Overview

The worldwide group is within the midst of a battery revolution. Shares of electrical automobile maker Tesla (NASDAQ:TSLA) surged over 740 p.c in 2020, then a further 56 p.c acquire in 2021, making it one of the crucial useful corporations on the earth. This dramatic enhance in demand showcases the promising progress narrative of the electrical automobile increase.

The revolution for electrical powered vehicles isn’t solely being led by Tesla, however many different automobile corporations together with Nio (NYSE:NIO), with a year-over-year enhance of 26 p.c. Volkswagen (OTC Pink:VWAGY), Basic Motors (NYSE:GM), Nissan (OTC Pink:NSANY), Hyundai (OTC Pink:HYMTF) and Bayerische Motoren Werke, generally known as BMW (OTC Pink:BMWYY) are additionally investing closely into the increase.

With the rising motion in the direction of a sustainable and electric-powered world, the lithium that will likely be wanted to assist this fast transition lends it the potential to grow to be one of the crucial useful assets on the earth.

On the forefront of this fast progress is Argentina, has the world’s third-largest lithium reserve and is the fourth-largest producer globally.

The well-known Triángulo del Litio — the Lithium Triangle — is an under-explored space that’s changing into a significant host for investor-friendly tasks ready to embrace the potential of a lithium-powered future.

Alpha Lithium (TSXV:ALLI,OTC Pink:APHLF) is one among many pursuing lithium on this area, given its potential to be one of many final greenfield undertaking alternatives on this part of the world.

Alpha Lithium is a improvement firm that’s targeted on extremely potential lithium manufacturing of its Tolillar Salar undertaking in Salta province, Argentina.

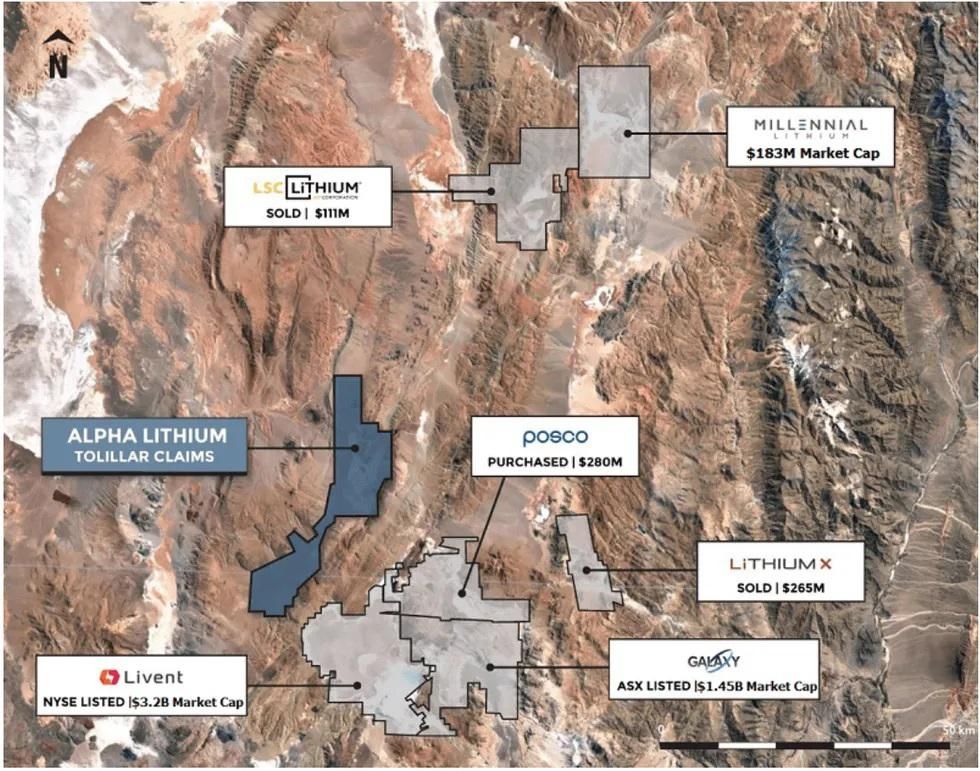

The corporate has been in a position to leverage its 100-percent possession and work in the direction of repeating the successes of its extremely established lithium producing neighbor. There’s promising potential for Alpha Lithium to thrive as the corporate is surrounded by notable gamers.

Alpha Lithium’s flagship Tolillar Photo voltaic undertaking is positioned in Northwest Argentina close to the center of the Lithium Triangle. Its extremely accessible infrastructure connects the undertaking website to Salta and San Antonio de Los Cobres by paved street networks, pure fuel assets and a talented native workforce.

