Nice information… the financial system recovered in Q3!

Based on the Bureau of Financial Evaluation (BEA), the U.S. financial system grew at an annual price of two.6% in 3Q22. So all of our issues a few recession had been misguided! The financial system is again on observe!

There’s just one downside with this narrative: the BEA “massaged” the info to make issues look higher than actuality.

As Invoice King notes within the King Report, the BEA used an inflation price of 4.1% to fabricate the GDP progress of two.6%.

Sure, you learn that appropriately. The BEA claims inflation was 4.1% in 3Q22.

It’s an odd declare, provided that the BEA used an inflation price of over 9% throughout 2Q22. So the BEA is claiming that inflation was lower in half between June and October?

Good luck with that!

It’s not like we don’t produce other information to check to. Heck, even the Shopper Worth Index (CPI), which most individuals know beneathstates inflation, had inflation round 8% for many of 3Q22.

Why would the BEA declare inflation was a lot decrease than actuality?

As a result of UNDER-stating inflation allowed them to OVER-state progress.

Let’s say that GDP grows by 10% in a given quarter. On the floor that sounds fairly implausible. However what if inflation was at 10% throughout that very same quarter? Properly then in actual phrases, there was ZERO progress: all the “progress” was in actual fact the product of costs rising courtesy of inflation.

Put one other means, by utilizing the ridiculously low inflation price of 4.1%, the BEA was capable of manufacture GDP progress 2.6% for 3Q22. Had the BEA used a extra real looking measure of inflation, GDP progress would have been ZERO if not adverse.

And we are able to’t have {that a} mere two weeks earlier than the mid-terms can we?

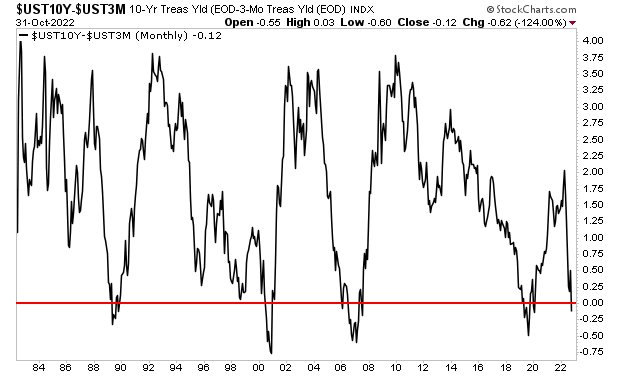

The fact is that the financial system is already in recession. I do know it. You recognize it. Heck, the bond market simply informed all of us when the yield curve inverted… simply because it did in 2007, late 2019 and right this moment.

By the point the official numbers admit this, shares can have already collapsed to new lows. Within the meantime, these traders who’re shopping for into the BEA’s ridiculous progress claims are being lead like sheep to the slaughter.

In the meantime, good traders are making the most of this to organize for the approaching crash.