The actual property market is in an attention-grabbing state proper now. House gross sales are slowing due to larger rates of interest, however costs in some areas have but to drop. Total, the median present residence gross sales worth in January 2023 was up 1.3% from the identical time final 12 months, however residence costs in costly areas have gone down, whereas costs in cheaper areas have gone up.

Contemplating that residence costs have been reaching report highs in 2021, one would anticipate them to have normalized with the slowing market, however that has but to occur. Nonetheless, if rates of interest proceed to rise, costs ought to proceed to drop.

However what does that imply to you and your funds? This text will discover how the present actual property market can affect you financially.

Actual Property Conditions that Can Have an effect on Your Funds

There are a number of conditions that you could be end up in the place the actual property market might have an effect on your funds.

1. Shopping for a House

Should you’re available in the market to purchase a house, you are going to pay the next rate of interest than you’d have in 2021. Nonetheless, the stock of properties is excessive and the variety of consumers is down. That implies that you might have extra negotiating energy with sellers. Costs could also be larger, however chances are high, most sellers are very motivated which may put you within the driver’s seat.

However you may find yourself paying the next price, however with a cheaper price level for the house, so it could even out for you financially. It’s also possible to refinance later if rates of interest go down and get forward of the sport.

Make sure you do your analysis into what is going on in your space by way of costs and the variety of gross sales which are occurring. Each native market is totally different. Be sure that your actual property agent talks to you about present comparable gross sales, and use your negotiating energy.

2. Promoting a House

Should you’re planning to promote your property within the close to future, chances are you’ll be underneath a little bit of strain. Patrons are fewer in lots of areas as a result of larger rates of interest, so the individuals which are shopping for have the negotiating energy. Should you can, chances are you’ll be higher off ready to promote till charges return down. Nonetheless, what is going to occur with rates of interest and when is a good unknown.

If it is advisable to promote and also you need to get a particular revenue on what you paid for the house or on what you owe in your mortgage, you may calculate right here what worth it is advisable to keep on with.

Usually the very best technique in this sort of market is to cost your property larger than what you really need. That manner the customer can negotiate and really feel like they’re getting a deal. It can’t be careworn sufficient, nonetheless, that the very best technique depends upon your native market.

Do your homework and speak to your actual property agent about what is going on in your market and what comparable properties are promoting for. And if it is advisable to make a sure revenue on your property, you may keep on with your weapons and look ahead to that purchaser that “will need to have” your property.

Work together with your agent to make your property as interesting to consumers as doable by making repairs or upgrades and staging the house properly. In a tricky market, it is advisable to make your property stand out from the competitors.

Additionally, work together with your tax advisor when contemplating the value that it is advisable to get. Promoting at cheaper price means much less in capital features tax, so that may have an effect in your funds total.

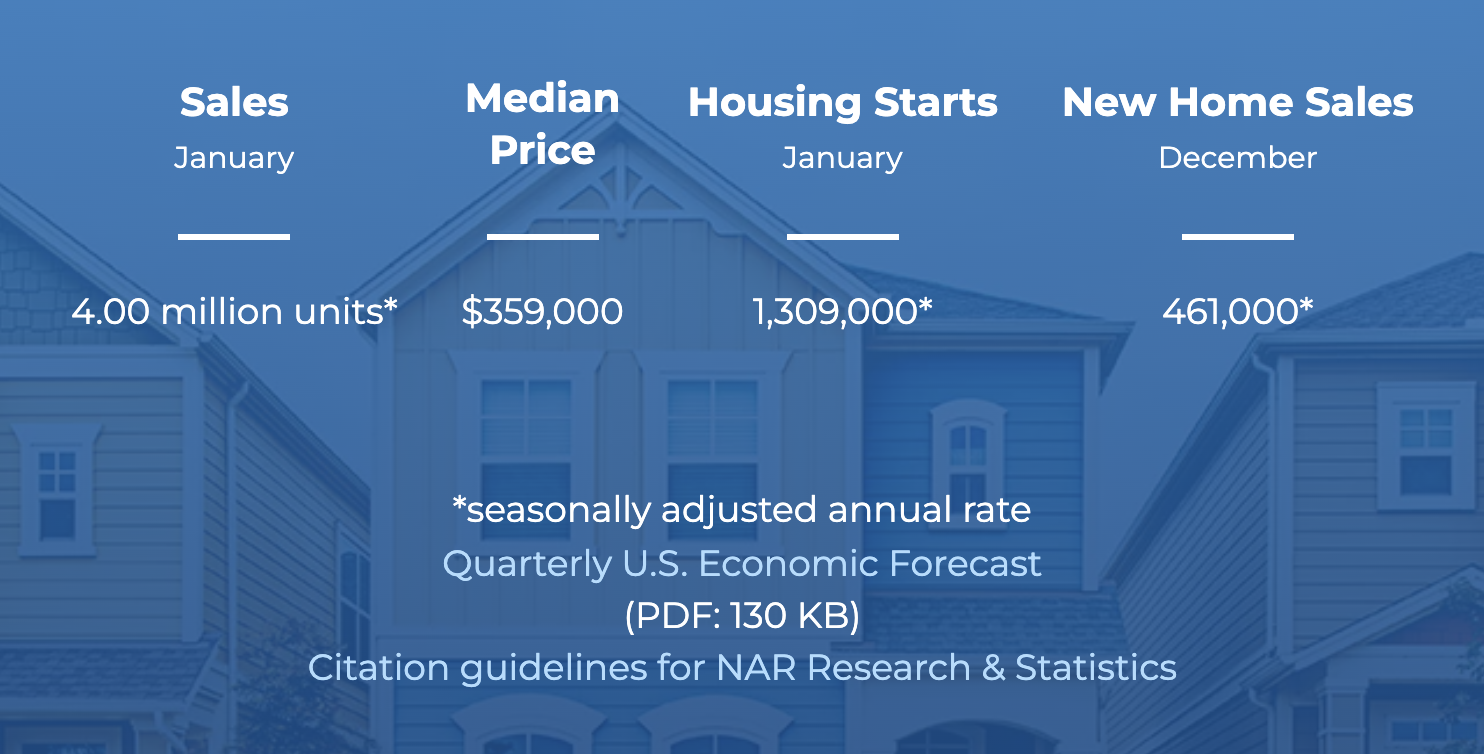

Particular observe: there was $400mm in gross sales in January 2023.