The corporate lately bought two mining properties within the famend Salar del Hombre Muerto, Argentina. Nestled proper alongside its current property, the corporate controls curiosity in a complete of 5,072 hectares in what many declare to host the world’s largest lithium brine reserves. This land is straight away bordered by Korean big, Posco, which lately introduced that it was investing US$4 billion in Hombre Muerto, up from its initially deliberate funding of US$830 million. The rise follows a drilling marketing campaign that elevated its estimated lithium carbonate equal sixfold from a 2018 estimate to 13.5 million tonnes.

In two geophysical surveying campaigns, the corporate found structural tendencies that mimicked the Salar del Hombre Muerto horizon. This basin hosts one of many longest working lithium brine producers on the earth with over 25 years of energetic extraction.

“We take into account the geological similarities between the Tolillar Salar, and different close by salars like Hombre Muerto, to be very encouraging,” stated Brad Nichol, president and CEO of Alpha Lithium.

Moreover, the undertaking’s discovery and exploration plans are particularly thrilling for Alpha Lithium (TSXV:ALLI,OTC Pink:APHLF) as a result of high-producing mining corporations located close to Tolillar Salar.

Native operations embrace Livent Company (NYSE:LTHM) with a market cap of roughly US$3.2 billion and POSCO (NYSE:PKX) with an approximate market cap of US$23.2 billion.

Alpha Lithium presents a singular entry alternative for traders as an rising participant within the lithium manufacturing house.

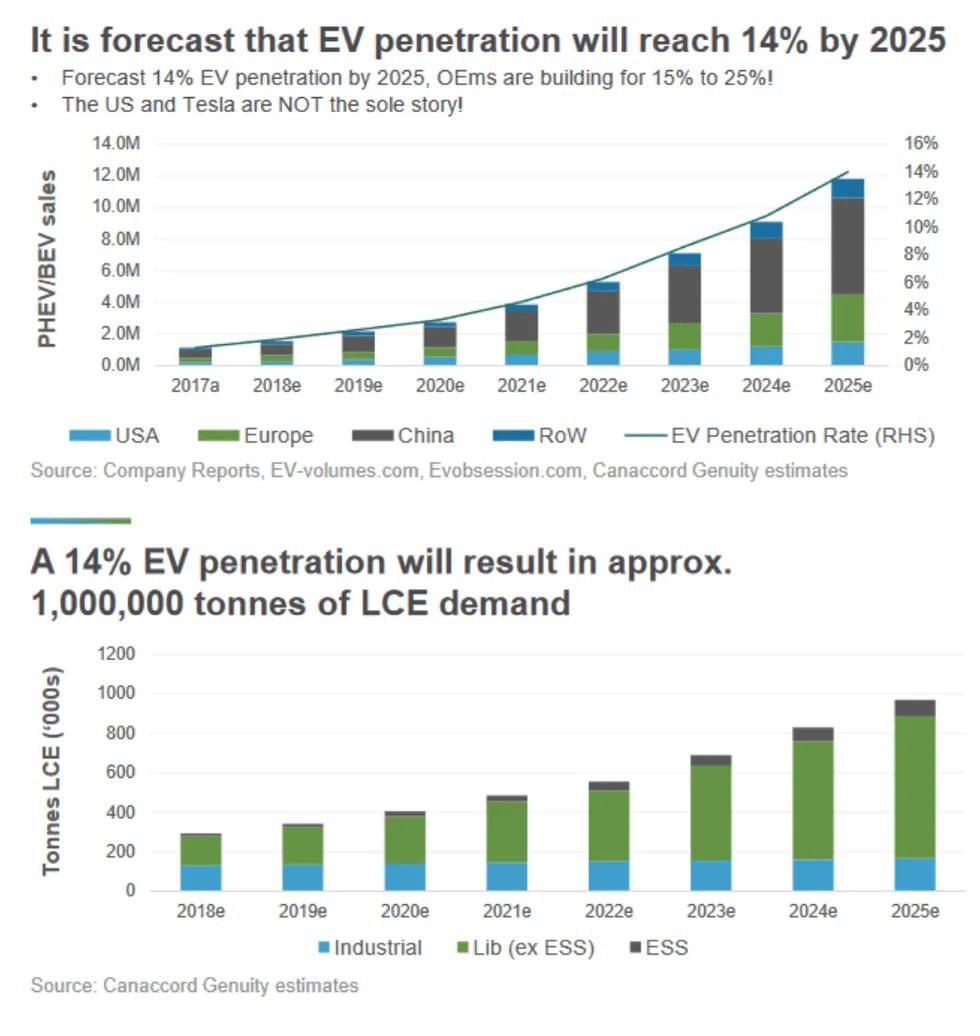

World demand for lithium is predicted to rise from an estimated 47,300 tonnes in 2020 to 117,400 tonnes in 2024, in keeping with a GlobalData report.

