by Boo_Randy

Peter Schiff calling out what the MSM touts & shills are attempting desperately to hide from you:

So the final time new houses had been this unaffordable the nation had simply skilled a monetary disaster, the U.S. economic system was within the worst recession for the reason that Nice Despair, and the S&P was on the backside of a 48% bear market decline. But “specialists” declare now the economic system is powerful.

— Peter Schiff (@PeterSchiff) August 23, 2022

The Numbers Don’t Lie; The Fed Received’t Win This Inflation Battle

The central bankers on the Federal Reserve proceed to speak robust about combating inflation. However is it a combat they’ll win?

The numbers say no.

After the CPI information cooled a bit in July, many observers anticipated the Fed to declare victory and start pivoting away from tightening financial coverage. As an alternative, the central bankers doubled down on the robust discuss. Minneapolis Federal Reserve Financial institution President Neel Kashkari mentioned the Fed stays “far, far-off from declaring victory” on inflation. He went on to say he hasn’t seen something that modifications the trajectory of the Fed’s inflation combat. Kaskari remained adamant that the central financial institution wants elevate charges to three.9% by the tip of the yr and to 4.4% by the tip of 2023. He even insisted he received’t be deterred by a recession.

The markets appear to have religion within the Fed’s capacity to deliver inflation all the way down to 2% and hold it there for a lot of the subsequent 30 years. Peter Schiff mentioned they’re “residing in fantasy land.”

There isn’t any means the Fed goes to even come near reaching that for 30 years. They’re not even going to realize it for 3 years. But, traders are nonetheless working below the delusion that the Federal Reserve can do what it claims it’s going to do.

Peter is correct.

For all of the robust speak about stopping inflation, the Fed’s plan isn’t sufficient. Pushing charges to three or 4 % received’t tame 8.5% CPI.

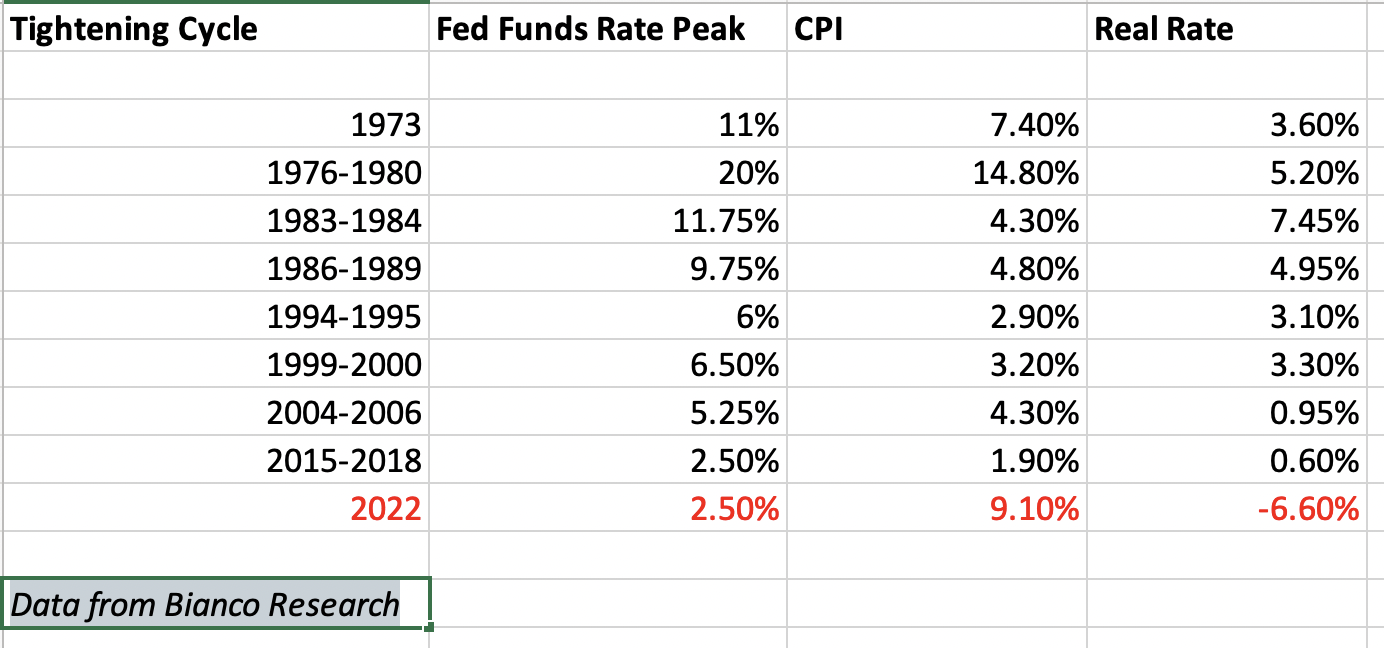

For those who take a look at all the Fed tightening cycles since 1973, the central financial institution has by no means stopped tightening earlier than the Fed funds price was greater than the CPI.

It’s clear from the chart that the Fed has lots of tightening to do earlier than it brings the actual price optimistic. It’s additionally clear that 3 or 4 % isn’t going to get the job carried out.

Analyzing rates of interest primarily based on the Taylor Rule leads us to the identical conclusion.

Economist John Taylor got here up with a system that hyperlinks the Federal Reserve’s benchmark rate of interest to ranges of inflation and financial progress. Primarily based on the Taylor Rule, the Fed fund price must be 9.69% assuming 2% actual impartial charges.