The struggle in Ukraine was a significant catalyst for oil and gasoline costs in the course of the first half of the 12 months.

Hampered provide out Russia drove the price of pure gasoline in Europe considerably increased, whereas a resurgence in oil demand following COVID-19 shutdowns and cargo disruptions pushed the price of West Texas Intermediate (WTI) and Brent crude to 11 12 months highs. Provide challenges saved values elevated via Q1.

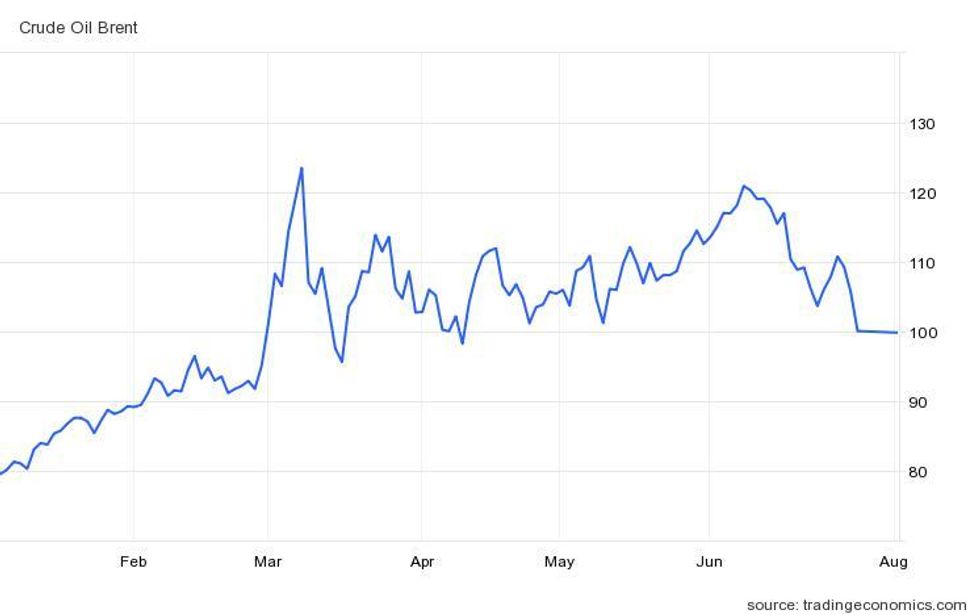

WTI crude began the 12 months at US$75.88 a barrel, whereas Brent crude was promoting for US$79.40. By the tip of January, Brent crude had grown by US$10 to US$89.59; WTI crude adopted swimsuit, concluding the 31 day interval at US$86.36.

“Easing issues surrounding the affect of the Omicron variant on the worldwide financial restoration supported costs for oil over the previous month,” a January report from FocusEconomics reads.

“Towards this backdrop of improved demand prospects, OPEC+ lately determined to stay to its present schedule for rising output in February, additional boosting costs in flip.”

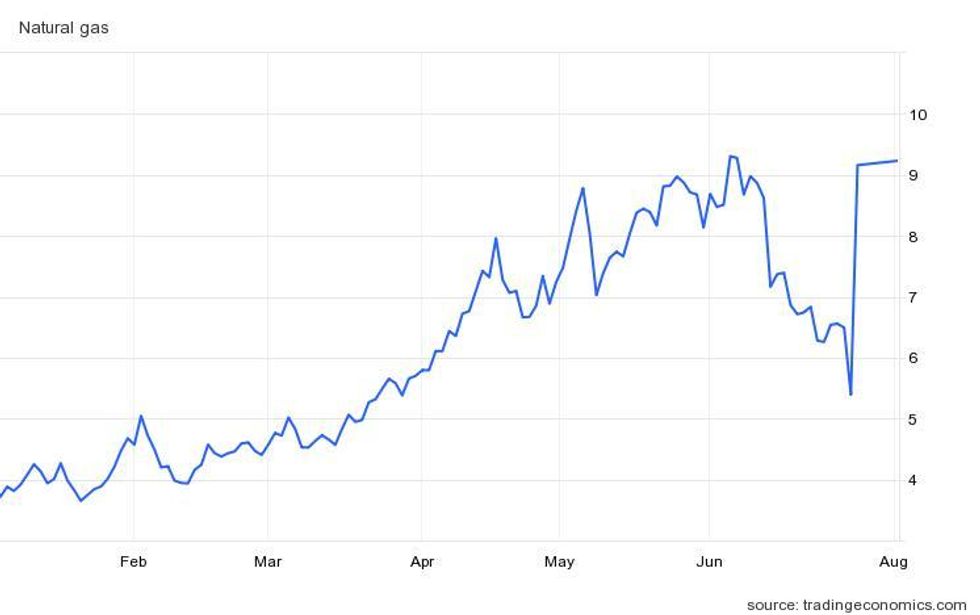

US pure gasoline costs additionally spent the primary month of 2022 transferring increased, beginning the session at US$3.68 per million British thermal models (MMBtu) and ending it at US$4.60.

