20 years in the past, it was exhausting to think about a world the place money did not exist. However with the rise in reputation of cashless fee strategies, a society with out money might quickly change into a actuality.

The COVID-19 pandemic is one main catalyst for the shift. To attenuate direct contact, individuals gravitated in direction of fee strategies that did not require using bodily cash, like financial institution playing cards and fee apps.

On this article, you may study what specialists take into consideration the way forward for cashless funds, fee strategies on the horizon, and corporations which are already making the change.

Firms Testing Cashless Experiences

The best way to Set Up Cashless Funds

Undertake Cashless Cost Strategies

Cashless Cost Predictions

The worldwide transition to cashless fee strategies is occurring in a short time. Specialists imagine that earlier than lengthy, we’ll be residing in a cashless society. In actual fact, some international locations are already working to utterly eradicate money from their economies.

Sweden has diminished the quantity of money in circulation by 50% over the past decade.

In accordance with the European Funds Council, conventional money transactions made up simply 1% of Sweden’s gross home product (GDP), and ATM money withdrawals are steadily declining by 10% annually. The Swedish Central Financial institution not too long ago said that solely 9% of the nation’s inhabitants makes use of money for transactions proper now.

Now, analysts predict that Sweden will change into the primary cashless nation on the planet by 2023.

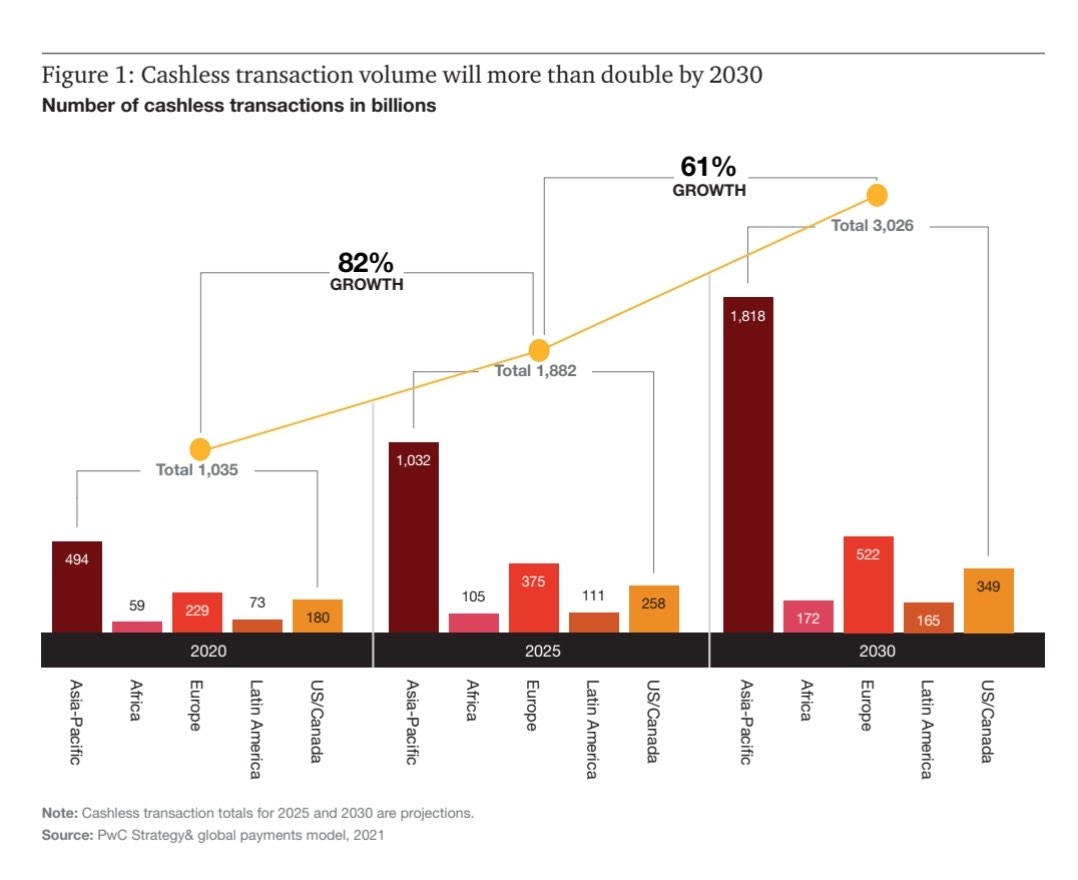

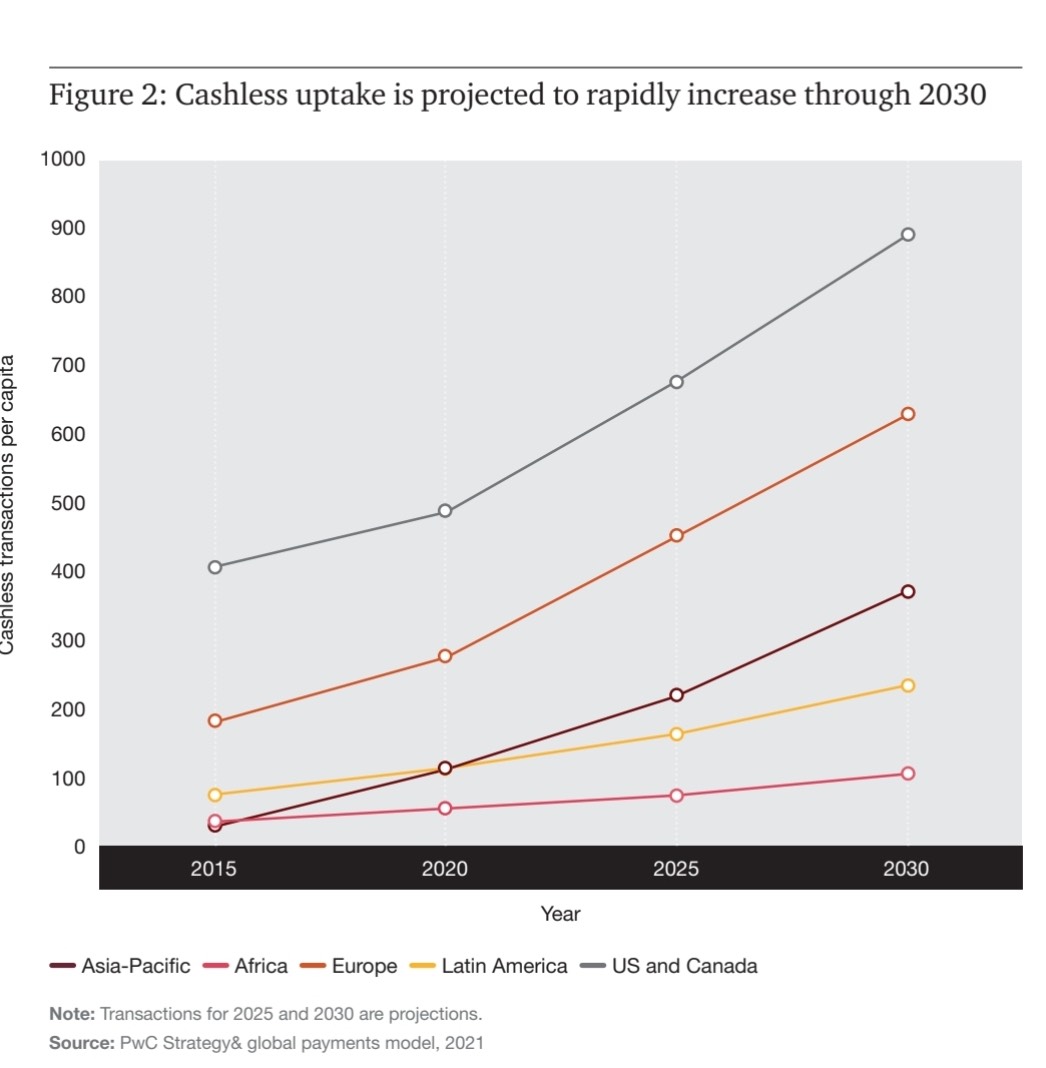

In PwC’s 2025 & Past: Navigating the Funds Matrix, PwC explored the continuing transition from cash-based to cashless fee strategies, the event of digital economies, and the affect of recent fee developments.

