For a lot of Individuals, the significance of planning for retirement has lately change into a vital monetary precedence as many soon-to-be retirees are gearing as much as exit the workforce within the coming years.

As individuals become older, retirement planning takes a superior place amongst different monetary priorities. In a time the place the price of dwelling is continually rising, towards the backdrop of an unsure future, planning in your monetary future turns into more and more difficult as you begin to age.

The state of retirement in America

Lately, a number of research and surveys have discovered that it is change into more and more exhausting for Individuals to avoid wasting and increase their retirement financial savings as a result of ongoing financial dangers

In a GOBankingRates survey of 1,000 Individuals aged 18 years and older, round 32.9% had not more than $100 of their financial savings account. An analogous examine printed in 2022 discovered that just about 22% of Individuals had lower than $100 of their financial savings accounts.

There is not any appropriate time or age to begin planning or saving for the longer term, particularly when all the pieces appears to have so many added dangers lately.

In line with a Northwestern Mutual 2021 Planning & Progress Examine, Individuals have lately been growing their retirement financial savings, with the common retirement financial savings account rising by 13% from $87,500 to $98,800.

Regardless of many bumping up their saving efforts, soon-to-be retirees, these aged 55 to 64 have a median financial savings steadiness of $120,000, whereas youthful U.S. adults, underneath 35 presently have a median account steadiness of $12,300 in line with a PwC report.

A variety of unplanned eventualities all through the previous few years have compelled many individuals into early retirement. Those that had been unable to correctly save and plan, have lately stepped out of retirement and again into the workforce as a technique to financially maintain themselves.

The common age of retirement has elevated from 60 in 1990 to 66 in 2021 and with the vast majority of adults now dwelling longer than beforehand, having fun with life after work will be expensive in case you do not begin planning properly earlier than the age of retirement arrives.

Retirement calculation – slicing prices earlier than retirement

Financial uncertainty and rising prices have beckoned American adults to begin saving early on of their careers.

From this, analysis exhibits that for youthful earners, these born between 1981 and 1985, the retirement outlook is extra optimistic, as consultants predict them to have the best inflation-adjusted median annual earnings by the point they attain 70.

Early millennials, as they’re referred to as, will see a 22% improve of their annual earnings as soon as they enter retirement, in comparison with pre-boomers, or these employees born between 1941 and 1945.

Era Z, people aged 19 to 25 are even higher at saving for his or her future, with a majority of them placing away on common 14% of their earnings in line with one BlackRock examine printed final 12 months.

Youthful generations have extra confidence, and extra optimism relating to planning for his or her retirement and future. Now with a majority of them taking on house within the workforce, monetary priorities will quickly start to alter, as many look to construct a nest egg that might final them by means of retirement.

Following a strict price range, slicing pointless bills, and studying how one can work with cash are among the few issues many individuals are doing to cut back prices to stuff their retirement financial savings.

Scale back high-interest debt

Inflationary stress all through a lot of final 12 months has seen an more and more excessive variety of American adults lean on bank cards and private loans to assist them pay for on a regular basis bills. As of 2023, near half – 46% – of U.S. adults carry month-to-month debt, whether or not it is bank cards or different interest-related debt.

Conserving bills to a minimal can begin by decreasing high-interest debt corresponding to bank cards or private loans. For almost all of the working class, whereas it is nonetheless attainable to afford it, it is recommended to reduce any curiosity debt you should still have, whilst you’re nonetheless receiving a month-to-month earnings.

Having this monetary security web means you are able to decrease your future bills and direct extra cash in the direction of extra necessary monetary objectives corresponding to saving for retirement.

Taking management of your debt could be a problem, as these bills are inclined to accumulate over time, so it is best suggested to take a look at which funds will be handled firstly, and whether or not it is attainable to shorten the cost interval in order that it would not stretch into your retirement years.

Assess your insurance coverage protection

One other technique to reduce bills early on in your profession is to evaluate your insurance coverage protection. As you change into older, medical health insurance protection turns into an more and more necessary product that you will want to hold for a lot of your golden years.

Taking the mandatory steps now to make sure you have the proper insurance coverage protection will assist you to higher perceive what sort of product you must take out, and what you might be paying for.

Typically individuals solely take out insurance coverage protection later of their life, as soon as they’re in a cushty monetary place. Whereas this could make sense on the time, insurance coverage merchandise are inclined to change into costlier as you age.

