It has been one other doozy of every week for the S&P 500 (SPY). We had Fed Chair Jerome Powell giving his semiannual testimony earlier than the Senate Banking Committee. We had the newest job openings abstract from January. We had a shock run on a financial institution in Silicon Valley push your complete monetary indicator underneath the microscope. And we had the February employment report. That is rather a lot to cowl, so let’s get to it!.

(Please get pleasure from this up to date model of my weekly commentary initially revealed March 10th, 2023 within the POWR Shares Beneath $10 publication).

Market Commentary

A lot occurred this week, that I am taking it daily. Be happy to think about the ticking clock from “24” once you learn the identify of every day.

Monday

All quiet on the Western Entrance.

Tuesday

Issues lastly kick off with the primary day of Powell’s testimony earlier than the Senate Banking Committee. The largest takeaway from the day?

“The newest financial knowledge have are available stronger than anticipated, which means that the final word degree of rates of interest is prone to be larger than beforehand anticipated.”

Powell says that inflation stays excessive and the labor market is robust and that, despite the fact that inflation has been moderating in current months, it nonetheless has an extended option to go earlier than it reaches 2%.

His feedback set off a 1.5% selloff throughout the market, with each sector ending decrease for the day.

Wednesday

On his second day on the podium, Powell repeats his message that the U.S. central financial institution is prone to take charges larger than beforehand anticipated, however following Tuesday’s selloff, he goes off-script to emphasize that policymakers had not but made up their minds on the scale of their interest-rate enhance later this month.

“If — and I stress that no choice has been made on this — but when the totality of the information had been to point that quicker tightening is warranted, we might be ready to extend the tempo of charge hikes.”

“The info” Powell is referring to the handful of essential financial studies on deck, together with the January studying on U.S. job openings, February’s employment report, and subsequent week’s shopper value knowledge.

On Wednesday, we additionally get the primary of these studies — the newest Job Openings and Labor Turnover Abstract (JOLTS) from January, which present the variety of job openings fell to 10.82 million, down from the upwardly revised 11.2 million openings within the prior month.

The Bureau of Labor Statistics studies that development, leisure, hospitality, and finance industries confirmed the most important pullbacks in job openings.

Shares fare barely higher, with the S&P 500 (SPY) and Nasdaq closing barely up and the Dow closing solely barely decrease.

Thursday

This was speculated to be a comparatively quiet day out there, with Powell’s testimony over and no main studies scheduled to be launched.

However as a substitute, we see Silicon Valley Financial institution (SIVB), the popular financial institution of many startups, shoot itself within the foot after saying it was liquidating its complete short-term securities e book and elevating $2.25 billion recent capital.

That in itself wasn’t an issue; it was when the CEO tried to guarantee its traders that the financial institution had loads of liquidity and acknowledged to the group, “the very last thing we’d like you to do is panic.”

No higher option to begin a run on a financial institution!

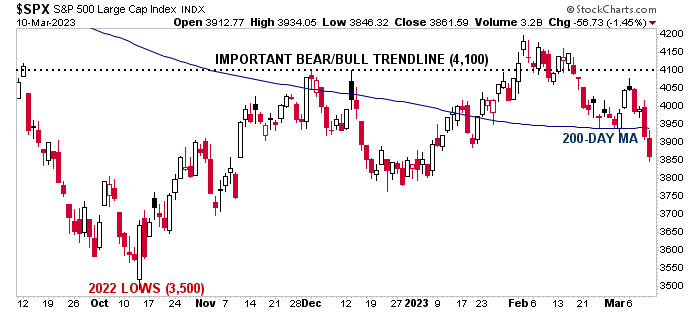

The complete banking sector will get shoved underneath the microscope, with many shares dropping double digits. The S&P 500 closes beneath the essential 200-day transferring common.

Friday

One other jobs launch, one other hotter-than-expected report. The economic system added 311,000 jobs in February (greater than the 215,000 anticipated) and the unemployment charge rose to three.6% as inflation forces extra individuals to search for jobs.

The intense spot within the report was that wage development got here in at 4.6%, barely decrease than the anticipated 4.7%. Nonetheless, that is nonetheless considerably above the pre-pandemic degree… and that is going to be a priority for the Fed.

Oh, and that financial institution I discussed earlier… the FDIC shut it down Friday morning. It is the most important financial institution to fall since Washington Mutual collapsed in 2008. Not nice!

Whew! What every week. This is a chart to point out you the place issues stand.

You realize, by way of all of it, I feel my greatest takeaway from every thing continues to be the potential that the Federal Reserve could return as much as a 50-bps hike after slowing to 25 foundation factors within the newest assembly.

Why did that catch my consideration? As a result of the Fed hasn’t stutter-stepped on the finish of a charge mountain climbing cycle since 1990.

What would it not imply for the economic system if we obtained a 50-bps hike on March 22?

Would it not be an automated “everybody panic, the recession is coming” siren? Completely not.

Would it not be an “Oh good, we’re positively going to get a smooth touchdown” all clear? Additionally positively not.

Actually, we do not know what it could imply as a result of we have not seen it occur in current historical past. And since we do not know what it means, we’ve to tread cautiously.

We are going to nonetheless hold buying and selling, and we’ll nonetheless hold utilizing our edge to seek out shares underneath $10 which might be able to explode to new heights.

Can all that occur in a market that feels prefer it’s on shaky floor? Completely.

Conclusion

For those who thought this week was risky, then buckle up for the increase!

We have CPI and PPI scheduled for Tuesday and Wednesday, quadruple witching on Friday (an choices occasion that normally comes with a wave of volatility), after which the subsequent Federal Reserve assembly the week after.

With everybody on edge, one other financial institution going underneath or a higher-than-expected inflation report might ship shares sinking. As I stated, we will be treading rigorously and whereas nonetheless maintaining a watch out for our subsequent huge winner.

What To Do Subsequent?

If you would like to see extra prime shares underneath $10, then you must try our free particular report:

3 Shares to DOUBLE This 12 months

What provides these shares the suitable stuff to grow to be huge winners, even on this brutal inventory market?

First, as a result of they’re all low priced firms with probably the most upside potential in right now’s risky markets.

However much more essential, is that they’re all prime Purchase rated shares based on our coveted POWR Scores system they usually excel in key areas of development, sentiment and momentum.

Click on beneath now to see these 3 thrilling shares which might double or extra within the 12 months forward.

3 Shares to DOUBLE This 12 months

All of the Greatest!

Meredith Margrave

Chief Development Strategist, StockNews

Editor, POWR Shares Beneath $10 E-newsletter

SPY shares closed at $385.91 on Friday, down $-5.65 (-1.44%). 12 months-to-date, SPY has gained 0.91%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Meredith Margrave

Meredith Margrave has been a famous monetary professional and market commentator for the previous 20 years. She is presently the Editor of the POWR Development and POWR Shares Beneath $10 newsletters. Be taught extra about Meredith’s background, together with hyperlinks to her most up-to-date articles.

The submit Making Sense of a Wild Week within the Markets appeared first on StockNews.com