Vinneth Bajaj, a senior mining analyst for GlobalData, stated lithium demand will likely be pushed by a surge in EV gross sales, with annual manufacturing anticipated to go from 3.4 million automobiles in 2020 to 12.7 million in 2024.

Lithium-ion battery manufacturing can also be forecast to rise from 95.3 GWh in 2020 to 410.5 GWh over the identical interval. A Fastmarkets report from 2021 explains that the projected EV market penetration will enhance from 15 p.c to 35 p.c by 2030. This sustained enhance in demand may pressure provide, exhibiting the rising worth of Argentine lithium deposits.

Alpha Lithium acquired promising VES geophysical survey outcomes at its Tolillar lithium undertaking and is getting ready allow purposes for exploration.

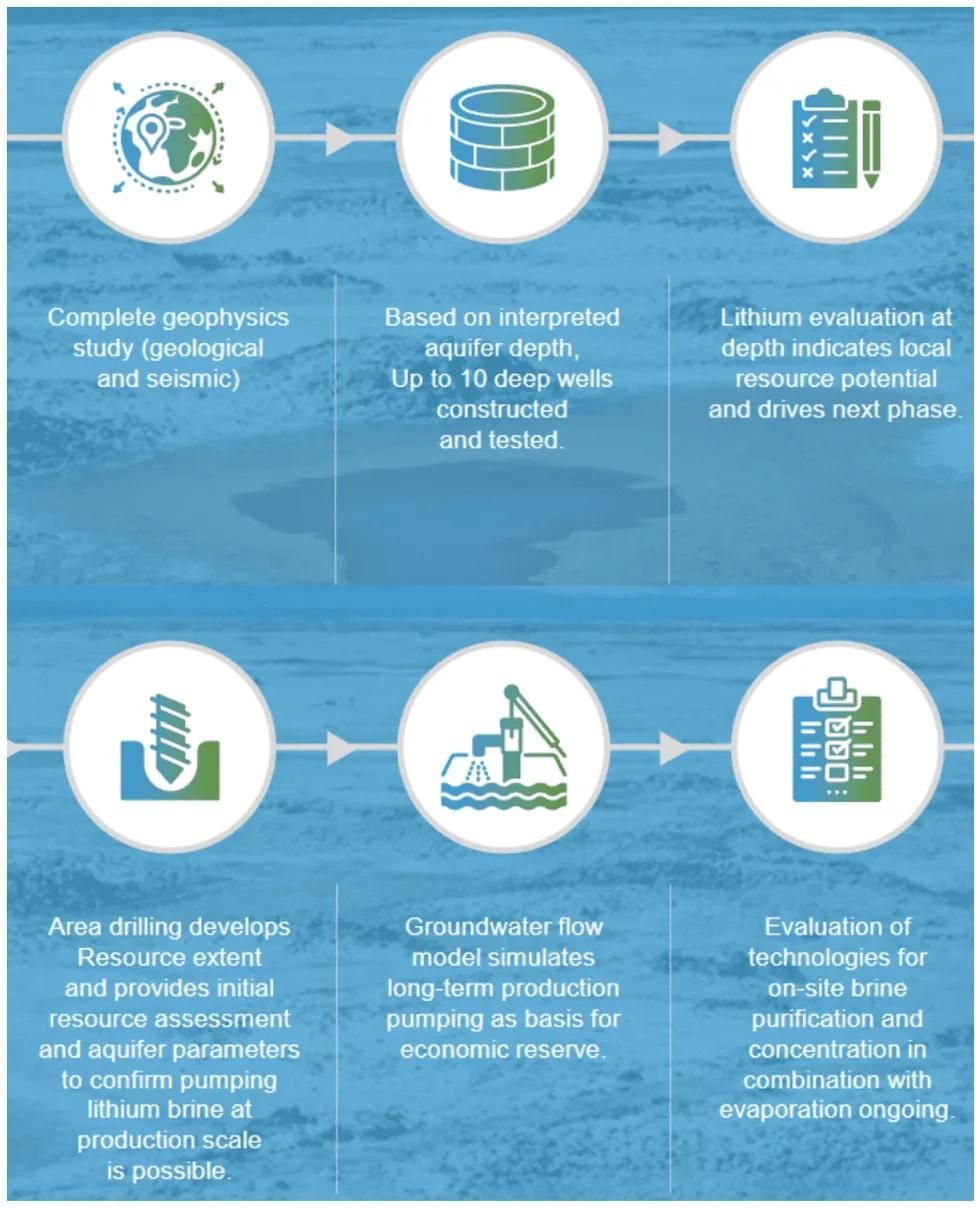

These achievements put Alpha Lithium on monitor for undertaking enlargement and execution of the corporate’s well-engineered six-phase method for growing its main rising lithium property.

Timeline – A Six Phased Method

Firm Highlights

- Alpha Lithium is an rising lithium improvement firm targeted on exploring its extremely potential, under-developed lithium property in Salta province, Argentina.

- The corporate owns 100% of its salar with over $40 million within the treasury.

- Alpha Lithium’s flagship Tolillar Salar undertaking is positioned close to the center of the Lithium Triangle, surrounded by multi-billion greenback lithium producers with a long time of energetic lithium manufacturing.

- The undertaking website’s infrastructure strategically positions the undertaking close by accessible electrical energy strains, paved street networks, pure fuel assets and a talented native workforce.

- Two geophysical surveys have supported theories that the Tolillar Salar property mimicked structural tendencies of the Salar del Hombres Muerto, one of many world’s longest-producing lithium brine basins.

- After two acquisitions in the identical salar Alpha now controls a 100% curiosity in 5,072 hectares within the Salar del Hombre Muerto and is the second largest landholder, after Posco, on the Salta facet of the well-known salar.

- All of Alpha’s 5,072 hectares are instantly bordered by Korean big, Posco, which lately introduced that it was investing US$4 billion in Hombre Muerto, a rise from its initially deliberate funding of US$830 million as a result of a drilling marketing campaign elevated its estimated lithium carbonate equal sixfold, to 13.5 million tonnes.

- Alpha Lithium is primed for undertaking enlargement and allow acquisition as drilling campaigns are presently underway.