Whereas the distinction in merchandise could also be a couple of {dollars} every month, over the long run these shortly add up. Chatting with a monetary skilled or dealer will provide you with higher steering on which insurance coverage merchandise are greatest for somebody in your place, and will provide you with probably the most advantages when you step into retirement.

Take management of scholar loans

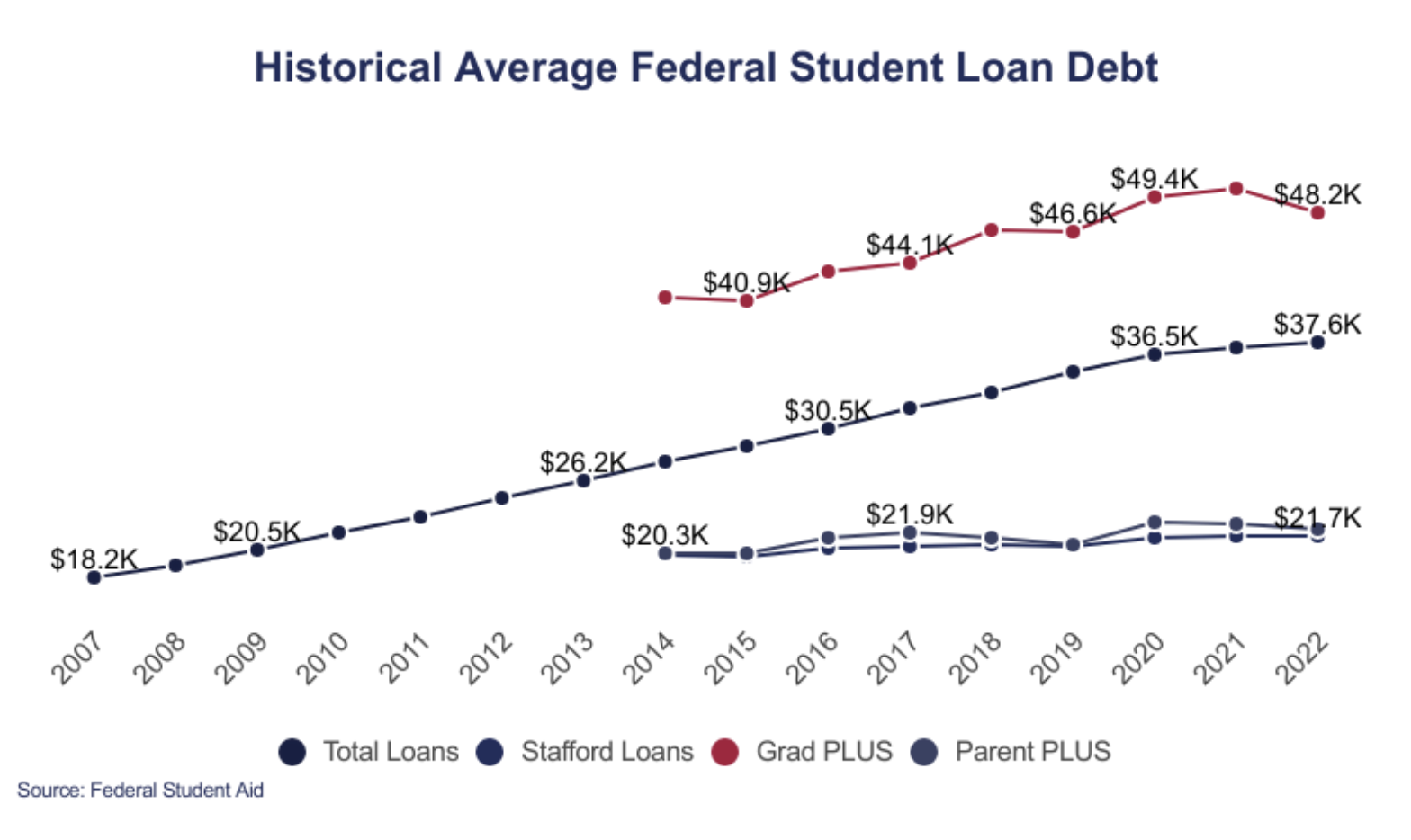

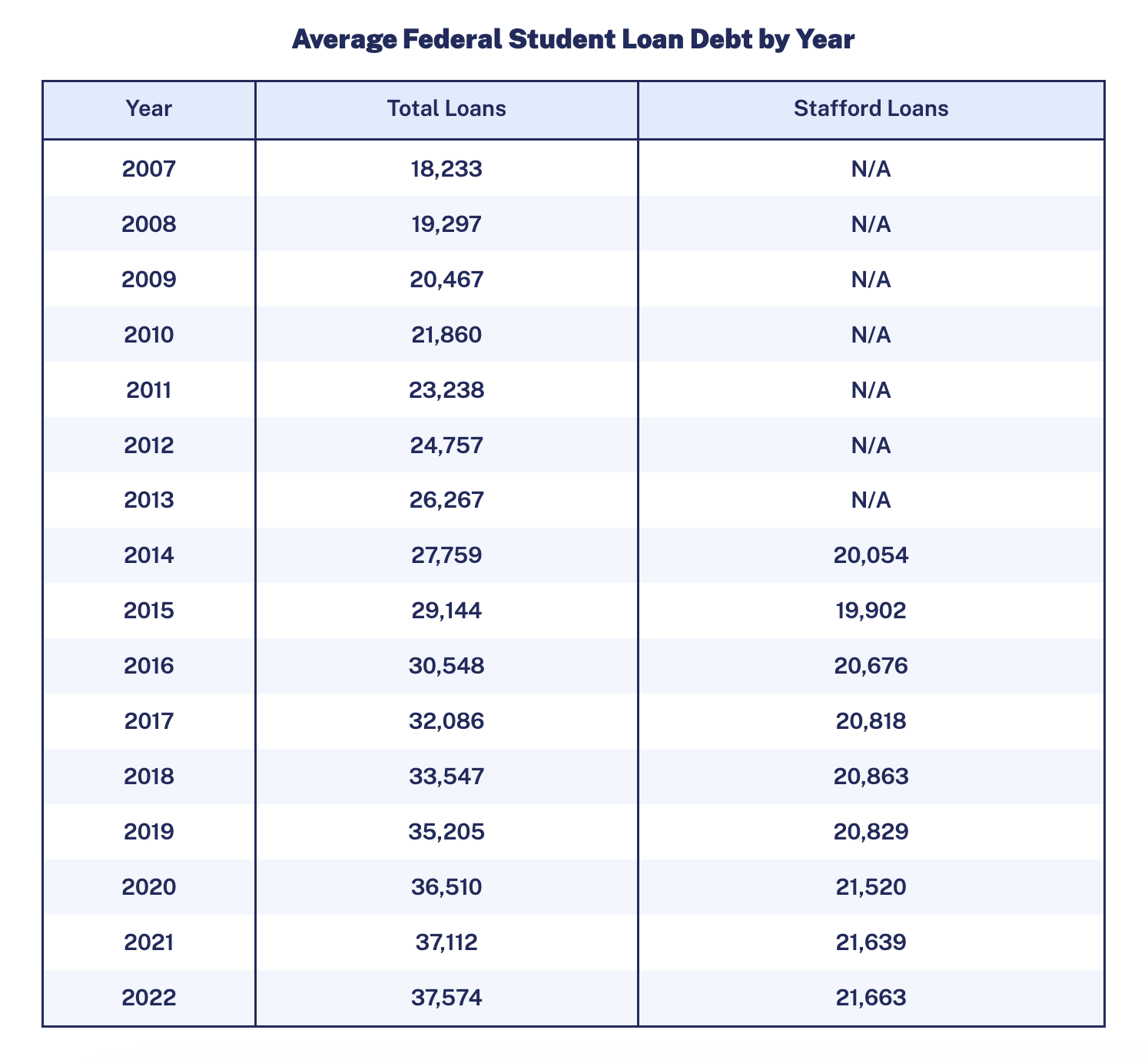

Pupil mortgage debt is a large burden for almost all of American adults. In line with the Schooling Information Initiative, the common federal scholar mortgage debt is $36,575 per borrower, whereas personal scholar mortgage debt averages $54,921 per borrower.

As of the beginning of this 12 months, round 45.3 million adults in America have some type of scholar mortgage debt, with a majority of them – 92% – having federal scholar mortgage debt.

Carrying this debt into retirement is just not solely a monetary burden, however it takes a pressure in your retirement financial savings plans in case you do not handle to prioritize these funds.

Taking extra possession of your scholar mortgage debt now will assist you to in the long run, permitting you to direct extra of your monetary efforts later in your life towards organising your nest egg. In the event you’re undecided how one can handle your scholar loans or have been struggling to make funds, attain out to a monetary advisor for steering, or apply for scholar mortgage reduction help.