Based on FocusEconomics panelists, after gasoline costs plummeted in November 2021 because of the rise in Omicron variant instances, values spent the primary calendar month recovering.

“On January 14, the Henry Hub pure gasoline worth was US$4.26 MMBtu, which was 12.4 % increased than on the identical day within the earlier month,” the agency’s January overview states. “Furthermore, the value was up 14.2 % on a year-to-date foundation and was 60.2 % increased than on the identical day in 2021.”

Forward of Russia’s invasion of the Ukraine, FocusEconomics outlined a number of elements that will affect the crude oil and pure gasoline sectors, together with OPEC’s manufacturing charge, elevated demand stemming from financial progress, excessive climate situations, forex fluctuations, transportation prices and geopolitics.

The lattermost proved to be particularly impactful in February and March.

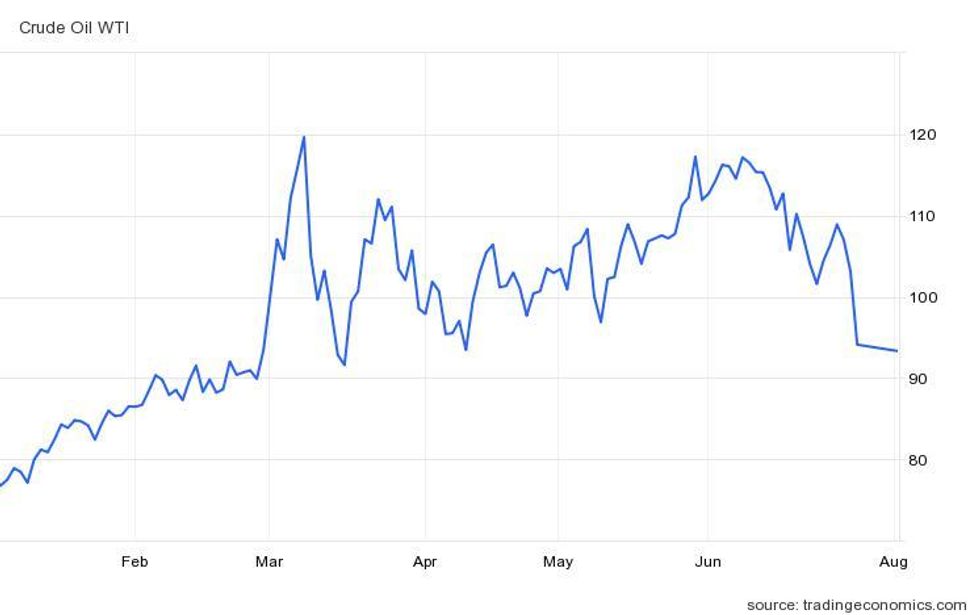

Oil worth replace: Conflict in Ukraine a significant Q1 worth catalyst

A gentle ramp up in oil demand all through early February supported each WTI and Brent crude earlier than costs spiked above US$100 per barrel on the finish of the month.

WTI crude’s H1 worth efficiency.

Chart through TradingEconomics.

The February 24 invasion of Ukraine instantly raised provide worries throughout the sector. Russia ranks third in annual oil manufacturing, outputting greater than 10 million barrels per day — roughly 10 % of worldwide provide.

Brent crude’s H1 worth efficiency.

Chart through TradingEconomics.

Western sanctions towards Russia drove commodities increased throughout the board, and each Brent (US$123.59) and WTI (US$120.10) crude soared to their highest values since 2008 on March 8.

“Markets had been unnerved by potential provide disruptions, which may come up both via direct harm to pipelines or through the current spate of powerful Western sanctions and potential Russian retaliation, comparable to lowering oil and gasoline exports,” a March report printed by FocusEconomics explains.

The US$120 vary was unsustainable for the vitality fuels, with each slipping again under US$100 by mid-March.

In accordance FocusEconomics panelists, the conclusion that the “sanctions have been designed to keep away from disruption to gas provides” considerably relaxed international markets, however created a worth discrepancy between WTI and Brent.

“Costs for WTI have risen much less sharply than Brent amid current forecasts of strong US crude manufacturing plus the US’s weaker dependence on Russian oil and gasoline,” the agency mentioned. Nevertheless, it identified that US inventories had been nonetheless depleted, with export demand sturdy and international inventories on the low finish.

By the tip of the primary quarter, WTI was up 37.86 % from the beginning of the 12 months, sitting at US$105.60, whereas Brent crude had elevated 29.13 % to hit US$103.16 over the identical interval.

Fuel worth replace: Q1 brings questions over Russian provide

Over the primary three months of the 12 months, pure gasoline costs additionally made massive positive factors, including 55.41 % by the tip of March. They began 2022 at US$3.70 and had climbed to US$5.75 by the tip of the quarter.

Tight US provide attributable to low inventories was additional heightened by issues over the way forward for Russian exports.

Virtually half of Europe’s pure gasoline comes from Russia, with the bulk flowing via the Nord Stream 1 and a pair of pipelines. Potential pipeline shutdowns rapidly turned a distinguished subject following the invasion of Ukraine.

