The notion of working in retirement could seem paradoxical, however it’s not. Though you will have moved past your major profession, it’s best to nonetheless dedicate part of your week to some kind of money-making exercise. It’s doable to spherical out your schedule and add satisfaction to your retirement by way of part-time, freelance, or consulting work. Moreover, there are monetary advantages as properly.

To that finish, listed here are 9 causes to contemplate reentering the workforce.

1. Further monetary stability.

Most often, retirees have enough financial savings and revenue from their retirement plans to satisfy their primary wants. Nonetheless, inflation, long-term care, and rising medical bills have to be taken into consideration as properly.

A survey carried out by the Insured Retirement Institute discovered solely 18% of child boomers are assured they are going to come up with the money for in retirement to dwell comfortably. Those that personal an annuity, nonetheless, report 45% extra confidence.

Briefly, if you happen to didn’t save sufficient cash for retirement, you might must proceed working as you age. Even when it isn’t, a paycheck goes an extended approach to supplementing and lengthening these financial savings over time.

Extra specifically, in retirement, you may profit financially from working:

- Caring for important bills. It’s doable to pay for housing, meals, utilities, and well being care with out utilizing retirement financial savings by persevering with to work. In consequence, you could possibly make investments a few of your financial savings extra aggressively and spend extra on “life-style” gadgets.

- Financial savings development. For 2023, you may contribute as much as $22,500 plus $7,500 in catch-up contributions in case your employer presents a 401(ok) plan. After reaching the annual contribution restrict in your 401(ok) or IRA, you could possibly proceed saving with a deferred annuity.

