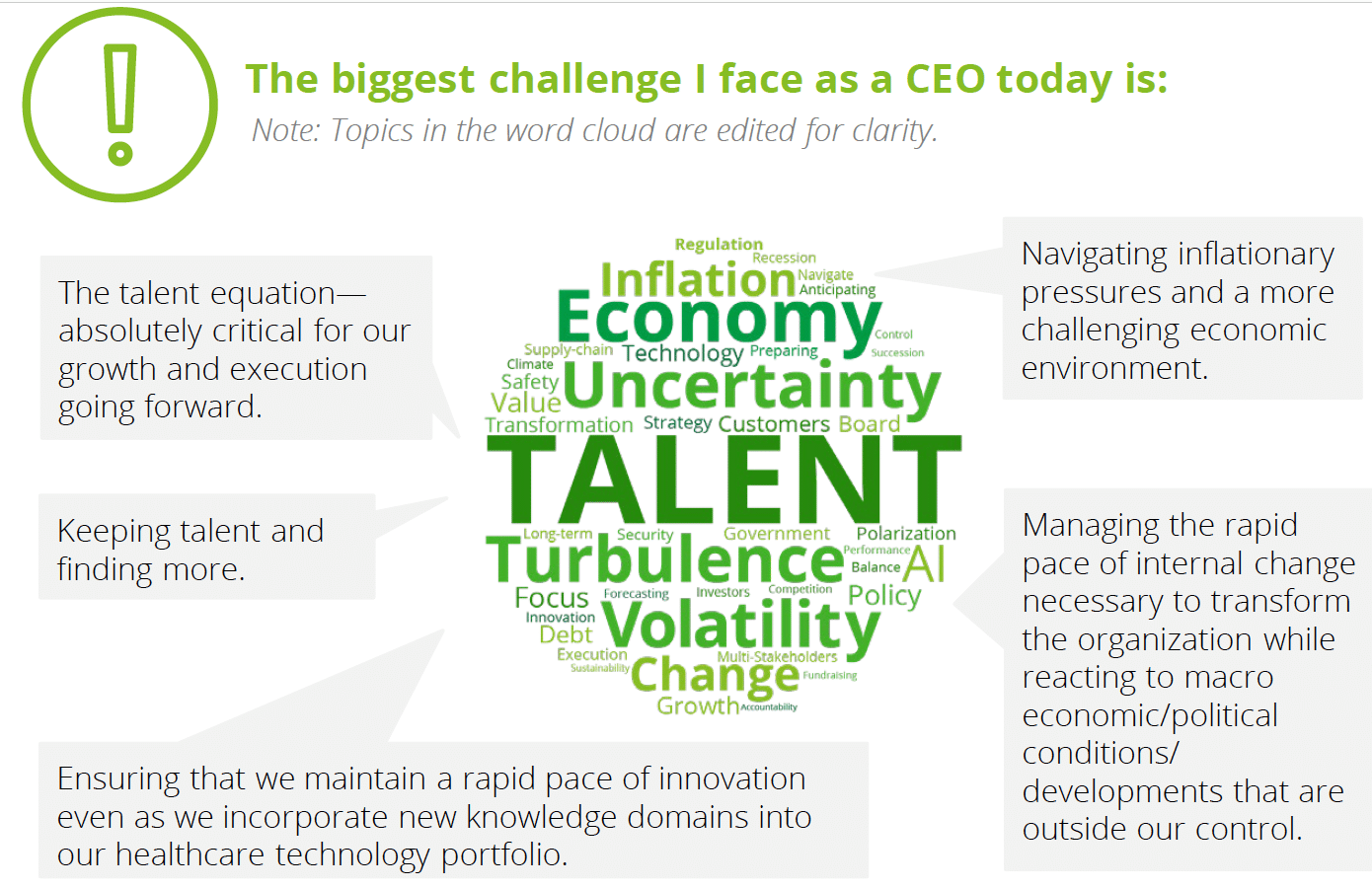

Feeling assured even amid rising inflation, geopolitical instability, and expertise recruiting and retention challenges, practically 150 main CEOs throughout industries categorical optimistic sentiments for the 12 months forward, new analysis from Deloitte and Fortune reveals. Whereas staffing stays high of thoughts, these CEOs search to steadiness prioritizing longer-term strategic targets by investing in enterprise transformation and innovation whereas not sacrificing give attention to the short-term.

