With US and International debt exploding previous to each belongings and debt imploding, allow us to take a look at the disastrous penalties for the US and the world.

Debt explosion resulting in the forex turning into nugatory has occurred in historical past for so long as there was some type of cash whether or not we discuss 3rd century Rome, 18th century France or 20th century Weimar Republic and plenty of many extra.

So right here we’re once more, one other financial period and one other assured collapse as von Mises mentioned:

“There isn’t a technique of avoiding the ultimate collapse

of a growth led to by credit score enlargement”

This disastrous borrowed prosperity, with ZERO means to repay the surging debt, will result in one of many three penalties under:

1. THE US$ GOES TO ZERO

2. A US DEFAULT

3. BOTH OF THE ABOVE

The most probably end result is quantity 3 for my part. The greenback will go to ZERO and the US will default. The identical will occur to most international locations.

I define the results for the world on the finish of his article.

Many individuals say that the US can by no means default. That’s after all absolute nonsense.

If a rustic prints nugatory debt that no person will purchase in a forex that nobody desires to carry, the nation has undoubtedly defaulted no matter spin they placed on it.

Within the subsequent few years, not simply US however all sovereign debt will solely have one purchaser which is the nation that points the debt. And each time a sovereign state buys its personal debt, it has to problem extra nugatory debt that no person will contact with a barge pool.

Printing extra money to pay for earlier sins has by no means labored and by no means will.

And that is how cash dies, identical to it has all through historical past.

The present financial period began with the muse of the Fed in 1913 and the acceleration of debt and forex debasement since 1971 when Nixon closed the gold window. With simply over 100 years into this period, it’s now approaching the tip, like all of them do.

International currencies are already down 97-99% since 1971 and we will now count on the ultimate 1-3% decline for all cash to turn into just about nugatory. That is after all nothing new in historical past since each single forex has all the time gone to ZERO. We should after all do not forget that the ultimate 1-3% transfer means a 100% fall from right now. The ultimate collapse is all the time the quickest so it may simply occur within the subsequent 2-5 years.

DEBT, DEBT AND MORE DEBT

Let’s take a look at the way it has all advanced.

Though US debt has elevated just about yearly since 1930, the acceleration began within the late Sixties and Seventies. With gold backing the greenback and subsequently most currencies UNTIL 1971, the flexibility to borrow extra money was restricted with out depleting the gold reserves.

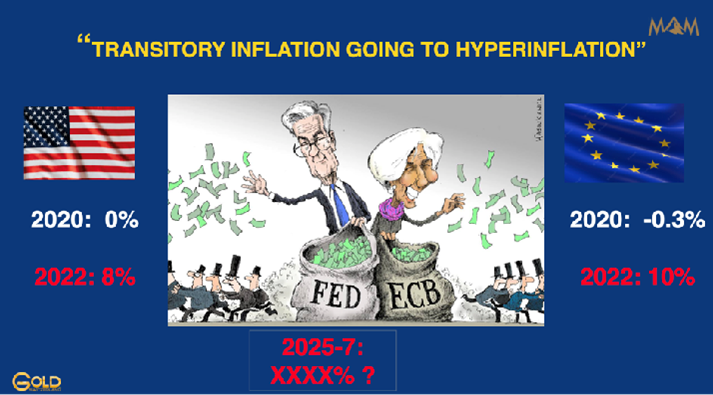

Because the gold customary prevented Nixon to print cash and purchase votes to remain in energy, he conveniently removed these shackles “quickly” as he declared on August 15, 1971. Politicians don’t change. Powell and Lagarde lately known as the rise in inflation “transitory” however regardless of their bogus prediction, inflation has continued to rise.

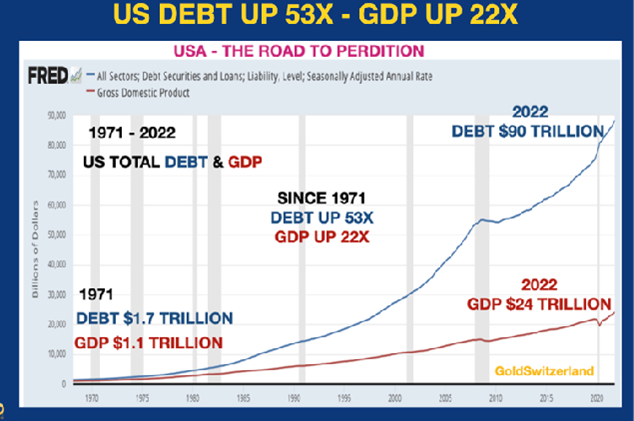

Since 1971 complete US debt has gone up 53X with GDP solely up 22X because the graph under exhibits:

Because the widening Hole between Debt and GDP within the graph above exhibits, it now takes ever extra debt to realize will increase in GDP. So with out printing nugatory cash, REAL GDP would present a decline.