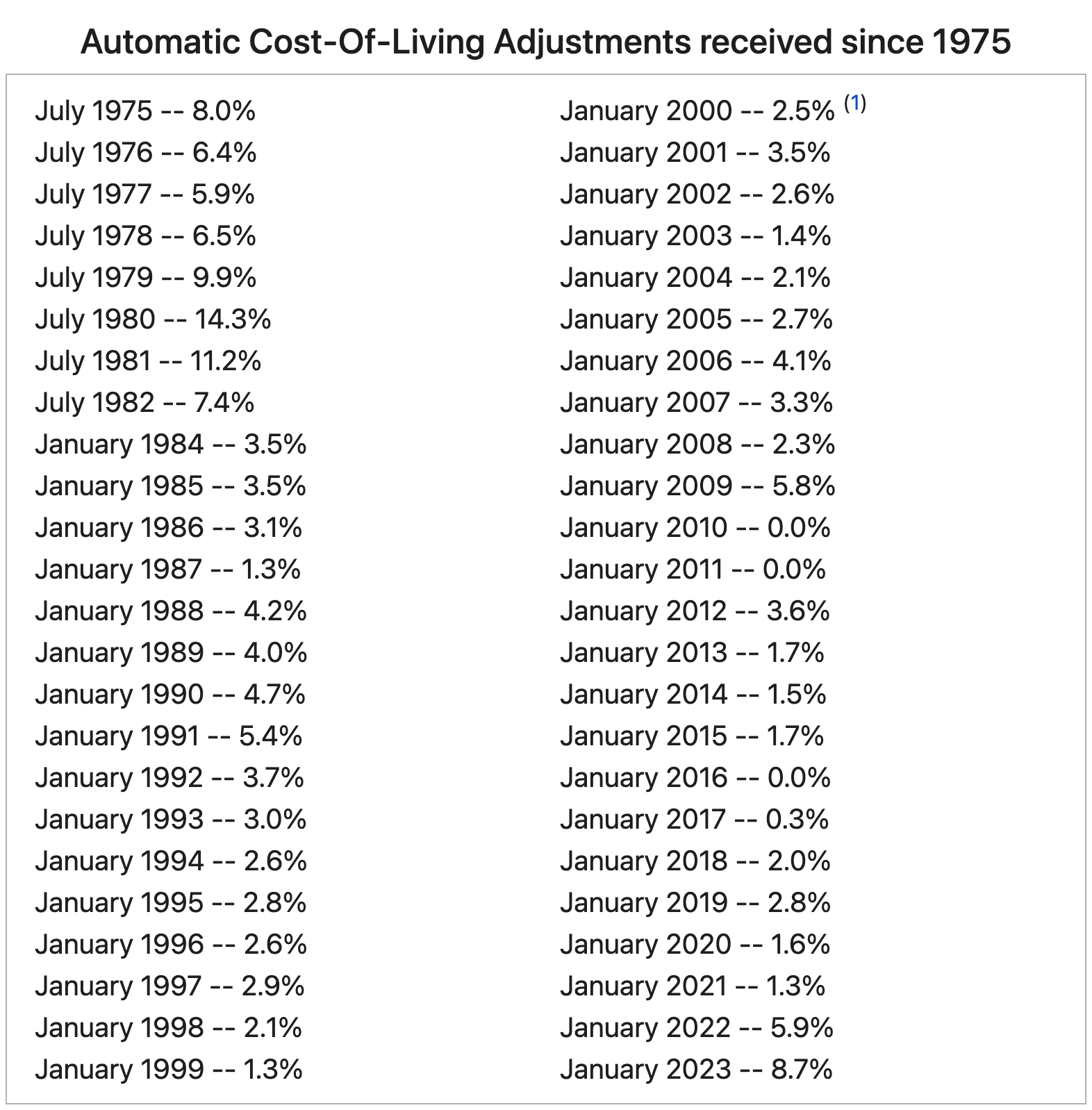

- The quantity of financial savings you should utilize yearly might be adjusted based on your wants. Various elements have an effect on the quantity of financial savings you may spend sustainably throughout retirement (i.e., your withdrawal fee), together with market volatility, rates of interest, inflation, well being care, and danger tolerance. By incomes revenue, you may offset these elements and lengthen the lifetime of your financial savings.

- Getting essentially the most out of your Social Safety advantages. Despite the truth that you may start accumulating advantages on the age of 62, ready to gather them generally is a good resolution. Yearly you delay, your profit will increase till you attain the utmost age of 70 at which your profit would be the highest. An individual’s Social Safety advantages are decided by his or her highest 35 years of earnings. Social Safety advantages aren’t calculated based mostly in your non-work years, so working longer may enhance yours.

2. Retains your mind wholesome.

Most individuals are unaware that their work might have an effect on their psychological capabilities after they retire, based on the College of Michigan’s Well being and Retirement Research (HRS).

“Your job can influence your cognitive functioning in later life,” says Amanda Sonnega, an affiliate analysis scientist on the Institute for Social Analysis (ISR).

It has been discovered that retirement is related to some stage of cognitive decline even after accounting for different well being adjustments related to age, she says.

“Normally, working appears to supply a stage of cognitive stimulation that’s protecting in opposition to cognitive decline at older ages,” Sonnega says. “Researchers are what it’s about work that serves this function.”

Half-time employment provides you the possibility to change jobs or roles. In consequence, there are a number of advantages you may take pleasure in. For instance, as you age, psychologists imagine it’s best to tackle new challenges to gradual your cognitive decline.

3. You are too younger to enroll in Medicare.

What occurs if you happen to’re retired however have not but reached 65, the age at which you develop into eligible for Medicare? You’ll have to pay out-of-pocket for insurance coverage or medical bills.

When seniors retire and not have entry to a company-sponsored medical plan, the excessive prices of medical care might be fairly surprising.

The answer? Work for an employer that provides medical health insurance even to part-timers.

It can save you a whole bunch and even hundreds of {dollars} each month by working part-time for an organization that provides medical health insurance.

Half-time staff are provided medical health insurance advantages by many giant firms, together with Starbucks, Ikea, UPS, Costco, Delta, Dealer Joe’s, Lowe’s, REI, and the American Crimson Cross. Yow will discover extra firms that provide part-time staff medical health insurance advantages by looking on-line for “medical health insurance for part-time staff”.

Furthermore, you might must pay vital out-of-pocket bills for prescribed drugs when you qualify for Medicare. There are gaps in Medicare protection that may be crammed by extra medical health insurance by way of your employer or Medicare Complement Insurance coverage regardless of turning 65 and qualifying for Medicare.

Medicare might not cowl all healthcare prices.

Moreover, Medicare doesn’t cowl all healthcare prices. “Pre-pandemic, the common hospitalization value was $285,000, that means you possibly can face staggering healthcare prices even with Medicare protection,” writes Chris Porteous in a earlier Due article.

“Moreover, it’s best to know that Medicare doesn’t cowl some crucial well being wants of retirees,” he provides. “These embrace long-term care, dentures, and listening to aids. Since 70% of seniors want assisted dwelling care, that could possibly be a major monetary drawback.”

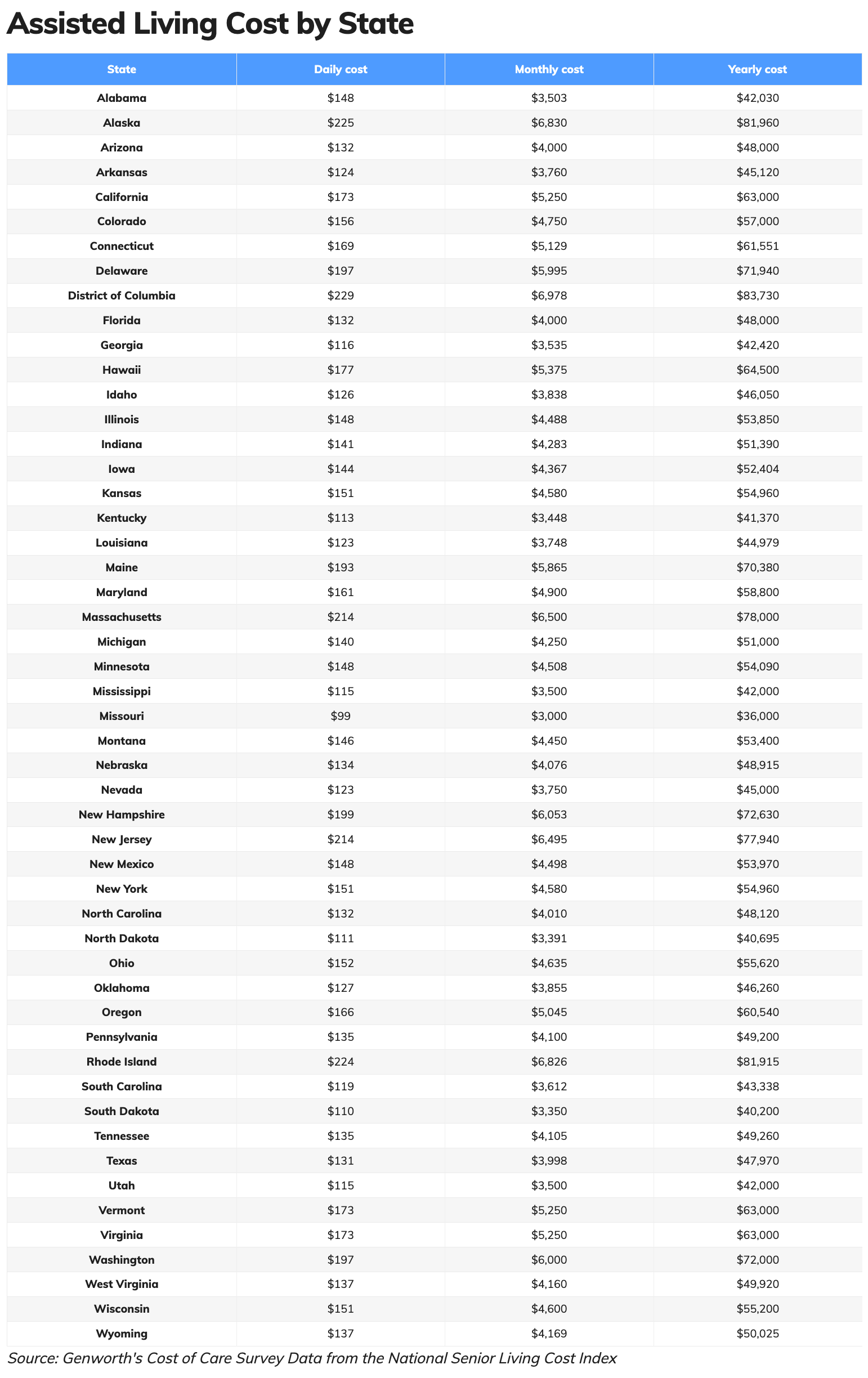

“The common value of assisted dwelling services is $4,500 per thirty days,” states Chris. If you happen to do not need Medicare Benefit, it’s not lined by Medicare. For a restricted time, it could solely pay a part of assisted dwelling prices.

“Whereas Medicare covers many healthcare prices, it stops wanting paying enrollees for long-term or custodial care,” he continues.

4. Preserves your portfolio.

The extra money you earn in retirement, the much less cash you will must take out of your investments to pay for it. The size of your financial savings may even be affected by low-paying jobs.

Suppose you earn $20,000 a yr as a retiree working part-time. For 30 years in retirement, a $500,000 portfolio generates $20,000 per yr utilizing the 4% withdrawal rule, notes Carolyn McClanahan, a monetary advisor in addition to a medical physician. Most often, it is simpler to earn $20,000 a yr working part-time than to build up one other half million.

“By not having to drag out of your portfolio, it permits it to develop,” says Karl Schwartz, a Miami monetary advisor, and authorized public accountant. “Your belongings find yourself rising fairly a bit longer in that situation.”

5. Having a way of neighborhood.

Since 1938, the Harvard Research of Grownup Growth has been monitoring generations of households, and one among its main findings has been that retirement well-being relies on good-quality relationships, based on Robert J. Waldinger, Harvard Medical College professor of psychiatry and examine director.

In retirement, the happiest individuals changed their previous work relationships with new ones. Working usually—whether or not full-time, part-time, or as a volunteer—creates an atmosphere during which new interactions might be shaped.

Moreover, research present that quite a lot of social relationships – similar to these you would possibly discover at a part-time job – can contribute to emphasize discount, reducing heart-related dangers, assuaging melancholy, and even extending your life.

6. It’s doable to attract Social Safety whereas working.

Do you know which you could work whereas drawing Social Safety advantages with out shedding your advantages if you happen to keep below the IRS earnings restrict?

As of 2023, the earnings restrict will enhance to $21,240 for employees youthful than full retirement age. For every $2 earned over $21,240, the Social Safety Administration (SSA) deducts $1 out of your advantages.

Earnings limits for individuals reaching full retirement age in 2023 are $56,520. For each $3 earned over $56,520, the SSA deducts $1 till you attain full retirement age. The earnings restrict for these over full retirement age is just not relevant for your complete yr, nonetheless.

7. Eases boredom.

This is one thing that nobody tells you about retirement. You are in all probability going to be bored — particularly if you happen to retire early. Nonetheless, it’s doable to fight boredom after retiring by taking over new work.

A retirement job might present psychological stimulation to retirees. Retirement may cause boredom when retirees are all of the sudden confronted with lengthy days with nothing to do. With a part-time job, retirees can nonetheless journey or spend time with their households whereas having fun with the thrill of working.

8. Provides you an identification.

While you meet somebody new, the primary query they ask is, “What do you do?” Most individuals reply this query by itemizing their job titles. However, the reply to this query is usually elusive to retired individuals.

An individual’s job sometimes signifies how they contribute to their neighborhood. The power to deliver worth to another person is without doubt one of the advantages of getting a part-time job.

“You’ll be able to construct in your previous experiences, your previous abilities and your previous colleagues to search for that part-time job, or you may create your personal new part-time job based mostly in your pursuits,” says Sally Balch Hurme, creator of Get the Most Out of Retirement. “Your enthusiasm for the subject or the world will put you forward in changing into a profitable worker.”

9. You’ll be able to (lastly) get artistic.

As already talked about, you may enhance your well being and cut back your danger of great sickness by staying socially energetic and exercising your mind. Partaking in artistic part-time work that challenges your thoughts and physique is the proper outlet to stay wholesome.

Furthermore, you may earn an revenue out of your artistic abilities with a little bit effort.

For instance, now that you’ve got the time, you may lastly pursue your passions, like portray, images, woodworking, or baking. An area store promoting your merchandise might be very satisfying and an effective way to make some more money. Or maybe Etsy can be a greater place so that you can promote your gadgets on-line.

Regardless, monetizing a lifelong interest can develop into an thrilling and profitable part-time job.

FAQs

Can you’re employed after retirement?

Brief reply? Sure.

Roughly 20% of People 65 years and older are both actively working or on the lookout for a job, based on a report from the Administration for Neighborhood Residing. Most of them are nonetheless employed full-time, though many have taken on various work or scaled again their hours after leaving their long-term careers.

Is it doable to gather retirement advantages and work on the similar time?

Positively.

It wasn’t unusual for employers to have necessary retirement insurance policies as late because the Seventies. Sometimes, these employers didn’t rent employees older than 65 years previous. Typically, these insurance policies are unlawful as we speak.

So far as Medicare guidelines are involved, they’re comparatively clear-cut. It is a completely different story with money advantages, although. A retiree’s wage revenue doesn’t have an effect on Social Safety advantages as soon as she or he reaches FRA (Full Retirement Age). However, the earnings limitation guidelines for youthful retirees are fairly advanced and range by age.

What are the dangers of working after retirement?

Stress is without doubt one of the first issues that involves thoughts. It’s doable to really feel bodily and emotionally drained if you happen to select the flawed job.

As such, you do not have to really feel unhealthy about quitting your part-time job if it leaves you exhausted and burdened. As an alternative, discover one other job that is extra appropriate.

Moreover, there are unintended monetary penalties. It is best to communicate to a monetary advisor earlier than taking over a part-time job throughout retirement to make sure you will not endure financially. You will need to take into account your retirement accounts, Social Safety, insurance coverage, and even tax penalties.

Lastly, you’ll have much less free time. Not all firms supply extra flexibility to retirees. As such, pre-approval could also be required for day off. You might also wrestle to set your personal schedule in retirement if you happen to tackle a part-time job.

What motivates you to work in retirement past incomes an revenue?

Many retirees who stopped working are shocked at how a lot they miss the sense of neighborhood, routine, and goal they’d after they labored. It is very important grasp the “why” behind your need to maintain working so you may resolve which post-retirement alternatives to pursue.

The submit The Advantages of Working Half-Time in Retirement appeared first on Due.