What’s totally different now? Fairly a couple of fundamentals are consequentially totally different.

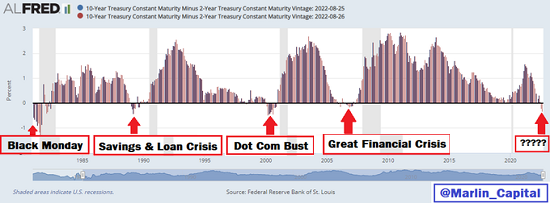

The closest factor to a assure in finance is the truism that recessions at all times comply with Treasury bond yield inversions, the place short-term bond yields exceed longer-duration bond yields.

Does historical past alone assure the identical end result this time? The consensus is “sure,” however as grizzled market observers have famous, when everybody is certain the market goes to do one factor, it does one thing else.

The higher strategy could be to say all else being equal to earlier circumstances, recessions comply with yield inversions as evening follows day. However are circumstances the identical now? It may be argued that circumstances are basically totally different, and so the assure of recession may be flawed.

What’s totally different now? Fairly a couple of fundamentals are consequentially totally different.

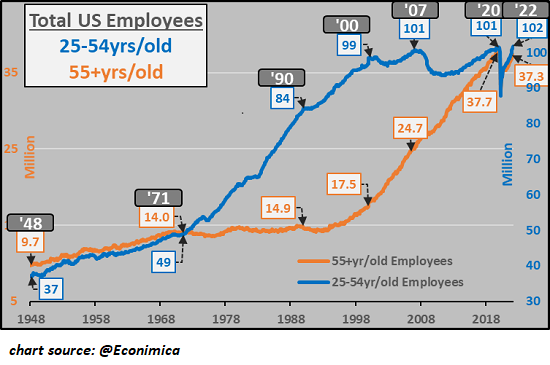

1. The labor pressure is not increasing, and could also be shrinking. Because the chart under illustrates (courtesy of Econimica), the variety of workers 25-54 has been stagnant for 20 years. The one progress within the employed are within the 55 and older cohort, which added 20 million employed in these 20 years.

Because the inhabitants ages and the birthrate declines, the workforce ages after which shrinks as older staff retire. This places a flooring underneath employment that didn’t exist in earlier eras. Wages are lastly rising after 45 years of stagnation. This pattern will solely speed up because the workforce contracts.

Social and well being modifications are exacerbating this contraction in these keen to work. Laying flat and Let It Rot are Chinese language phrases for youthful generations opting out of the rat-race, however they apply to American staff as effectively. Quiet quitting is just one manifestation of a bigger social motion of take this job and shove it.

Lengthy COVID will not be being tracked all that effectively, however anecdotal proof suggests it’s impacting the youthful workforce. The overall decline of American staff’ well being (life-style illnesses / problems, burnout, and many others.) is having a considerable however poorly documented impact. The workforce isn’t just a depend of heat our bodies, it’s the depend of these keen and capable of work demanding jobs.

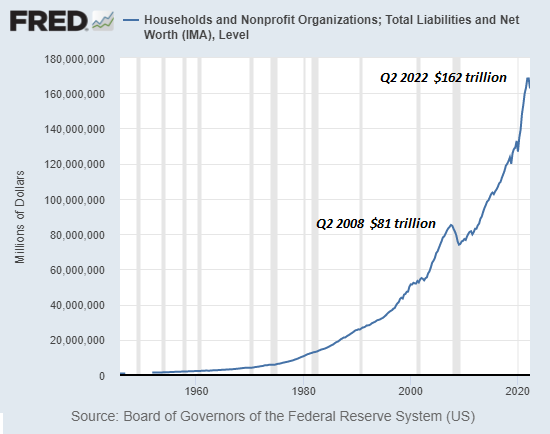

Turning to family wealth, notice that family wealth doubled from 2008 to 2022, from $81 trillion to $162 trillion in Q2 2022. As famous right here many instances, nearly all of this wealth is within the arms of the highest 10%, who generate roughly 40% of all shopper spending.

Many of those households purchased belongings way back. Asset valuations can drop considerably however the beneficial properties are so massive that those that personal a lot of the belongings will nonetheless really feel well-off. For instance, when you purchased a home for $150,000 and it was value $1 million earlier this yr, if it drops to $750,000 subsequent yr, you could remorse not promoting it however you’re not precisely hurting.

In different phrases, there are buffers in employment, wages and wealth which might be considerably totally different from earlier eras. Labor has already been reduce to the bone in most of Company America and small enterprise, and important staff run the spectrum from resort maids and different lower-skill positions to skilled welders and electricians to tech staff.

The slack bought squeezed out way back. If you happen to struggled to rent dependable, skilled staff, you’re going to do every part else to chop bills to maintain these important staff in a downturn.

Lastly, reshoring and friendshoring are bringing capital and jobs again to North America. The perversities and vulnerabilities of Hyper-Globalization are actually obvious to all, and this actuality will solely collect momentum.

Recessions should not equal. A deep recession is characterised by 10% to fifteen% of the workforce being laid off, and credit score, consumption, asset valuations and earnings all fall off a cliff.

A recession wherein the GDP shrinks by 1% for 2 quarters whereas employment stays secure could also be extra statistical than consequential. All issues should not equal, and the herd working towards the “assured recession” could thunder off the cliff.