3. Investing in Actual Property

Investing in actual property proper now could be an attention-grabbing proposition. Warren Buffet stated “be grasping when others are fearful”. Actual property buyers proper now are afraid of financial and market instability; nonetheless, having that form of outlook depends upon your targets and your threat tolerance.

Should you’re seeking to flip homes as an funding, it is doubtless that you could find offers, significantly on distressed properties. However with the variety of residence consumers lowering, chances are you’ll end up having bother discovering a purchaser and thus incur carrying prices. You may nonetheless make a revenue, although, for those who can put minimal cash into the property and worth it competitively primarily based on native actual property circumstances.

Your finest guess if you wish to flip properties now, is to fastidiously analyze every potential deal, together with what is going on within the particular space the property is in, and cherry choose solely the offers that take advantage of sense and have the least threat. With so many “fearful” buyers, you may have much less competitors, so you may afford to be picky.

Should you’re contemplating shopping for rental properties, it is nonetheless a matter of every deal. The upper rates of interest imply that fewer consumers are shopping for and are renting as a substitute, which might drive rents up. That is nice if you could find an awesome deal and pay money for the property. If it is advisable to finance the property, nonetheless, you may be paying the next rate of interest which can cut back your money circulate.

The underside line is, for those who’re contemplating investing, it’s a must to actually perceive your native market. Do appreciable analysis earlier than making a call.

5. Refinancing Your Mortgage

Clearly, in case your present rate of interest is decrease than present mortgage charges, refinancing your mortgage might not be a good suggestion, and vice versa. You even have to think about your closing prices when deciding if refinancing is financially useful.

If you’re refinancing to a decrease price and getting money out out of your fairness, chances are you’ll discover that when the financial institution assesses your property’s market worth, it could be decrease than you suppose. Once more, it depends upon what’s occurring to costs in your native market.

If you wish to refinance to a shorter mortgage time period, you should still be capable of profit. Charges on 10 or 15 12 months mortgages are typically decrease than 30 12 months mortgages, however your fee should still be larger due to the shorter time period.

One other factor to think about is that lenders are typically extra conservative in a gradual actual property market, so it could be harder to qualify for the refinance. Credit score rating and earnings necessities will likely be tighter, so be ready to undergo a extra rigorous utility course of.

Your finest guess is to buy round for the very best charges and phrases, analyze your choices, and resolve which possibility, if any, is best for you.

Here’s a nifty refinance mortgage calculator that can assist you.

6. House Fairness Loans

Should you’re contemplating getting a house fairness mortgage, whether or not the actual property market will affect you depends upon your targets.

If you would like a house fairness mortgage to consolidate different debt, present mortgage charges are nonetheless doubtless decrease than the charges on different debt comparable to bank cards. Nonetheless, just like a cash-out refinance, your fairness might not be as excessive as you anticipate primarily based on market values.

If you would like a house fairness mortgage to rework your property, for those who’re doing it simply since you need your home to be good and you’ll afford the funds, go for it. You may need to think about a house fairness line of credit score with a variable price in order that the speed goes down when charges go down generally. Nonetheless, charges might also go up.

If you would like a house fairness mortgage for transforming, however with the purpose of promoting your property for the next worth within the close to future, you may want to offer it cautious consideration. If charges proceed to rise and residential costs fall, chances are you’ll not get your a reimbursement from the reworking you do and the curiosity you pay on the mortgage. Make sure to not overdo your enhancements.

7. Renting

Fewer individuals shopping for properties means extra individuals renting, which is making a rental scarcity attributable to excessive demand. Consequently, in 2023 many predict that rental worth progress is more likely to stay excessive, which is dangerous information for renters.

Different financial elements are additionally lowering the quantity of earnings that renters can spend on lease. What this implies is that leases in higher-priced areas will likely be much less in demand, which ought to begin to pressure costs on these leases down a bit.

In the long term, rental costs are more likely to begin to come again down, so for those who’re discovering it tough to afford present rents, chances are you’ll solely be struggling briefly.

As with all the opposite results of the actual property market, how the present circumstances will have an effect on renters is location dependent. Should you’re available in the market for a brand new rental, do your homework and store round, and do not be afraid to barter with landlords to attempt to get a greater price.

In Closing

The actual property market is attention-grabbing proper now, and it is tough even for consultants to foretell precisely what is going to occur in 2023 and past. Many elements will have an effect available on the market’s course, so it is best to keep knowledgeable about what’s occurring available in the market, significantly in your space.

Should you’re in any of the conditions mentioned, be sure you do your market analysis and look to professionals, whether or not or not it’s an actual property agent or a monetary advisor, for recommendation. By doing so, you could find methods to efficiently navigate this unpredictable market and defend your funds.

The put up How the Present Actual Property Market Can Have an effect on Your Funds appeared first on Due.