So that is what our flesh pressers are doing, shopping for votes and creating pretend progress by printed cash. This provides the voter the phantasm of elevated revenue and wealth. Sadly he doesn’t grasp that the illusory improve in residing customary is all based mostly on debt and devalued cash.

Let’s additionally take a look at US Federal Debt:

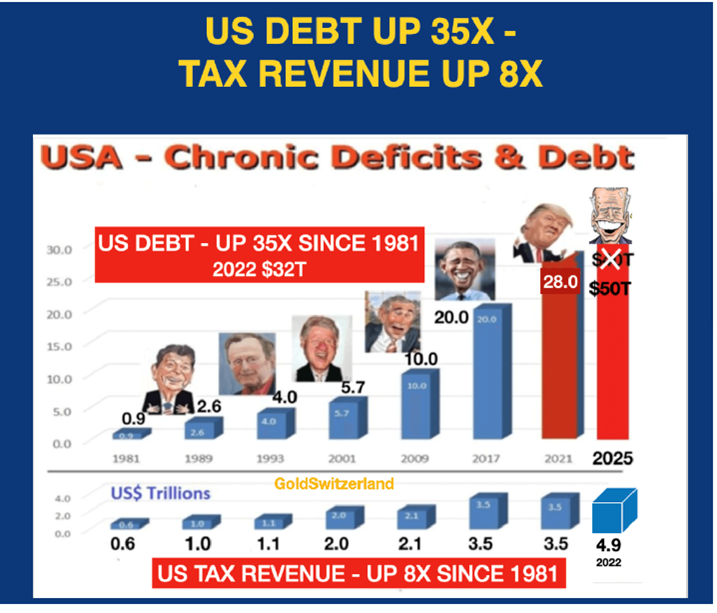

Since Reagan turned president in 1981, US federal debt has on common doubled each 8 years. Thus when Trump inherited the $20 trillion debt from Obama in 2017, I forecast that the debt would double by 2025 to $40t. That also seems to be like a sound projection however with the financial issues I count on, a $50t debt by 2025-6 can’t be excluded.

So presidents know they’ll purchase the love of the individuals by operating persistent deficits and printing cash to make up for the distinction.

But when we take a look at the graph above once more, it exhibits that debt has gone up 35X since 1981 however that tax income has solely elevated 8X from $0.6t to $4.9t.

How can any sane particular person consider that with debt going up 4.5X quicker than tax income that the debt can ever be repaid.

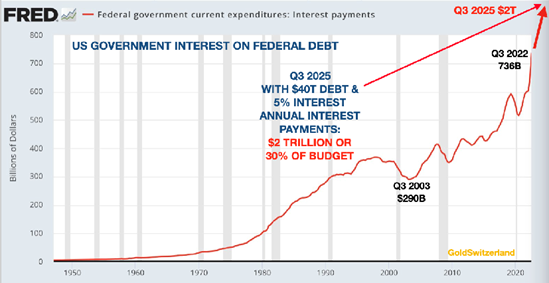

Even worse, with US curiosity funds on the debt surging from round 0% to in all probability 5% by 2025 the curiosity on the debt will climb to $2 trillion or circa 30% of the annual finances.

So with increased rates of interest, increased deficits and rising inflation the scene is ready for a excessive or hyper-inflationary interval within the subsequent few years

FED PIVOT?

So just about each observer believes that the Fed (and ECB) won’t simply cease elevating rates of interest however pivot and decrease them once more.

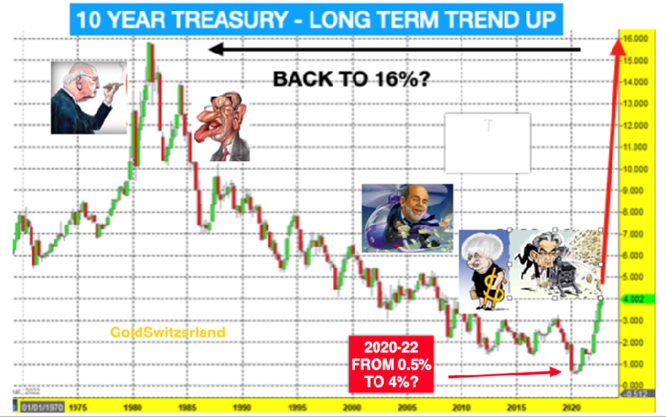

In my opinion this won’t occur apart from presumably very brief time period. The 40 yr rate of interest downtrend completed in 2020 and the world is unlikely to see low or adverse charges for a few years or a long time. Excessive inflation and excessive charges will proceed for years. However as we see within the 40 yr chart of the ten yr US treasury under, there shall be many corrections within the coming uptrend.

US MONEY SUPPLY GROWING AT 74% ANNUALISED

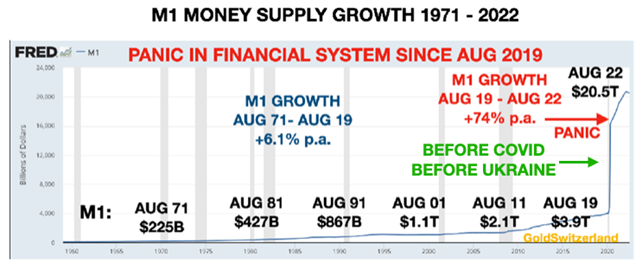

Between August 1971 and August 2019 US cash provide grew at 6.1% p.a.

In August 2019, the hangover from the 2006-9 Nice Monetary Disaster hit the monetary system once more leading to main assist actions from the Fed and different central banks.

So the contemporary issues emerged earlier than Covid and earlier than Ukraine. However these two new crises clearly exacerbated the systemic issues that had been placed on ice for 10 years. This led to huge cash printing and M1 within the US not elevated at 6% yearly however at a hyperinflationary 74% p.a. because the graph under exhibits.

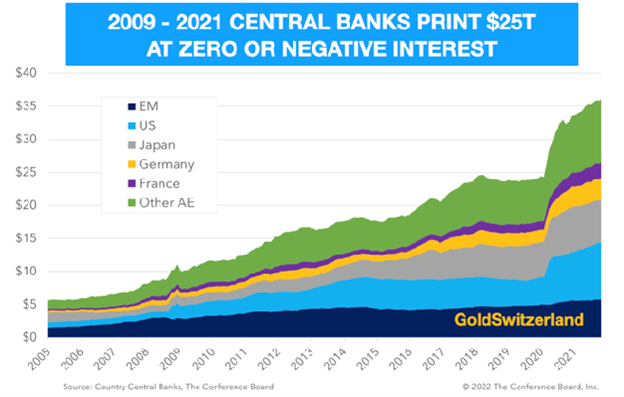

$25 TRILLION GLOBAL LIQUIDITY/DEBT INCREASE AT ZERO COST

Central banks are all the time unsuitable and all the time behind the curve. They saved brief time period charges at zero or adverse for over a decade. From 2009 to 2019 the stability sheets of main central banks elevated by $13t. However then from Aug 2019 to 2022 an explosion in central financial institution debt befell, increasing their stability sheets $23t from $13t to $36t. All the identical causes that I focus on within the paragraph above relating to US cash provide are clearly additionally legitimate for international debt enlargement.

There’s nothing like free cash! The banks created this cash at ZERO price. They did no work and nor did they produce any items or companies. All they wanted to do was to press a button. And with rates of interest at zero or adverse, many central banks had been really receiving curiosity from the lenders.

What an attractive Ponzi scheme. CBs print/borrow cash after which they’re paid for the pleasure of borrowing this cash. Any personal swindler launching such a scheme like Ponzi or Madoff would spend the remainder of his life in jail however the bankers are praised for “saving” the system.

What just about no particular person understands is that this free cash then enters the monetary system as having an actual intrinsic worth. As with all Ponzi schemes, the present monetary system will collapse too because the holders of the pretend paper cash realise that the cash is nugatory and that the emperor is completely bare.