Listed here are a few of the cashless fee predictions within the report:

- Cashless transactions will develop quickest in Asia-Pacific, rising by 109% from 2020 to 2025, after which by 76% from 2025 to 2030, adopted by Africa and Europe.

- International cashless fee volumes are set to extend by greater than 80% from 2020 to 2025, and to virtually triple by 2030.

- 89% of respondents agreed that the buyer shift from bodily shops to on-line shops will proceed to extend, requiring vital funding in on-line fee options.

- Digital wallets will account for greater than half of all e-commerce funds worldwide by 2024.

Cashless Funds At the moment

Listed here are a few of the cashless and contactless fee strategies which are rising in reputation. You would possibly already use a few of these funds whenever you go to the shop. Specialists predict companies will supply many of those fee strategies transferring ahead.

Credit score and Debit Playing cards

Credit score and debit playing cards are some of the incessantly used cashless fee strategies on the planet proper now. They’re a fast, safe, and handy technique of fee.

However using banking playing cards has begun to say no in favor of cell wallets and fee apps. In 2021, bank cards and debit playing cards accounted for 21% and 13% of worldwide e-commerce fee strategies, respectively. By 2025, using bank cards is anticipated to fall to 19%, whereas debit playing cards will stay secure at 13%.

When you personal a enterprise, this doesn’t imply you must utterly forgo banking playing cards and begin utilizing cell wallets as a substitute. By 2025 (and past), many individuals will nonetheless depend on banking playing cards to make funds, particularly now that banks are issuing playing cards enabled with Faucet to Pay expertise.

Savvy companies settle for each banking playing cards and cell wallets as viable fee strategies.

Cellular Wallets and Cost Apps

Cellular wallets, or digital wallets, are monetary purposes that run on cell units. These apps securely retailer your fee card info as a way to pay for objects on-line or in-store with out having to hold your playing cards round. All you could provoke transactions is your smartphone/smartwatch and a great web connection.

Examples of cell wallets and fee apps embody:

- Apple Pay

- Google Pay

- Samsung Pay

- PayPal

- Venmo

- CashApp

- AliPay

Digital wallets are extraordinarily well-liked at present, and also you doubtless use them typically. Ian Wright, the founding father of Service provider Machine, believes that the recognition of cell wallets will solely develop sooner or later.

“Merchandise like Apple Pay and Google Pay will definitely change into extra ubiquitous, which can give Apple and Google the chance to disrupt Visa and Mastercard,” Wright says.

That is true. Information from FIS International Funds Report 2022 exhibits that by 2025, cell wallets shall be used for 53% of e-commerce transactions worldwide — rising from 49% in 2021. For international point-of-sale (POS) transactions, using digital wallets is anticipated to rise from 29% in 2021 to 39% in 2025.

FIS discovered that folks have began utilizing digital wallets for funds greater than they use their playing cards. E-wallets are anticipated to outgrow different POS fee strategies and attain a 36.8% share — over $22.7 trillion.

Cryptocurrency

At this yr’s Tremendous Bowl recreation, audiences have been proven a intelligent 60-second advert from Coinbase, a platform for getting and promoting cryptocurrency. This advert got here within the type of a QR code that, when scanned, took individuals to Coinbase’s web site the place they provided free Bitcoin value $15 to new signups (for a restricted time).

Not lengthy after the advert aired, Coinbase’s app crashed from the inflow of visitors from the Tremendous Bowl.

That goes to indicate simply how mainstream cryptocurrency is — particularly Bitcoin, which is the usual digital forex for cell funds.

Bitcoin does not require additional charges or intermediaries to maneuver from a client to a service provider. Apps like Coinbox implement a POS performance to make the fee course of simpler for each companies and clients.

