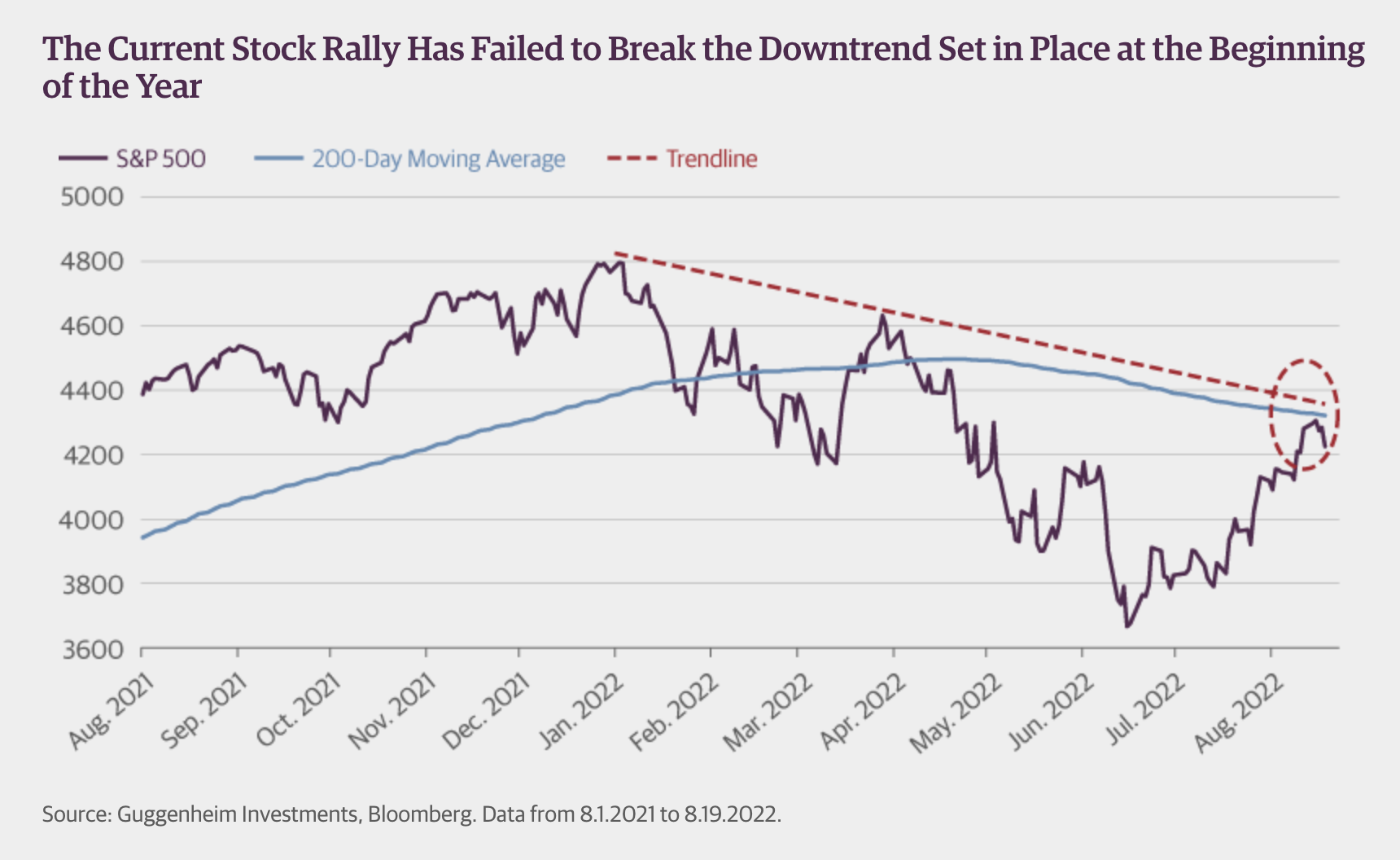

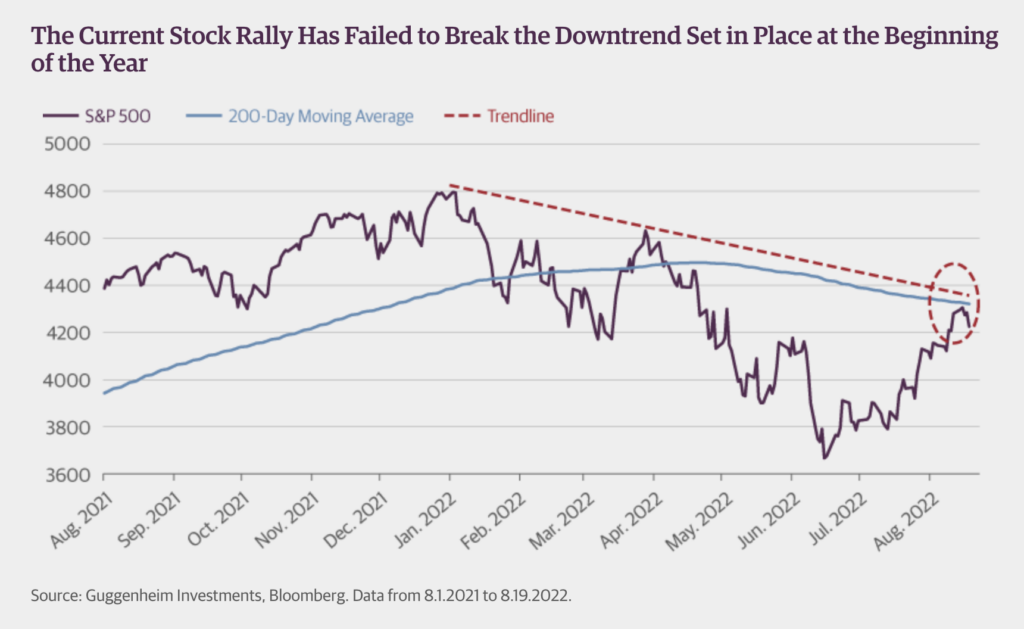

Sharing this chart from Guggenheim exhibiting that the S&P 500’s bear market bounce actually stopped on a dime and was turned away on the 200-day shifting common. It’s nearly too excellent. We handle our tactical portfolio primarily based on technically-oriented guidelines not as a result of it all the time works (it doesn’t!) however as a result of it eliminates emotions like concern or concern of lacking out from the decision-making course of. As you’re in all probability nicely conscious, from February til July, concern had been the predominant driver of market exercise. This switched in early July, at which level concern of lacking out started to take over.

Clearly, this form of subjective switching forwards and backwards between these sentiment shifts isn’t any strategy to handle retirement belongings or reside your life. Until, for some unusual purpose, you discover it enjoyable and attention-grabbing to connect your self to a display ten hours a day. Most individuals don’t need to spend what little time they’ve on this earth attempting to guess the feelings of the investor class each day. I do know I don’t.

Final phrase goes to Guggenheim:

In Could 2008, the market restoration stalled simply shy of its 200-day shifting common. The S&P 500 went on to fall one other 53 % earlier than bottoming in March 2009, bringing the peak-to-trough decline to 57 %. Equally, the bear market of 2000–2002 noticed a number of failed breakout makes an attempt that in the end resolved in a peak-to-trough decline of 49 %. Additionally price noting is that the downtrend was not damaged in both of those episodes.

Okay. It’s price stating that the majority rallies that fail on the 200-day (or tenth-month) don’t flip into 2008. However the threat is definitely there. Which is why having a rules-based reply for the likelihood is so essential for an already-wealthy investor whose bought a lifetime’s price of financial savings on the road.

Supply: