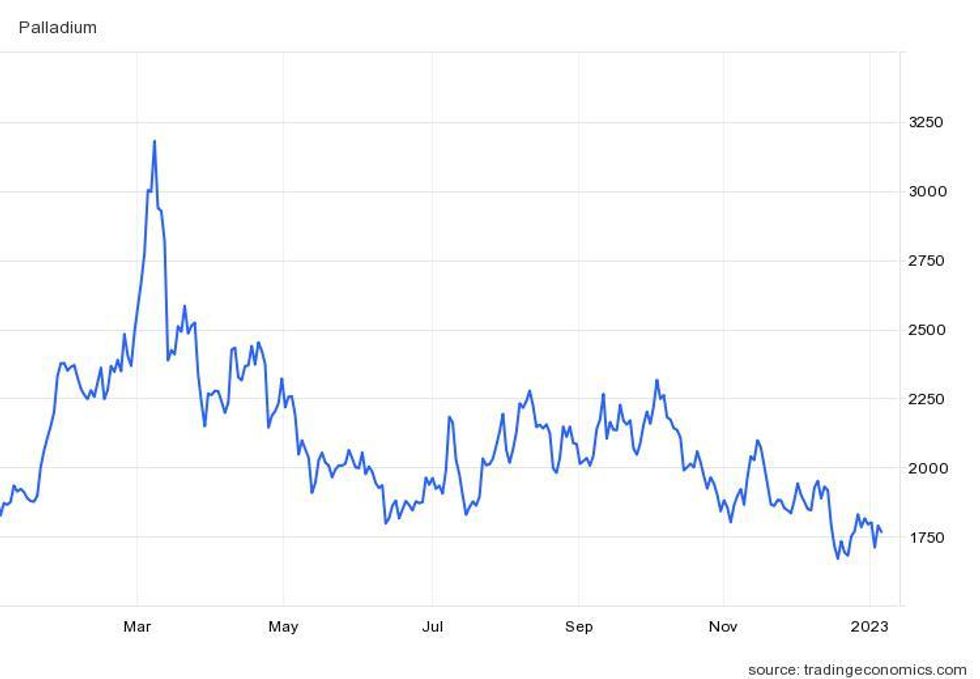

With costs spiking to an all-time intraday excessive of US$3,339 an oz. and falling to a year-to-date-low of US$1,657, there is no query that the palladium market was punctuated by volatility in 2022.

The valuable steel began the 12 months on the US$1,840 stage, however rallied a formidable 81 p.c between January and March as Russia’s invasion of Ukraine infused uncertainty into international markets.

Russia is the world’s second largest palladium producer, and in response to a report from Johnson Matthey (LSE:JMAT,OTC Pink:JMPLF), the nation accounted for 28 p.c of major and secondary palladium provide in 2021. “Palladium peaked … as costs of a spread of Russia-exposed commodities surged larger,” the doc reads.

The steel’s value rapidly pulled again to US$2,200 as materials from main Russian palladium producer Norilsk Nickel (MCX:GMKN) continued to succeed in the market. However one other provide pace bump quickly emerged.

“The (April 2022) delisting of Russian refiners by the London Platinum and Palladium Market (LPPM) reignited availability fears and spurred the worth again above US$2,500,” the market overview states. “The LPPM determination implies that ingot and sponge produced by Russian refineries after April eighth will now not be accepted for ‘Good Supply’ into the London and Zurich bullion market.”

Nonetheless, as Wilma Swarts, director of platinum-group metals (PGMs) at Metals Focus, defined, provide troubles out of different areas had a serious influence on palladium’s 2022 value story. “The Russian conflict on Ukraine had a really materials influence on the palladium value, however this was primarily as a consequence of market hypothesis fairly than weakening regional provide,” Swarts wrote in an electronic mail to the Investing Information Community (INN). “Mine provide from Russia remained in keeping with manufacturing steerage.”

As an alternative, the PGMs professional pointed to the auto sector and output hiccups in Africa and North America. “The decrease provide stemmed extra from the weak automotive recycling market and operational challenges in South African and North American mine provide,” she mentioned. “The delays within the Polokwane smelter rebuild and flood injury in Montana curtailed palladium mine provide.”