Cost apps like PayPal have additionally began supporting crypto buying and selling and funds on their apps. Main companies like Microsoft and Expedia are additionally accepting crypto funds.

The crypto market is risky, fluctuating incessantly. This fee technique will not be the best choice for small-to-medium-sized companies proper now. But when the market stabilizes, it might very effectively be.

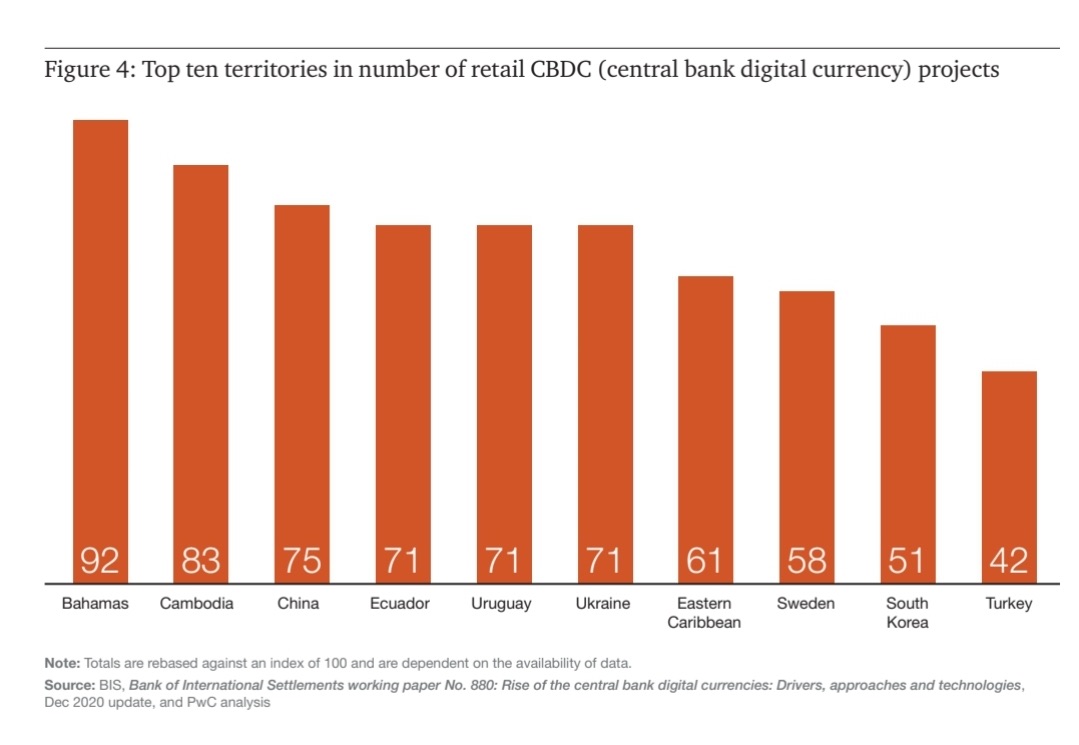

Central Financial institution Digital Foreign money

Central Financial institution Digital Currencies (CBDCs) are digital tokens issued by a rustic’s central financial institution to signify the digital type of that nation’s forex. This digital forex has the identical worth as fiat (bodily) cash.

The principle aim of CBDCs is to supply privateness, monetary safety, accessibility, transferability, and comfort to companies and customers — particularly those who have restricted entry to banks. CBDCs additionally goal to cut back the dangers of utilizing digital currencies (aka cryptocurrency) of their current, risky kind.

“If CBDCs are designed prudently, they’ll doubtlessly supply extra resilience, extra security, better availability, and decrease prices than personal types of digital cash,” IMF Managing Director, Kristalina Georgieva, mentioned in her 2022 speech on the Atlantic Council in Washington D.C.

“That’s clearly the case when in comparison with unbacked crypto property which are inherently risky,” she says. “And even the higher managed and controlled stablecoins will not be fairly a match towards a secure and well-designed central financial institution digital forex.”

Proper now, ten international locations and territories have launched CBDCs:

- Nigeria

- Jamaica

- Grenada

- The Bahamas

- Dominica

- Antigua and Barbuda

- Montserrat

- Saint Lucia

- St. Vincent and the Grenadines

- St. Kitts and Nevis

About 105 different international locations, together with the U.S. and the U.Ok., are nonetheless investigating CBDCs and the way they have an effect on present monetary networks.

QR Codes

Fast Response codes, or QR codes, are machine-readable barcodes that retailer info. This code consists of distinctive black and white pixels in a square-shaped grid.

To make funds by way of QR codes, an individual has to scan the code displayed by the service provider with their cell system. Then, customers put within the quantity they should pay and submit.

Apple launched QR code scanners in smartphones in 2017. Since then, most — if not all — different smartphone manufacturers have included them into their fashions. And now, QR code funds are some of the environment friendly and well-liked cashless fee strategies on the planet.

The numbers replicate this. In 2020 throughout the pandemic, 1.5 billion individuals used QR codes to make a fee, in accordance with Juniper Analysis. The agency additionally predicts that 30% of all cell customers will use QR codes by 2025.

This fee technique is a safe various to money transfers. Plus, companies can course of transactions with out having to purchase conventional fee {hardware}. All they should do is about up QR codes that can take clients to their internet fee kind.

ACH Financial institution Transfers

An ACH switch is an digital fee made between financial institution accounts by means of the Automated Clearing Home (ACH) community.

This fee technique is without doubt one of the hottest varieties of financial institution transfers and is used for B2B direct deposit and computerized invoice funds. In actual fact, 93% of People use ACH transfers to obtain their salaries and pensions.

In 2021, the sum of money transferred by means of the ACH was over $8.89 trillion. That’s greater than the quantity transferred by way of checks and wire transfers.

All banks in america help ACH funds. Now, fee processors like PayPal, Stripe, and Sq. additionally help this fee technique.

All that you could make or obtain an ACH fee is a working checking account and routing quantity. Transfers made by means of this route usually take 3-4 enterprise days to finish.

ACH funds have decrease processing charges than bank cards. So when you have shoppers that pay you recurring charges or workers that you just pay each month, ACH transfers are an effective way to try this with out incurring a loss. That is particularly good for companies in industries like authorized, healthcare, training, property administration, and subscription-based providers.

Brick-and-mortar retail companies shouldn’t use ACH funds for POS buyer transactions. ACH transfers require a checking account and routing quantity and many patrons don’t know their banking information off-hand.