Pure gasoline’ H1 worth efficiency.

Chart through TradingEconomics.

Based on the Worldwide Financial Fund (IMF), disruptions to Russian gasoline provide would weigh closely on vitality safety and on the GDP of a number of European nations.

“Within the most-affected nations in Central and Japanese Europe — Hungary, the Slovak Republic and the Czech Republic — there’s a threat of shortages of as a lot as 40 % of gasoline consumption and of gross home product (GDP) shrinking by as much as 6 %,” the IMF’s mid-2022 report explains.

Oil worth replace: Vitality safety comes into focus in Q2

Crude oil costs remained locked between US$95 and US$110 from March via Might earlier than one other rally set in. Continued sanctions and fears round Russian provide sustained 10 12 months highs, whereas mounting nervousness about geopolitics in different oil-producing nations additional eroded international vitality safety.

“The oil market has twisted and turned in response to some seemingly jaw-dropping information in current weeks,” FocusEconomic states in a Might market report. “On the finish of Might, the European Union slapped a ban on most Russian oil and agreed, together with the UK, to bar the insurance coverage of ships carrying Russian oil. Just a few days later, OPEC+ agreed to speed up oil manufacturing.”

Regardless of these developments working to “cancel one another out,” the rising worldwide vitality disaster propelled costs to a Q2 excessive as WTI touched US$117.51 and Brent reached US$120.74 on June 8.

Fueled by uncertainty round provide from Russia and OPEC’s lack of ability to achieve beforehand set targets, many market analysts acknowledged each the precarious vitality state of affairs and the issues with forecasting.

“Hardly ever has the outlook for oil markets been extra unsure. A worsening macroeconomic outlook and fears of recession are weighing on market sentiment, whereas there are ongoing dangers on the provision aspect,” reads an oil market report launched by the Worldwide Vitality Company in July.

The six months of excessive vitality costs seen in H1, paired with inflation and pandemic restoration, are all anticipated to weigh closely on international GDP this 12 months, based on the World Financial institution and IMF. The organizations are anticipating that GDP will contract from its 2021 degree of 5.9 % to roughly 2.9 %.

Fuel worth replace: Costs peak in Q2

As the results of sanctions started to take maintain in April, pure gasoline costs started a extra pronounced upward pattern. By Might 5, values had reached a 14 12 months excessive of US$8.93, a greater than 140 % improve from January.

By June, rivalry over provide from each Nord Stream 1 and a pair of hit a fever pitch, and costs hit a recent 14 12 months intraday excessive US$9.35. The edge was unsustainable, nevertheless, and values fell via the tip of the month.

On the finish of the quarter, costs had contracted to US$5.29, down 43 % from H1’s excessive level. Nevertheless, pure gasoline values spiked increased in early July as provide over the winter started to take middle stage in Europe.

Wanting ahead, the primary vitality disaster because the Nineteen Seventies has invigorated the transfer in direction of cleaner, renewable vitality. Nonetheless, pure gasoline demand is projected to extend over the following 10 years.

“Fuel demand is projected to develop by 10 % within the subsequent decade in all eventualities,” McKinsey & Firm notes in a report on international vitality views.

Presently, gasoline accounts for 23 % of all vitality demand, however that’s anticipated to say no to fifteen % by 2050.

“After 2030, gasoline projections diverge throughout eventualities pushed by rising decarbonization stress in buildings and trade. The demand for gasoline is projected to be extra resilient than for different fossil fuels,” the overview states.

Oil worth replace: Elevated manufacturing to tame values in H2

For the reason that finish of June, WTI values have continued to consolidate under US$100, whereas Brent has hovered round that degree, breaking via to US$106 earlier than contracting once more.

The worth retraction for each lessons falls according to FocusEconomics’ outlook from earlier within the 12 months.

“A rebound in U.S. shale oil and international oil manufacturing will seemingly push the market into surplus this 12 months, regardless of strong US and international demand,” it reads. “A lot relies on the evolution of the Russia-Ukraine battle, Western sanctions, potential Russian retaliation and the pandemic, whereas U.S. financial coverage and the prospect of a brand new Iranian nuclear deal poses key draw back dangers.”

As such, panelists polled by the group are calling for WTI to common US$79.06 in the course of the fourth quarter.

For Brent, the outlook is a bit more opaque, though panelists are additionally anticipating costs to stay off their beforehand set highs this 12 months.

“That mentioned, they’ll stay elevated amid persistent geopolitical tensions, together with between Russia and the West,” the Brent crude replace notes. “A lot rests on the provision aspect of the value equation.”

Extra manufacturing out of OPEC, a decline in inflation and rebounding financial exercise are all elements that the group believes may function worth movers within the months forward.

“Our panelists proceed to have diverging views on the value outlook,” FocusEconomics explains. “For This autumn 2022, the utmost worth forecast is US$100 per barrel, whereas the minimal is US$65 per barrel.”

Remember to comply with us@INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the data reported within the interviews it conducts. The opinions expressed in these interviews don’t replicate the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

From Your Web site Articles

Associated Articles Across the Internet