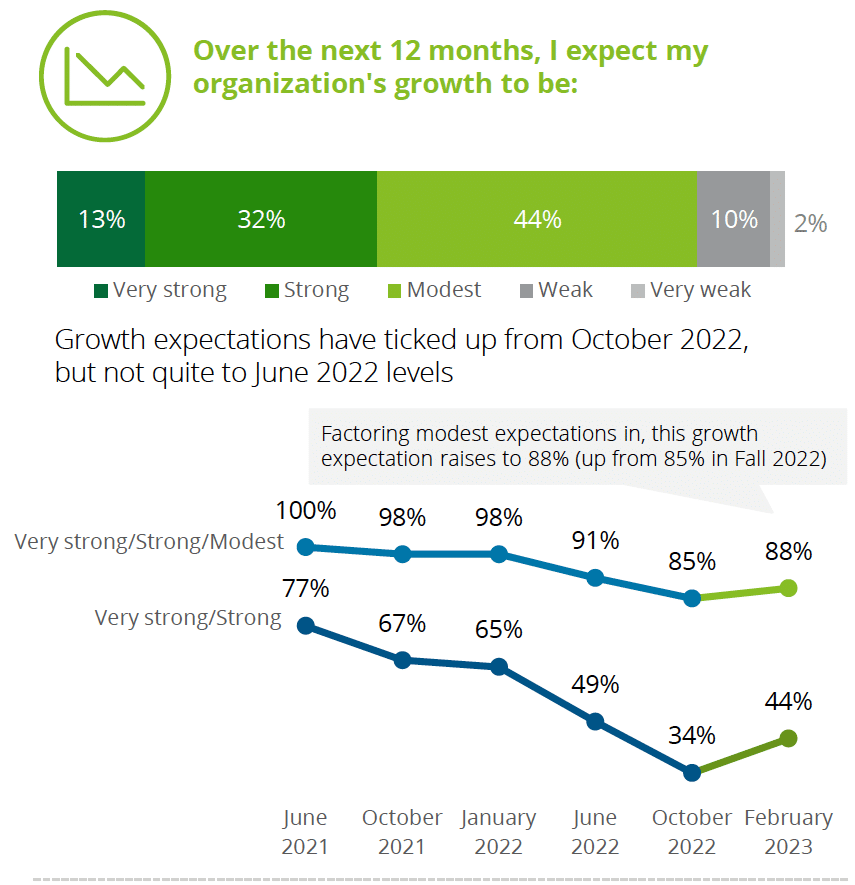

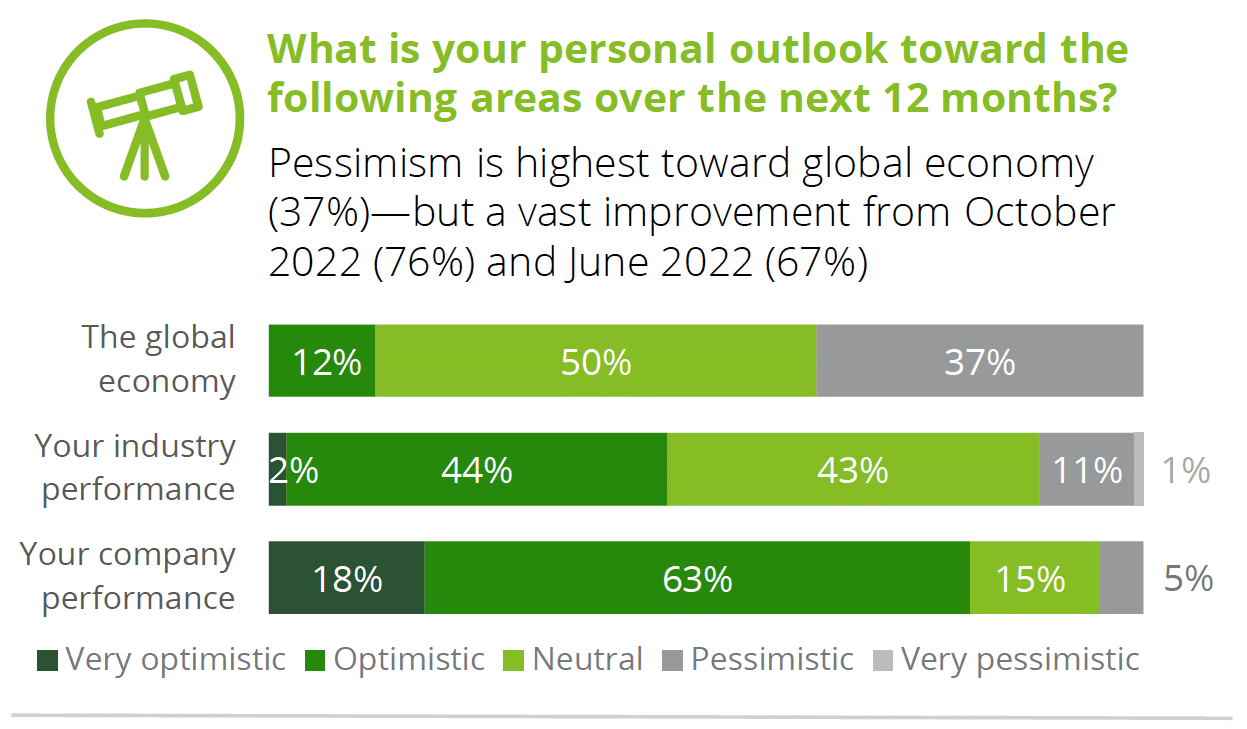

The agency’s Winter 2023 Fortune/Deloitte CEO Survey reviews that CEOs are more and more trending extra optimistic about their firm’s progress over the subsequent 12 months: 45 % of CEOs count on sturdy or very sturdy progress, up from 34 % in October 2022, however nonetheless down from 49 % in June 2022. With optimism on the rise from summer season and fall of final 12 months, and pessimism declining, considerations in regards to the world financial system dropped sharply from 76 % in October 2022 to 37 %.

“CEO optimism has clearly dimmed since this time final 12 months, however the CEOs are nonetheless not in something like a recessionary mindset,” stated Alan Murray, Fortune CEO, in a information launch. “They see inflation and labor shortages—each issues ensuing from extra demand—as their largest threats. And so they really feel the mandate to spend money on transformation as strongly as ever.”

The CEO Survey sequence tracks the views and actions of CEOs from the world’s largest and most influential corporations, offering key insights into their priorities, challenges, and expectations throughout greater than 15 industries, together with know-how, finance, and healthcare.

