Overview

Aclara Assets (TSX:ARA), a uncommon earth ingredient (REE) exploration and improvement mining firm, is on a quest to reinvent mining as a climate-friendly trade, sustainably supplying minerals the world critically requires to realize a low-carbon future.

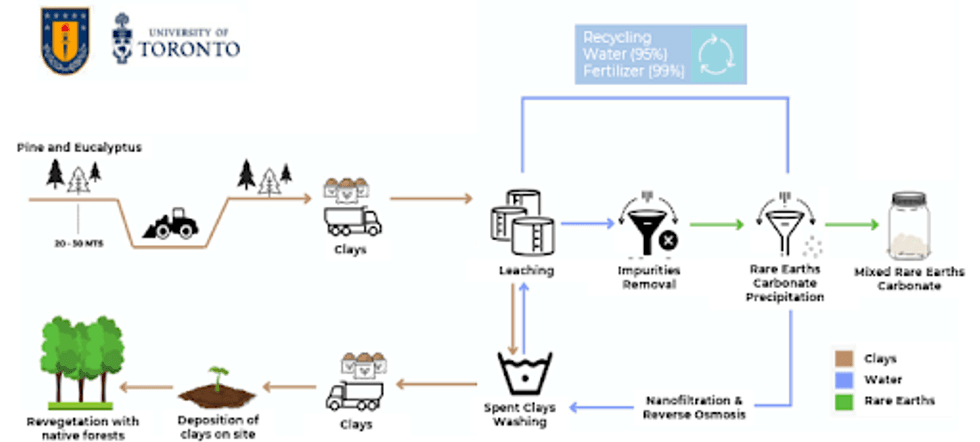

By its Penco Module ionic clay asset in Chile, Aclara is testing its modern, patent-pending Round Mineral Harvesting Course of, a novel, sustainable extraction methodology developed in collaboration with the College of Toronto and the College of Concepción in Chile.

The mining trade has long-endured a unfavorable public fame. However current efforts, such because the World Financial institution’s Local weather-Sensible Mining Initiative, are hoping to reshape the mining trade as a sustainable, very important companion in reaching the world’s net-zero emissions targets. The Local weather-Sensible Mining Initiative units out tips to enhance sustainability and decrease the environmental impression of mining operations.

Aclara Assets goals to be on the forefront of this motion.

Clear applied sciences, similar to electrical automobiles and wind generators, require uncommon earth parts to fabricate the highly effective magnets they want. Nevertheless, whereas REEs are technically considerable within the Earth’s crust, there are few economically viable deposits worldwide, outdoors of Southern China and Myanmar. Ionic clay deposits, referred to as ionic adsorption clay (IAC), have three particular traits, (1) comprise excessive worth of scarce heavy uncommon earths (HREE), (2) generate no radioactivity, and (3) have a easy metallurgy permitting for low prices and capital expenditures.

IAC are main contributors to the world’s whole HREE output. For years, the one important IAC deposit outdoors of China has been Ionic Uncommon Earth’s (ASX:IXR) Makuutu challenge in Uganda. Luckily, that’s about to vary as new IAC deposits have been found and are actually transferring in direction of improvement.