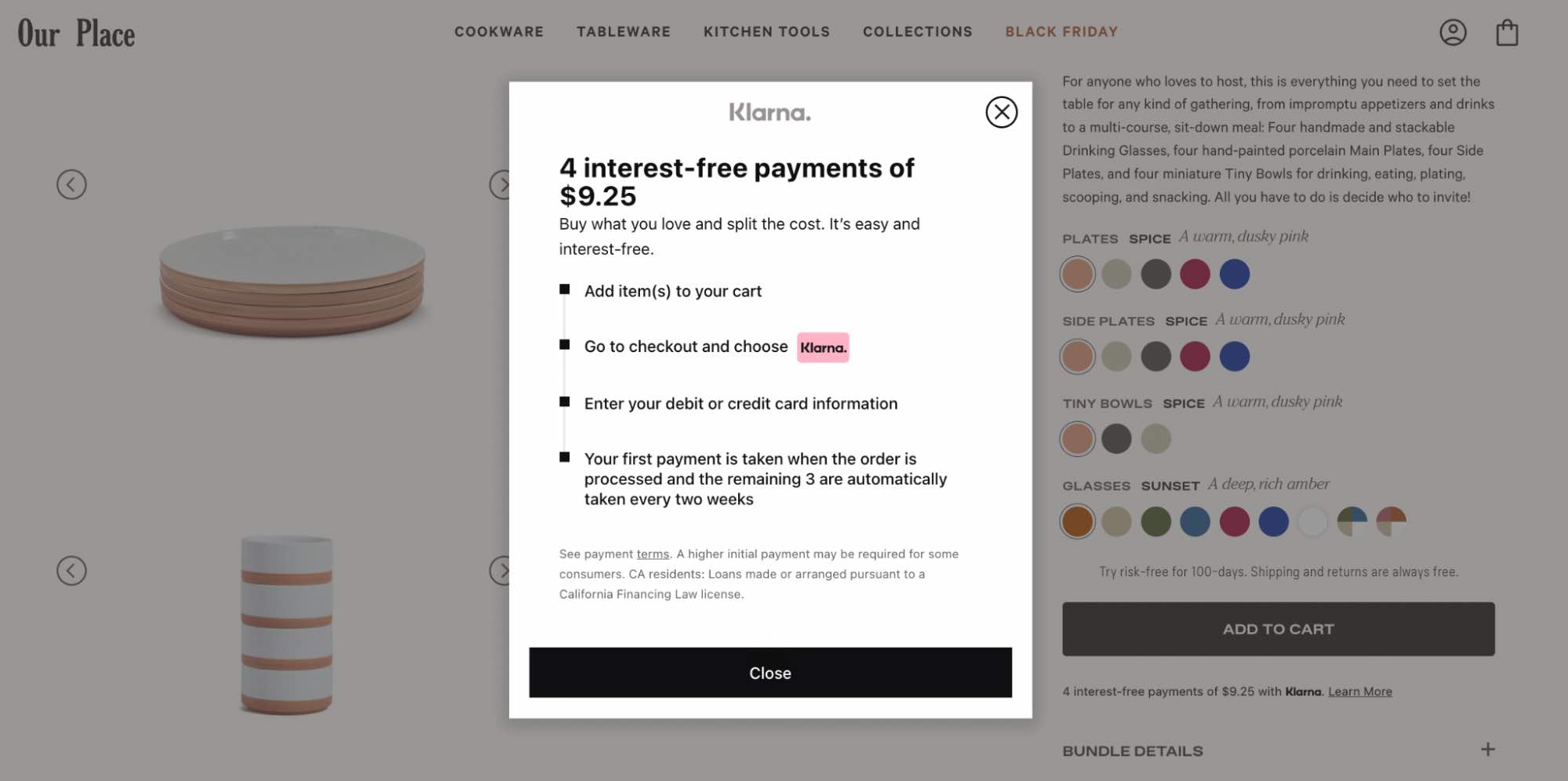

Purchase Now, Pay Later

Purchase Now, Pay Later (BNPL) is a fee technique that permits clients to buy costly objects on credit score and pay in installments over time. It’s a kind of mortgage, besides you don’t should pay curiosity when you make your funds on time and in full.

The prospect of with the ability to make a number of interest-free funds over time can encourage buyers to purchase extra, which ends up in extra income for distributors. A examine by McKinsey confirmed that 29% of BNPL customers would have made a smaller purchase or wouldn’t have purchased in any respect if this fee possibility wasn’t accessible.

Banks like Chase and a few bank card firms supply cardholders the chance to purchase objects and pay for them later. Apps like Afterpay (acquired by Sq.) and PayPal have additionally jumped on the bandwagon.

In 2021, BNPL accounted for 2.9% of worldwide e-commerce transactions (a $157 billion worth). Juniper’s analysis predicts that this worth will develop 5.3% (or to $438 billion worth) by 2025.

Firms which are already testing new cashless experiences

Amazon

In early 2020, e-commerce large Amazon introduced its new contactless fee expertise, Amazon One. Here is the way it works: Buyers go to a point-of-sale station in sure places to hyperlink their palms and fee playing cards to Amazon One. As soon as they’ve carried out that, all they should do at future checkouts is hover their hand over a scanner to pay for his or her objects.

The reasoning behind that is easy. Your palm is made up of tiny, largely undetectable options which are distinctive to you. The Amazon One system, nonetheless, can learn and acknowledge these options.

The system makes use of pc imaginative and prescient algorithms and proprietary imaging to seize and encipher a picture of your palms. This manner, it creates a singular palm signature that it could possibly acknowledge each time you employ the system.