High considerations stay the identical

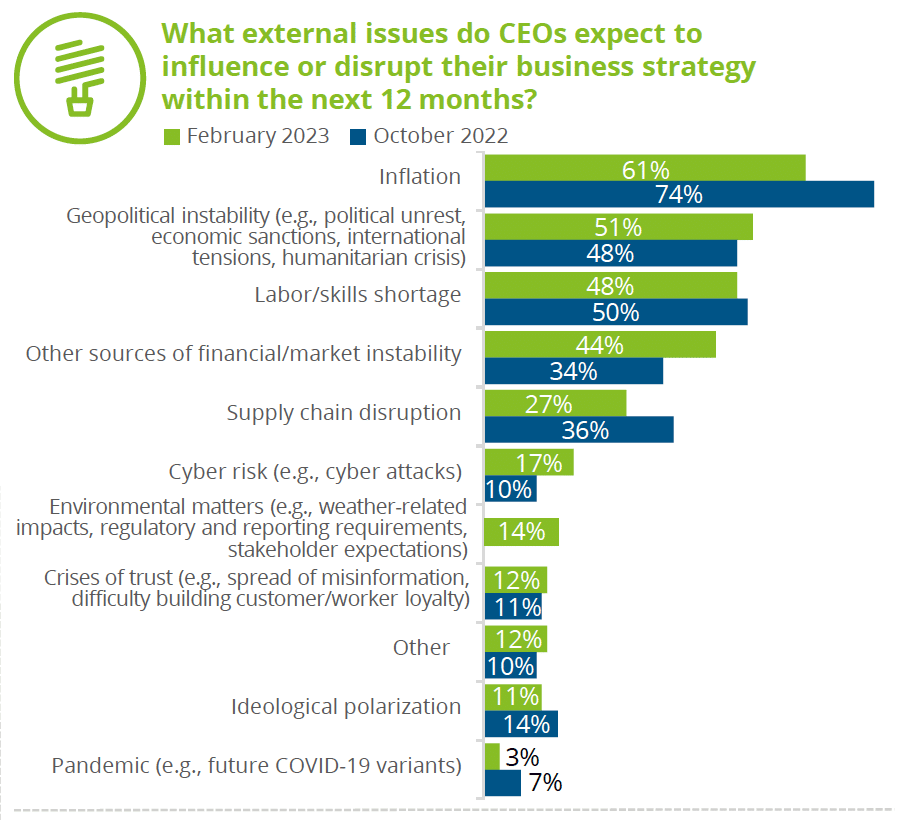

Whereas the highest three disruptors—inflation, geopolitical instability, and expertise—stay the identical, CEOs are exhibiting reducing concern round these high points. Though inflation continues to be seen as the largest problem CEOs will face right this moment, these surveyed predict that inflation will lower by mid-year. Nevertheless, this improved inflation price might come at the price of a rise within the federal funds rate of interest.

Geopolitical instability surpassed labor/expertise shortages and ranked second behind inflation as exterior points that CEOs count on to affect or disrupt their enterprise technique inside the subsequent 12 months. In comparison with October 2022, when 48 % of CEOs ranked geopolitical instability as a high concern, 51 % expressed the identical concern on this survey. Labor/expertise shortages dropped to 3rd on this survey with 48 %, down 2 % from the autumn. Different sources of economic instability, which ranked fourth, has risen steeply to 44 %, up from 34 % in October and nearly double (23 %) from June 2022, whereas provide chain disruption dropped to 27 %, down from 36 % in October.

“After what many CEOs agree was one other 12 months of disruption and complicated challenges, it’s extremely promising to see rising optimism amongst CEOs for the 12 months forward and expectations that their organizations will proceed to develop,” stated Jason Girzadas, CEO Elect at Deloitte US, within the launch. “Whereas inflation and an unsure financial system are actually on the minds of CEOs, they seem undeterred from prioritizing investments in key areas like core enterprise transformation, expertise, and market innovation which will assist drive long-term progress.”

CEOs are concurrently specializing in the current and the longer term

Balancing short-term calls for with long-term threats, CEOs are discovering they spend barely extra time (55 %) centered on the long-term vs. the brief (45 %). With no scarcity of funding areas and priorities to give attention to, over two-thirds of CEOs ranked core enterprise transformation (67 %) and expertise acquisition (67 %) as high precedence funding areas. Rounding out the highest three priorities, properly over half of CEOs (62 %) ranked different new product/service/market improvements as precedence funding areas.

They proceed to look to spend money on and leverage AI

Following the October 2022 survey when the bulk (91 %) of CEOs stated they plan to speculate to a point in AI over the subsequent 12 months, they now appear to be taking a realistic method. Most look like centered on the foundational elements of AI know-how, viewing it as a platform for superior predictive analytics (85 %), refined knowledge evaluation (80 %), and, to a considerably lesser diploma, suggestion engines (52 %). Almost 4 in 10 (39 %) stated they presently view AI as a platform for generative AI, and solely a fourth (27 %) envision AI as a platform for autonomous determination making.

To fight societal points, CEOs view collaboration as the very best means ahead

CEOs consider collaboration is the greatest plan of action for ESG points, belief in establishments, cybersecurity dangers, and moral know-how however not essentially for superior applied sciences. Overwhelmingly, CEOs see fixing local weather change (93 %) and geopolitical stability (92 %) points with collaboration relatively than competitors.

Learn the total report right here.

Fielded between Feb. 14-21, 2023, 149 CEOs representing greater than 15 industries shared their views, expectations, ideas, and priorities for the subsequent 12 months. These leaders surveyed embody Fortune 500 CEOs, International 500 CEOs, and choose CEOs within the world Fortune neighborhood.