Palladium’s value efficiency in 2022.

Chart by way of TradingEconomics.

Sadly, tailwinds from provide disruptions have been countered by weak auto demand.

This key end-use section continues to endure provide chain points and a semiconductor chip scarcity, that are weighing on manufacturing and in flip dampening demand for palladium.

Central bankers’ dedication to quashing rampant inflation additionally repressed markets and helped to maintain palladium values beneath US$2,250 from Might by to October.

Palladium market shifts again into deficit

Although annual manufacturing has declined since 2019, the palladium market briefly moved into extra in 2021.

“After posting its first surplus prior to now 10 years in 2021, palladium will shift again to a big deficit,” Swarts mentioned. “Like platinum, the market steadiness outcomes from weaker provide fairly than extra strong demand.”

In actual fact, palladium demand has but to recuperate to its 2019 pre-pandemic stage of 11.4 million ounces. Persistently excessive costs have not helped the state of affairs, with substitution within the auto sector taking a toll on the dear steel.

“Palladium automotive demand, other than the erosion of gasoline light-duty automobile manufacturing, was additionally negatively impacted by the transition in direction of larger platinum loadings in autocatalysts on the expense of palladium,” Swarts mentioned. “The slowdown in client electronics additionally weighed on palladium demand.”

The Russia-Ukraine conflict pressured automakers to downgrade their output steerage early within the 12 months, and the market was additional impacted in H2, when COVID-19 lockdowns in China closely impacted auto manufacturing.

“In keeping with the China Affiliation of Car Producers, complete automobile gross sales fell by 7.9 p.c year-on-year (y/y) in November to 2.33m models, the primary y/y decline since Might,” a mid-December Metals Focus report reads.

Palladium funding demand contracts additional

Not like different valuable metals, palladium has been unable to see upside from funding demand just lately.

“Following steady liquidation of palladium ETFs between 2015 and 2020, complete holdings had fallen from a peak of practically 3 million oz to lower than 600,000 oz by the beginning of 2021,” the Johnson Matthey report notes.

Though the steel rallied to contemporary highs from 2020 by 2022, buyers have chosen to keep away from palladium publicity.

“This is because of a mix of things, together with elevated costs and vast spreads (which restrict the upside for buyers), together with widespread recognition of the chance posed by BEVs to future palladium demand,” the agency’s overview states.

Swarts additionally pointed to the rising shift towards electrical automobiles as a deterrent for palladium buyers.

“As an funding steel, palladium has for a while misplaced its luster as buyers take inventory of the shift in direction of electrical automobiles and the success in substituting,” she defined to INN. “(In 2022), retail funding is anticipated to contract by 11 p.c and is anticipated to say no additional in 2023.”

Shopper demand can be key to 2023 progress

By December, the palladium value had reached US$1,657, its lowest level since February 2020. The autocatalyst steel rapidly rebounded and ended 2022 at US$1,806, representing a 2.06 p.c decline from its January beginning value.

Though 2022 was unstable, palladium’s efficiency within the 12 months forward will rely largely on one issue.

“The well being of the automotive sector will stay palladium’s main barometer — in any case, the sector accounts for over 80 p.c of demand,” Swarts mentioned. Metals Focus sees auto manufacturing progress being marginally constructive for palladium demand in 2023.

Inflation and its influence on client buying energy is one other key space that would have a knock-on impact on the auto provide chain. “A weaker international economic system may see weaker consumption negatively impacting palladium demand,” she added.

When it comes to provide, the director of PGMs mentioned monitoring developments within the Russia-Ukraine conflict can be key.

“Whereas Russian manufacturing remained primarily unaffected throughout 2022, the self-sanctioning motion of apparatus suppliers may rein in 2023 manufacturing and ought to be carefully monitored,” mentioned Swarts. “In the meantime, the expansion in automotive gross sales we forecast in 2023 ought to result in an improved provide of scrapped automobiles within the recycling market.”

Do not forget to observe us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the knowledge reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

From Your Web site Articles

Associated Articles Across the Net