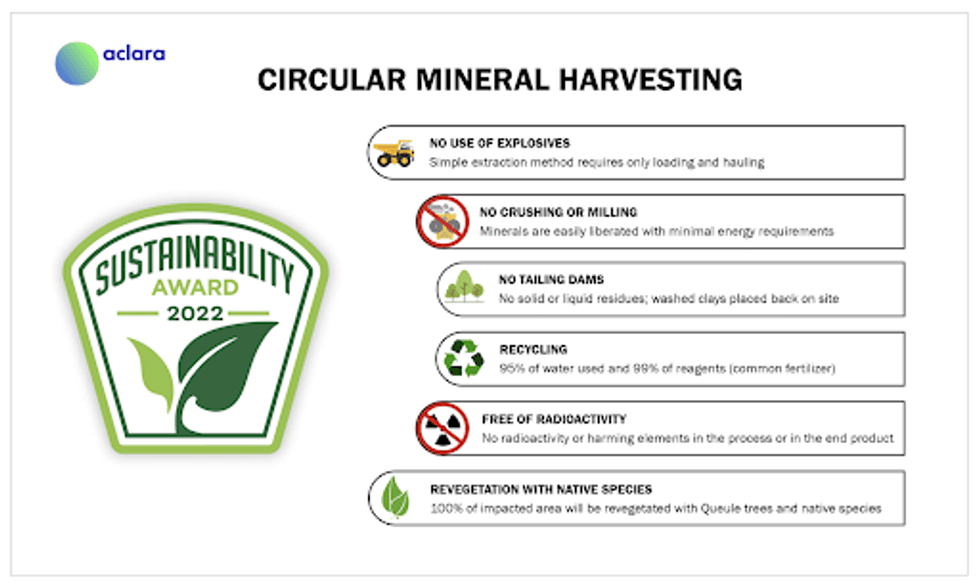

Aclara Assets’ Penco Module, the corporate’s flagship asset in Chile, incorporates ionic clays wealthy in each HREE and LREE. The challenge shall be a testing floor for its Round Mineral Harvesting Course of for additional optimization for future initiatives. This superior extraction course of doesn’t use explosives, crushing or milling, nor produces strong or liquid residues.

The extraction course of advances Aclara’s mission of turning into a frontrunner in climate-smart mining practices. The Round Mineral Harvesting Course of produces no tailings dam, prioritizes revegetation, recirculates as much as 95 % of water used and 99 % of the principle reagent. This transformative new course of led to the corporate incomes the 2022 Sustainability Initiative of the Yr award.

Along with its new extraction course of, Aclara has proposed and designed steps to realize sustainability and ESG excellence all through the Penco Module. These steps embody preserving the native organic hall, establishing a security buffer to guard natural world, reforestation of native species, and extra voluntary environmental safety dedication. The corporate lately voluntarily withdrew its Environmental Affect Evaluation software following suggestions from authorities to permit the corporate to scale back its environmental impression additional. Aclara is now refining its operations earlier than transferring ahead and resubmitting its software.

In parallel to the Penco Module improvement, Aclara owns a big concessions land bundle of 451,985 hectares to permit natural progress. The corporate is exploring to the south and north of the Penco Module (located in solely 600 hectares) to doubtlessly incorporate extra modules within the medium time period. An exploration plan has already been designed for the following 3 years and a drilling marketing campaign is already underway.

Aclara Assets’ administration crew has numerous experience all through the pure sources sector. Expertise consists of challenge financing, REE challenge improvement, company administration and worldwide regulation. The vary of expertise builds confidence within the crew’s capability to steer the corporate in direction of its targets.

Firm Highlights

- Aclara Assets is an HREE-focused exploration and improvement firm transferring in direction of improvement at its ionic adsorption clay deposit in Chile.

- The corporate’s distinctive, patent-pending Round Mineral Harvesting Course of improves its future ESG score by eliminating tailings dams, prioritizing revegetation and recirculating as much as 95 % of the water used and 99 % of the principle reagent.

- Aclara was awarded the 2022 Sustainability of the Yr award for its modern Round Mineral Harvesting Course of.

- The Penco Module, the corporate’s flagship asset, incorporates an encouraging IAC deposit and can function a pilot challenge for the brand new harvesting course of.

- Aclara voluntarily withdrew its Environmental Affect Evaluation software following suggestions from authorities, permitting the corporate to enhance and refine its environmental practices earlier than reapplying.

- Aclara owns a big concessions land bundle of 451,985 hectares to permit natural progress (Penco Module located in solely 600 hectares). Exploration plan to include extra modules already below method.

- An skilled administration crew leads the challenge in direction of turning into a pivotal turning level in environmentally sustainable REE mining.

- With $78 million in money, Aclara’s essential shareholder is main valuable metallic producer Hochschild Mining, with a 57 % stake within the firm.

Key Initiatives

The Penco Module

A course of developed by Aclara in collaboration with College of Toronto & College of Concepción

Aclara’s flagship asset covers 451,985 hectares of land within the Maule, Ñuble, Biobío and Araucanía areas of Chile. The challenge is absolutely funded to the development choice and is a spin-off from Hochschild Mining’s REE challenge. Hochschild Group will retain a 57 % curiosity in Aclara, which owns a land bundle and mineral concessions in Chile containing ionic clays wealthy in REEs. Environmental sustainability is paramount to the operation’s targets, and the asset is near a educated workforce and established infrastructure.

Venture Highlights:

- Environmental Sustainability Prioritized All through: The corporate’s transformative Round Mineral Harvesting Course of permits for unprecedented sustainability. Aclara is not going to use explosives, crushing or milling to reap REEs. Moreover, there isn’t a tailings dam, makes use of excessive ranges of water recycling, and ends in negligible radioactivity within the end-product.

