Prometheus Biosciences (NASDAQ:RXDX) inventory soared practically 225% prior to now two days and hit $117.73 for the primary time since going public in March 2021. Optimistic Part-2 trial outcomes for its PRA023 drug, designed to deal with ulcerative colitis and Crohn’s illness, supported the rally.

As the subsequent step, Prometheus CEO Mark McKenna stated, “We stay up for discussions with regulatory businesses as we put together to advance into Part 3 research in Ulcerative Colitis and Crohn’s Illness.”

Moreover, the corporate not too long ago introduced the pricing of a $500 million public providing. It plans to make use of the web proceeds to fund the event of PRA023, PRA052, and different analysis and improvement packages.

The clinical-stage biotech firm makes a speciality of immunotherapies with a concentrate on inflammatory bowel illness. Final month, Prometheus delivered outcomes for the third quarter of 2022. The corporate reported a web lack of $0.90 per share, which was under the consensus estimate of a lack of $0.88.

Is RXDX a Good Purchase?

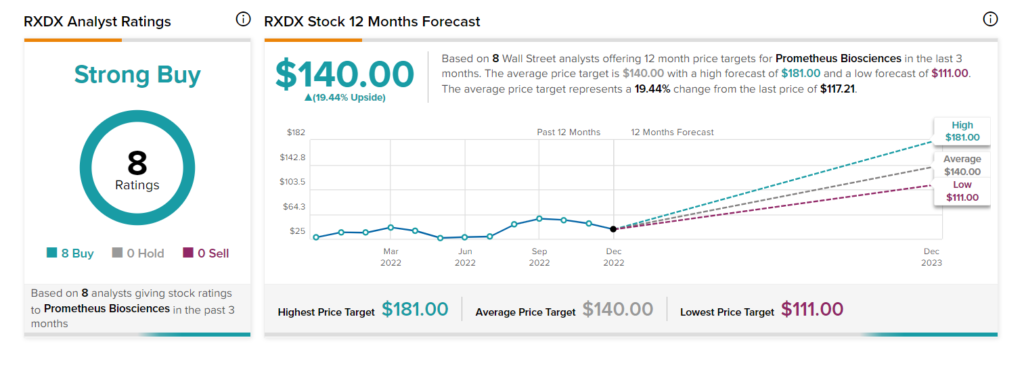

Wall Avenue is extremely bullish on Prometheus. The inventory has a Robust Purchase consensus score based mostly on eight unanimous Purchase suggestions. The RXDX common value goal of $140 implies 19.4% upside potential.