As of September 2021, Amazon rolled out this new fee technique to over 65 Complete Meals shops in California. This huge rollout definitely helps Amazon in its effort to modernize retail buying and make it simpler for patrons to make funds.

Walmart

In December 2021, Walmart quietly filed a number of new logos that point out that it plans to make and promote digital objects, together with toys, electronics, self-care merchandise, and residential décor within the metaverse. Mainly, Walmart desires to create its personal cryptocurrency and non-fungible token (NFT) collections.

Quick ahead to September 2022 and Walmart introduced that they’re launching two digital experiences — Walmart Land and Walmart Universe of Play — in Roblox, a gaming platform.

These experiences will characteristic completely different video games, a blimp that drops toys, a music competition with well-liked artists, and a retailer of digital merchandise (referred to as “verch”) that matches Walmart’s bodily and on-line stock.

Walmart’s Chief Advertising and marketing Officer, William White instructed CNBC that Roblox is presently a testing floor for Walmart because it considers working within the metaverse and past. He additionally mentioned that the way in which COVID-19 out of the blue reworked individuals’s buying habits and on-line engagement prompted Walmart to start out experimenting with new methods to achieve buyers — particularly Gen Zs.

On income, White famous that Walmart will not make any cash from these newly launched digital experiences for now. But when issues work out effectively, they may make cash by partnering with different manufacturers or by turning individuals’s immersive experiences into real-life retailer visits or on-line purchases.

Albertsons

One more retail large is experimenting with cashless funds. For Albertsons, it is I-powered self-checkout carts.

These carts are made by Veeve, an organization based by two ex-Amazon engineers, and so they goal to make in-person buying smoother, particularly in short-staffed shops. These carts use cameras and sensors to scan objects that buyers choose, evaluate merchandise, and make personalised suggestions by way of a small on-cart display. These carts additionally construct 3D fashions of all of the merchandise within the retailer, in order that it could possibly acknowledge this stuff over time with out the shopper scanning them.

What’s extra, you do not want to take a look at whenever you use this cart. After buying with Veeve carts, individuals will pay for his or her objects by inserting or tapping their card with out ever going to the checkout line.

In November 2021, Albertsons began testing these carts at two of its shops in California and Idaho. Now, they’re increasing and including the carts to extra shops.

Apple

In June this yr, Apple launched the Faucet to Pay expertise on iPhones. In accordance with Apple, this new tech will allow hundreds of thousands of US retailers — from solopreneurs to mega-retailers — to simply settle for contactless credit score and debit playing cards, Apple Pay, and different cell wallets by way of a faucet of an iPhone. No fee terminal or additional {hardware} wanted.

After an individual is finished buying, the service provider will inform the shopper to carry their iPhone to pay with their contactless card, Apple Pay, or different digital pockets close to the product owner’s iPhone. With the faucet of a button, the cash strikes from the shopper to the service provider by means of near-field communication (NFC) expertise.

Apple is partnering with fee apps like Sq. and Stripe to make the Faucet to Pay on iPhone characteristic accessible on their platforms. This characteristic will solely work with contactless credit score and debit playing cards from well-liked fee networks, together with Visa, MasterCard, American Categorical, and Uncover.

Word: Faucet to Pay characteristic solely works on the Cellphone XS or newer. Older iPhone fashions do not help this characteristic.

In October this yr, Google introduced that it has partnered with Coinbase to simply accept cryptocurrency funds for its cloud providers.

Each Google and Coinbase need to diversify their enterprise fashions and develop their choices. For Google, accepting crypto funds will give them entry to fast-growth firms within the Web3 area. These firms would pay for Google’s cloud providers by means of Coinbase — a platform that trades ten completely different digital currencies, together with Bitcoin, Ethereum, Litecoin, and Dogecoin.

As digital funds are available in, Coinbase will take a lower of the charges, which is able to function a separate income stream that is not straight associated to retail buying and selling charges.

The best way to Set Up Cashless Funds

With the rising reputation of cashless fee strategies, companies that need to keep related sooner or later should arrange versatile fee strategies. Listed here are some methods you’ll be able to put together.