That would be the ultimate section of the present financial system with limitless cash printing because the $2.3 quadrillion debt pyramid collapses which I mentioned on this article and additionally on this interview with Greg Hunter USA Watchdog .

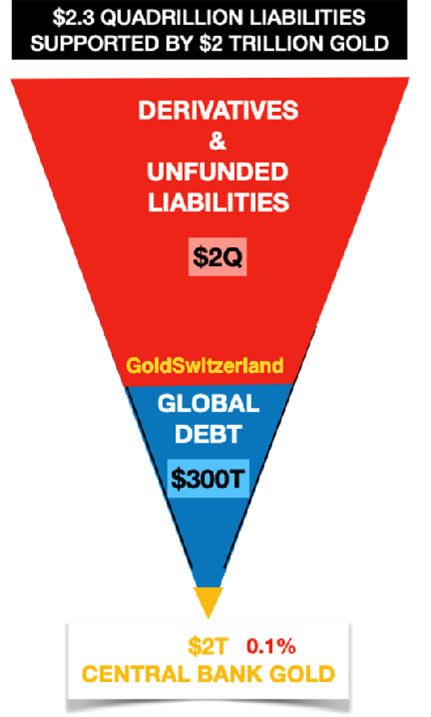

That is what the worldwide monetary system seems to be like:

The estimated $2 quadrillion gross derivatives is right now quasi debt however will at some point turn into actual debt, as central banks try and rescue the monetary system. When counterparties fail, the gross will stay gross. So in complete the world will face a $2,3 quadrillion debt resting on $2 trillion of central financial institution gold, a 0.1% protection.

Throughout the subsequent 5 years or so, the triangle is more likely to be inverted with central financial institution gold as the muse on the backside. However as a substitute of gold being solely 0.1% of worldwide liabilities, it is going to be as a lot as perhaps 20%. That 200x revaluation of gold shall be a mix of the worth of worldwide belongings and liabilities collapsing and gold rising.

Personally I don’t consider in a long-lasting formal reset with a brand new forex system backed by gold. I can not see the three main gold producers/holders China, Russia and India agreeing with the US on a revaluation. It’s also questionable if the US has anyplace close to the 8,000 tonnes of gold they’re declaring. Additionally, China and Russia in all probability have significantly extra gold than they’re declaring.

As an alternative, after the pretend paper market in gold has collapsed, the worth should be based mostly on provide and demand of unencumbered bodily gold or Free Gold. However that may solely occur after the present monetary system based mostly on pretend cash, debt and derivatives not capabilities.

CONSEQUNCES

However earlier than that, the world should pay for the excesses of the final 50 years. The implications shall be dire as we face a significant cataclysm or disorderly reset which is able to contain:

- DEBT DEFAULTS – SOVEREIGN, CORPORATE & PRIVATE

- BURSTING OF EPIC BUBBLES IN STOCKS, BONDS & PROPERTY

- MAJOR GEOPOLITICAL CONFLICTS WITH NO DESIRE FOR PEACE

- SECULAR FALL OF LIVING STANDARDS DUE TO HIGHER COST OF ENERGY & ENERGY SHORTAGES

- FOOD SHORTAGES LEADING TO MAJOR FAMINE AND CIVIL UNREST

- POLITICAL AND ECONOMIC INSTABILITY & CORRUPTION

- NO COUNTRY WILL AFFORD SOCIAL SECURITY OR PENSIONS

- INFLATION HYPERINFLATION AND LATER DEFLATIONARY IMPLOSION

I sincerely hope that these predictions won’t happen. As a result of in the event that they do, everybody will undergo dramatically for an prolonged interval. Nobody, wealthy or poor will keep away from these issues.

I’m naturally not predicting, like a Cassandra, (my 2017 article with a well timed gold projection) that this disorderly reset will completely happen. Solely future historians will inform us what really occurred.

However what I’m saying is that the chance of a significant disaster has by no means been increased in historical past, every time it really occurs.

Bodily gold and silver won’t prevent however clearly be the most effective monetary insurance coverage you may maintain.

Most vital is a assist system of household and buddies. Bear in mind additionally that along with household and buddies, a few of the finest issues in life are free like nature, music, books and plenty of hobbies.