- Current Exploration Identifies New Space: Constructive outcomes from a current exploratory drilling marketing campaign have recognized a brand new space, Alexendra Poniente, which is now included into the challenge and affords clear potential to extend the mineral useful resource base. Greater than 72 drill holes confirmed the underlying mineralization’s continuity and supported the corporate’s technique of constructing a pilot plant for its harvesting course of.

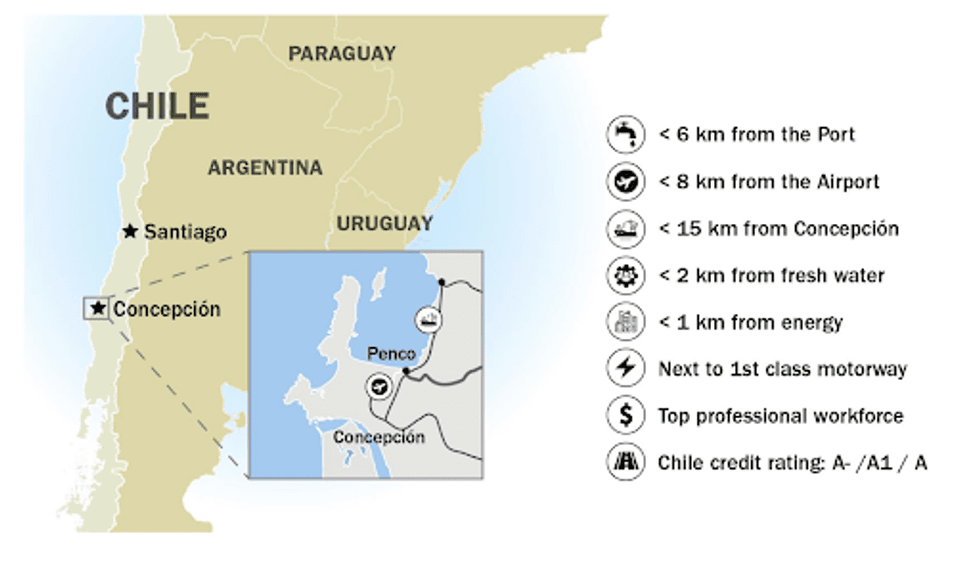

- Intensive Current Infrastructure: The asset is ideally situated 6 kilometers from a port, 8 kilometers from an airport and 15 kilometers from the town of Concepción. Moreover, the Penco Module is subsequent to a first-class motorway and has entry to educated staff, recent water and vitality.

- Giant concession land bundle of 451,985 Ha to permit natural progress: The Firm is aggressively exploring to the south and north of the Penco Module (located in solely 600 hectares) to doubtlessly incorporate extra modules within the medium time period. Exploration plan in place for the following three years and drilling marketing campaign already underway.

Administration Group

Ramon Barua – CEO and Director

Ramon Barua has greater than 10 years of expertise as CFO of Hochschild Mining. He was beforehand CEO of Fosfatos del Pacifico S.A., basic supervisor of Hochschild’s Mexican operations, and deputy CEO and CFO of Cementos Pacasmayo.

Rodrigo Ceballos – President & Basic Supervisor

Rodrigo Ceballos has greater than 20 years of expertise working in molybdenum, rhenium and uncommon earths markets at corporations together with Molibdenos y Metales S.A (Molymet) and Mathiesen Company. He was a member of the Minor Metals and Molybdenum Committees of the London Metals Alternate.

Francois Motte – CFO

Francois Motte has greater than 10 years of expertise in numerous monetary positions, together with serving in company finance, monetary planning, administration and management, enterprise improvement and investor relations at Hochschild Mining.

Barry Murphy – COO

Barry Murphy is an skilled mining trade veteran with greater than 30 years of expertise within the trade. Prior senior positions included roles at Torex Gold Assets, Inc., Yamana Gold Inc. and Anglo American. Moreover, he has led technical companies and challenge improvement groups in Chile, Peru, Argentina, Mexico and South Africa.

Diego Brieba – Basic Counsel

Diego Brieba has greater than 20 years of expertise within the mining sector. His prior positions included working at Codelco as senior company counsel, head of the mining observe group at Prieto & Cía. Abogados in Chile and overseas authorized marketing consultant at McMillan Binch Mendelsohn LLP in Canada.