Key Initiatives

The Tolillar Salar Challenge

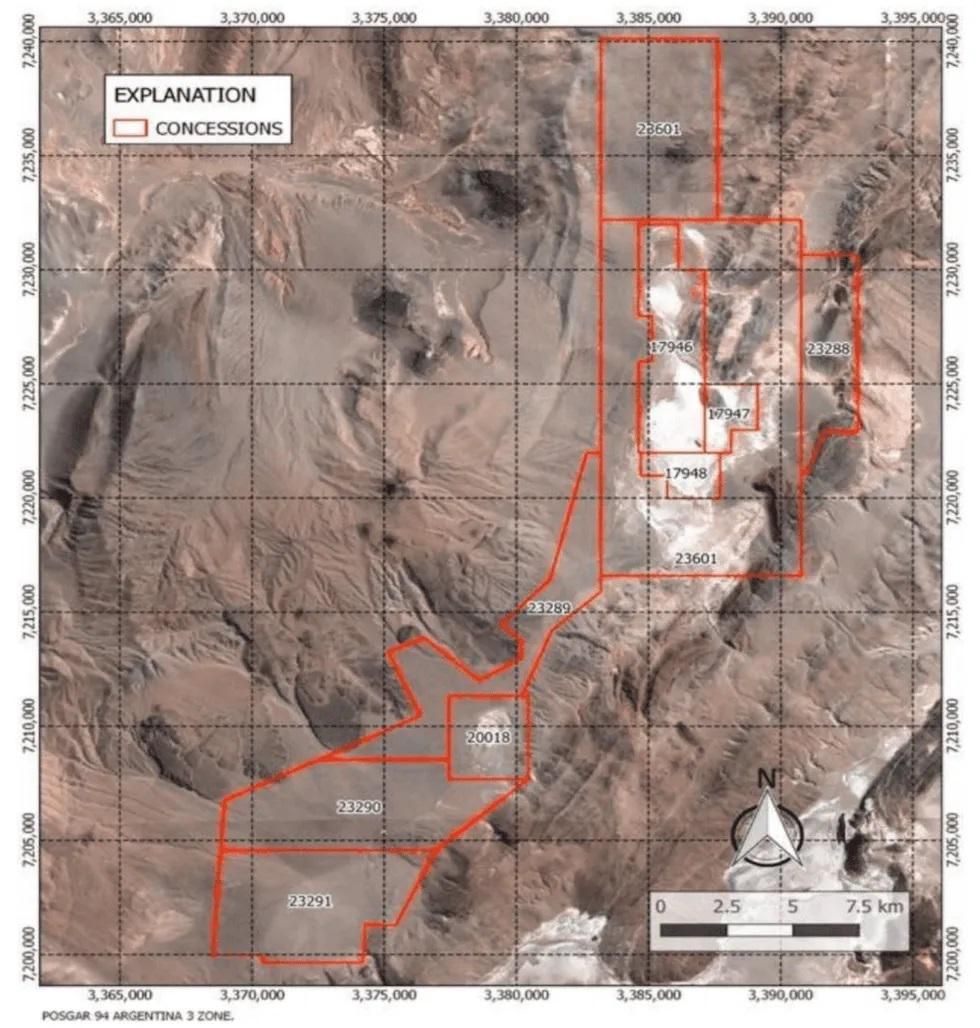

The Tolillar Salar property covers 27,500 hectares and consists of 10 exploration concessions registered within the Salar de Tolillar basin in Argentina’s Salta province. With restricted exploration historical past, and a strategic location close by a number of lithium producing heavyweights, the Tolillar Salar undertaking places Alpha Lithium in a singular first-mover place for important mining success.

The Tolillar Salar occupies an internally drained basin with a lot of the property’s rock formation courting again to the Ordovician interval. This geological make-up has created a sediment profile that features youthful continental sediments, salt crusts and evaporite deposits.

This property is in shut proximity to the Hombre de Muerto Salar, a premier lithium brine basin. The corporate lately acquired 3,800 hectares on this space, anticipated to yield high-grade lithium discoveries with low impurities.

Early stage investigations have already revealed lithium concentrations as much as 504 mg/l in a sampling marketing campaign from 2015. With drilling licenses accepted, Alpha Lithium is able to start a sophisticated drill program.

The corporate has carried out two substantial geophysics surveying applications and achieved improvement objectives underneath finances and forward of schedule. This pattern in lithium exploration exhibits promise for the way forward for the undertaking.

Location

Alpha Lithium is positioned lower than 10 miles away from Livent, which has a market cap of over US$3 billion and over 20 years of manufacturing from the close by property. The corporate is strategically positioned roughly six miles from Livent’s high-quality, low-impurity Fenix Challenge.

Instantly adjoining to Livent is South Korean firm Posco (NYSE:PKX), with a staggering market cap of round US$20 billion. Posco has been very busy within the space, increasing on their lithium undertaking that they purchased from Australian lithium miner Galaxy Sources, now Alkem (ASX:AKE), for US$280 million in 2018.