In the event you presently work within the public sector, or for a authorities entity, see whether or not there are any scholar mortgage reduction packages you may qualify for to assist lighten the burden.

Pay-off your mortgage

Mortgage charges have practically doubled in a 12 months, because the Federal Reserve continues with its aggressive financial tightening, making it costlier for shoppers to borrow cash.

In mid-January 2023, the benchmark 30-year mortgage fee was 6.48%, up from 3.22% on the similar time a 12 months in the past. In line with the U.S. Census Bureau, the median month-to-month mortgage cost sits round $1,100.

Individuals have witnessed home costs soar in latest months, as demand grows, provide decreases, and the price of labor and constructing supplies proceed to rise.

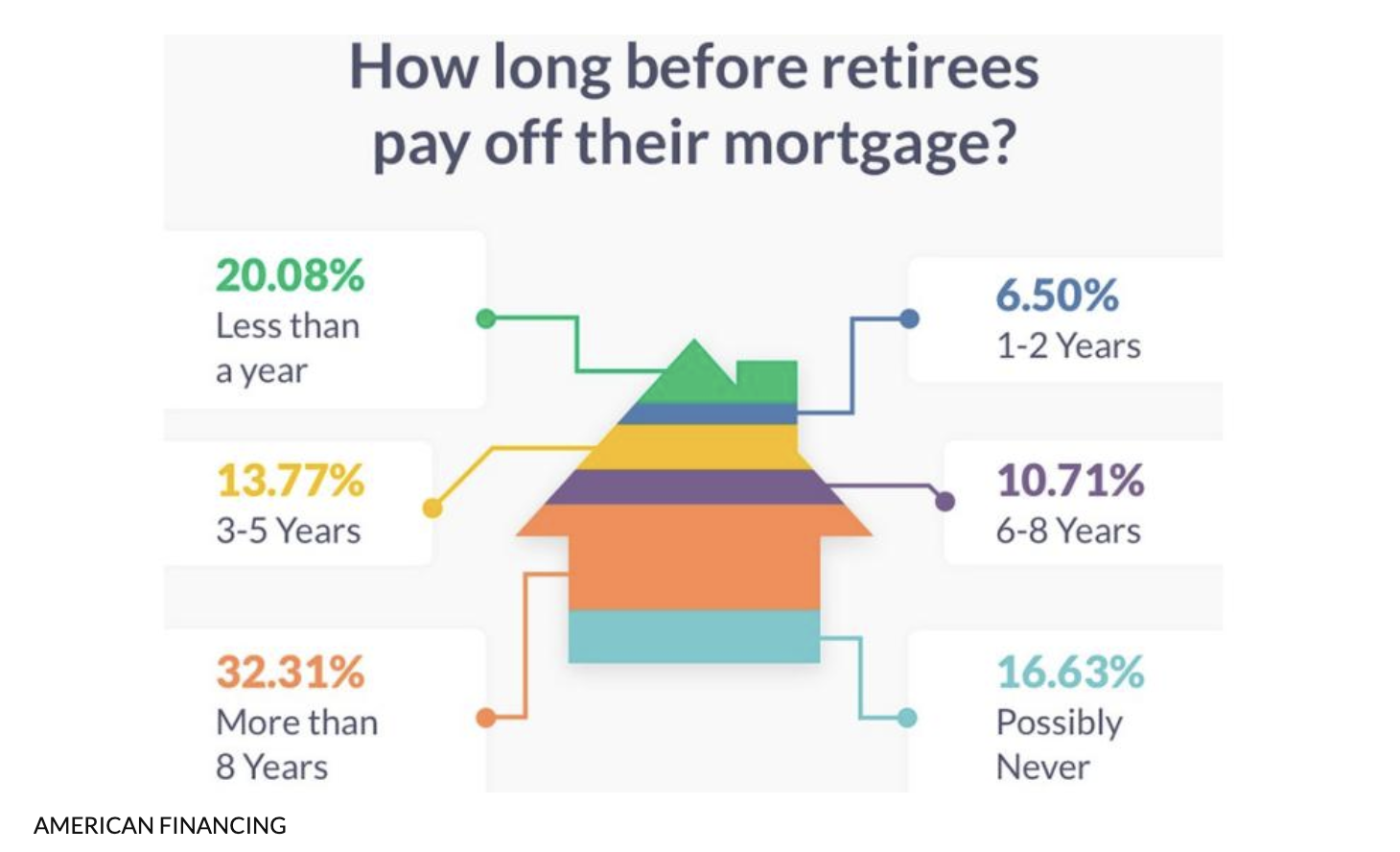

Regardless of these challenges, many adults nonetheless sit with a mortgage by the point they retire. Shockingly sufficient, 44% of Individuals aged 60 to 70 have a mortgage as soon as they step into retirement, with 17% saying they may by no means be capable of utterly pay it off in line with the American Affiliation for Retired Individuals.