1. Take into account the fee strategies your clients choose.

Not all companies are the identical. When you’re a small enterprise, there is a good likelihood you will not be capable of use the identical fee strategies as giant enterprises just because it is not crucial.

One of the best ways to know for certain which fee strategies you must settle for is by figuring out your clients’ fee preferences and implementing these choices.

For instance, in case your clients like utilizing their playing cards to pay, arrange a POS terminal. If a lot of your clients have contactless fee playing cards or use iPhones loads, you’ll be able to settle for funds by way of the Faucet to Pay expertise. But when they do not carry playing cards in any respect, there are different choices you’ll be able to supply, like digital wallets or QR codes.

An essential factor to think about is that your clients’ fee preferences could differ by age, location, and different demographic components. So it is best to supply completely different fee choices so that you just cater to all of your clients’ wants.

2. Use a fee processor.

To just accept debit card and bank card funds, digital pockets funds, and ACH transfers, companies should companion with a fee processor that complies with Cost Card Business (PCI) requirements. Cost processors are third-party distributors (or apps) that handle monetary transactions by mediating between the service provider and clients concerned.

These apps make sure that a buyer has sufficient funds to pay for an merchandise and securely transfer the cash from the shopper’s account to the product owner’s within the blink of a watch.

Common fee processors embody:

- Sq.

- Clover

- Stripe

- Stax

- Cost Depot

- PayPal

- Payoneer

Along with fee processing, a few of these apps supply service provider accounts and fee gateways.

When selecting the best fee processor for your small business, look out for the next:

- The type of funds the processor accepts.

- The charges the processor expenses per transaction.

- What platform transactions can happen.

3. Supply Purchase Now, Pay Later.

It has been confirmed that retailers that provide a Purchase Now, Pay Later (BNPL) choice to their clients are prone to get extra gross sales.

Between 2020 and 2021, the speed of American customers utilizing the BNPL fee possibility elevated by 80%. Of these customers, 40% have been millennials, and Gen Z customers are shortly catching up. So when you’re attempting to develop your buyer base to incorporate youthful individuals, BNPL may also help you get there.

This fee technique works exceptionally effectively for e-commerce shops to achieve new clients, get extra conversions, and improve common order worth (AOV).

Some dependable BNPL suppliers embody:

- Affirm

- AfterPay

- Klarna

- Stripe

4. Set up a commerce-powered CRM.

Image this: You might have a buyer who’s ready so that you can ship an bill to their mailbox earlier than they’ll mail you again a examine for an merchandise they purchased. As they waited on your bill, they determined to do a trial purchase of the identical merchandise out of your competitor. As a result of your competitor gives the Faucet to Pay possibility, the shopper was in a position to pay for the merchandise in a number of seconds.

Which firm do you suppose the shopper would need to work with subsequent time: you or the competitor?

To stop a scenario like this, use a CRM platform with fee gateway integration. HubSpot is a superb instance of this.

Contained in the HubSpot CRM is a local funds instrument that streamlines your complete gross sales course of as a way to receives a commission early, tackle extra clients/shoppers, and develop your small business. HubSpot’s funds instrument permits you to ship your clients quotes or fee hyperlinks, after which they pay you. No want for paper checks.

If the funds are recurring — like on-line subscriptions — you’ll be able to merely automate the method as a substitute of sending quotes to clients each month. HubSpot funds instrument additionally offers your clients the pliability to make transactions each time and nonetheless they need on the CRM.

This significantly boosts your buyer expertise and helps you preserve your relationship together with your clients long-term.

Undertake Cashless Cost Strategies

The elevated use of cashless funds has revolutionized the way in which individuals do enterprise all over the world. From grocery shops to eating places and on-line shops, many companies now supply cashless transactions.

If you would like your small business to remain afloat throughout this alteration, you could begin accepting a wide range of cashless fee strategies. This manner, your clients are usually not restricted of their choices, and you’ll gather funds speedily and securely.

.jpg#keepProtocol)