The Tolillar undertaking space has by no means been extensively explored, but is positioned in prime territory, immediately close to a focus of main lithium producers, offering a good portion of the worldwide lithium provide.

The world’s going to want extra lithium mines as a result of unprecedented lithium-ion battery demand required to gasoline electrical automobiles and energy-hungry units. With a undertaking positioned within the coveted Lithium Triangle in South America, Alpha Lithium could possibly be sitting on a probably large lithium discovery.

The administration staff at Alpha Lithium includes business professionals and skilled stakeholders with years of experience in mining, exploration and capital markets. This well-connected staff makes use of a confirmed de-risk method, priming the corporate for important progress on the worldwide lithium market.

Administration Group

Brad Nichol – President & CEO

Brad Nichol is a global entrepreneur who has served and suggested firms on technique and finance for over 25 years. All through his profession, Nichol has served as each senior government and director of a number of private and non-private enterprises throughout the finance and useful resource sectors. He has led successive organizations via a number of rounds of personal and public undertaking financing, initiated and executed twin listings and established key worldwide and home monetary relations. Nichols additionally has important expertise in varied enterprise capabilities together with monetary, operational, human assets, investor relations and authorized and regulatory processes.

Beforehand, Nichol labored at Schlumberger, the world’s largest oil and fuel providers agency, in varied technical, managerial, advertising and marketing and gross sales roles in North America, South America and Europe. He left Schlumberger to pursue his MBA at one of many world’s top-ranked enterprise faculties, the London Enterprise College within the UK, Nichol he graduated with honours in 2003. Nichol additionally holds a BSc. in Mechanical Engineering from the College of Alberta and has been a registered Skilled Engineer since 1994.