Many soon-to-be retirees and even these nonetheless lively within the workforce reside with the excessive cost-burden of their mortgage. Being proactive to cut back these settlements whilst you’re nonetheless pulling a paycheck every month could assist you to decrease your down cost time period, but additionally offer you some respiration room to quite put this cash in the direction of your retirement fund.

A number of totally different monetary packages exist to assist householders with fulfilling their mortgage cost duties, and sometimes banks present clear and extra concise monetary steering. Take the chance to resolve these funds sooner quite than later, and reap the benefits of decrease charges the place attainable.

Reassess your automotive insurance coverage

Automobile insurance coverage tends to extend over time, and insurance coverage suppliers alter funds primarily based on inflation and the market worth of your automobile.

Over time, it’s possible you’ll find yourself paying barely extra in your automotive insurance coverage, even in case you nonetheless have the identical automotive, or maybe have downsized. Values for automotive insurance coverage are calculated by your insurance coverage supplier utilizing the precise money worth (ACV) of your automotive, to find out how a lot they might want to pay out within the occasion of an accident or to conduct any repairs on the automobile.

What some insurers have accomplished in newer instances, is to supply decrease premiums for older prospects, to assist lighten the expense burdens they may have on their automobiles. This could make it lots cheaper and maybe extra reasonably priced for some retirees or automotive homeowners to carry onto multiple automotive.

Moreover, you may strategy your present insurance coverage supplier to assist settle a extra manageable insurance coverage premium primarily based on a number of components corresponding to years of driving expertise, age, and situation of the automotive, the place it is parked in a single day, how usually you make use of it, and who the first driver of the automotive is perhaps.

These components, together with others will affect the entire month-to-month quantity you have to to pay in your insurance coverage. It is suggested to yearly assess your automobile insurance coverage to be sure to get probably the most budget-friendly deal obtainable.

Minimize pointless bills and subscriptions

One other helpful and sensible technique to decrease your bills early on in your profession is to keep away from any pointless bills corresponding to subscriptions, streaming providers, and web payments.

Whereas some could argue that these are important to their on a regular basis life-style and leisure. The most recent figures point out that the common American spends roughly $114 on video downloads and streaming providers, an almost four-figure improve from 2016.

Web payments have additionally elevated over the past couple of years, regardless of seeing a rising variety of shoppers coming on-line.

The typical American family pays between $40 and $100 per thirty days for web providers, with the common being $64 per thirty days. Even the bottom web packages can price households near $58 per thirty days when adjusted for taxes and different service charges.

Whereas there’s a want and use for these services or products within the on a regular basis family, it is usually greatest to maintain these prices to a minimal. Splitting prices between these residing in the identical home or house will be a method of bringing down bills.

One other might be to take out fewer streaming or subscriptions and hold solely the mandatory merchandise which have a function.

Ensure that to analysis the absolute best offers for these kind of providers, and every now and then take a while to evaluate your account statements so that you could see the place your earnings is being spent.

You may all the time choose out or cancel these subscriptions, however ensure to learn the nice print first, in order that you do not find yourself paying the next cancellation charge, or proceed paying for one thing you not use.

The underside line

Planning for retirement has change into a vital monetary precedence for a lot of Individuals. For people who nonetheless have sufficient time earlier than the age of retirement, it is best to plan and strategize as a lot as attainable to make sure you’re on monitor together with your monetary and financial savings objectives.

Then again, for these people that may quickly step out of the workforce, and into retirement, making some cutbacks to reduce pointless bills, whereas additionally boosting your retirement portfolio is maybe one of the best ways to make sure you can get pleasure from your golden years, with none monetary stress.

There is not any proper time to begin saving for retirement, the earlier you’ve a financial savings plan in motion, the higher. Take management of your funds, and make an effort of breaking down the smaller prices, and decrease prices that might quite be directed to your retirement fund.

The put up Small Modifications, Huge Outcomes: What You Can Do To Decrease Prices And Plan For Retirement appeared first on Due.