David Guerrero – Nation Supervisor

David Guerrero brings virtually 20 years of worldwide expertise within the mining business, 10 of that are particularly associated to lithium as a specialty product. He has held varied roles with mining main Rio Tinto in addition to senior administration positions with Canadian firm, Lithium One, and with Australia-based Galaxy Sources. On this capability, Guerrero undertook a vital purposeful position in a current US$280 million M&A transaction with big South Korean steelmaker POSCO for mineral assets on the Salar del Hombre Muerto, the very best quality brine producing district in Argentina. He was additionally the previous president of the Salta Mining Suppliers Chamber and the AUSCHAM Argentina chapter’s vp. Guerrero brings indispensable native information and communal management to Northern Argentenian tasks.

Nathan Steinke – CFO

Nathan Steinke is a extremely revered monetary skilled with over 15 years of expertise at private and non-private corporations within the worldwide useful resource sector. Since 2003, Steinke’s obligations have included all the corporations’ monetary points, together with debt and fairness financing, company construction design and administration, money movement administration and forecasting, authorized and regulatory compliance, stakeholder engagement and reporting, twin itemizing execution and administration and danger administration.

Foster Wilson – Director

Foster Wilson has over 30 years of expertise in exploration and improvement, together with reserve drilling and estimation, feasibility research, mine allowing and improvement. He has labored in varied capacities for Placer Dome, Echo Bay, American Bonanza Gold and totally different junior exploration corporations. Foster additionally at the moment serves as president of Mesa Exploration.

Sean Charland – Director & Company Secretary

Sean Charland is a seasoned communications skilled with expertise in elevating capital and advertising and marketing useful resource exploration corporations. His community of contacts inside the monetary group extends throughout North America and Europe. Charland additionally serves as a director of Maple Gold Mines, Arctic Star Exploration, Eyecarrot Improvements and Voltaic Minerals.

Andrew Hallett – Director

Andrew Hallett is a commodity transaction specialist with over 10 years of cross-commodity funding expertise inside funding banking, buying and selling, and asset administration. Hallett is at the moment a associate at Rice Capital and an funding advisor specialised in various investments, specializing in upstream metals and mining investments in vital uncooked supplies. Hallett acquired a bachelor’s of arts in economics from the Augustana School of the College of Alberta and a grasp’s of science in finance from the London College of Economics. He was beforehand a director inside the commodities investments group at BTG Pactual Commodities, liable for all principal investments and structured finance transactions in metals, mining and power. His prior expertise consists of commodity funding roles inside international markets at Deutsche Financial institution as a senior structured originator and as a director at Natsource Asset Administration.

Chris Cooper – Director

Chris Cooper has over 20 years of administration and finance expertise within the oil and fuel, mining and expertise industries. Cooper acquired his B.A. from Hofstra College and his M.B.A. from Dowling School, each in New York State. He has been concerned within the creation and funding of a number of oil and fuel issuers, together with Selection Sources Corp., an intermediate oil and fuel producer, earlier than it was taken over in August 2007 by Buffalo Sources Corp. Cooper additionally sits on the board of different junior public corporations, together with Counterpath Company, Westridge Sources Inc, Bullion Gold Sources Corp. and Planet Mining Exploration Inc. He has sat on the audit committee of many public corporations in a number of totally different business sectors and has a broad, complete information of monetary stories.

Darryl Jones – Director

Darryl Jones has over 15 years of capital market expertise and an established monetary community. Jones was an funding advisor in Canada with PI Monetary and Raymond James. He was liable for elevating important danger capital for progress corporations in all sectors, specializing in pure assets.

Pedro Mauricio Torres – Technical Advisor

Pedro Mauricio Torres is a metallurgical Engineer with 17 years of expertise in operation, course of and tasks of chemical vegetation. He has 10 years of expertise in SQM Salar, the place he participated in growing the brand new lithium hydroxide plant, enlargement of the lithium carbonate plant to 70,000 tonnes per 12 months. Lately, Torres has additionally labored as course of advisor for Galaxy Lithium, Tianqi Lithium and Eramet Chilean Lithium Salars.

Adrian Sergio Arias – Technical Advisor

Adrian Sergio Arias has over 22 years of expertise within the operation of assorted chemical vegetation. Arias has devoted the final seven years to growing applied sciences and course of enhancements for the processing of lithium brines. He has additionally labored in exar with Lithium Americas to develop the Cauchari Lithium undertaking, lately taking up the place of course of supervisor of Galaxy Lithium within the Sal de Vida undertaking, positioned within the Salar del Hombre Muerto.