Some scams are simple to identify. I prefer to assume if I related with The Tinder Swindler on a courting app, I’d understand one thing was up the primary time the so-called inheritor to a diamond fortune hit me up for cash.

Different scams are a bit tougher to detect. If Frank Abagnale, Jr. was as charming as Leo DiCaprio portrayed him in “Catch Me If You Can,” there’s a great likelihood I’d consider he was a pilot/physician/lawyer, particularly with no Web to fact-check him.

Financial institution scams run the gamut from the clearly fraudulent to the deceptively convincing, and even the very best of us will be fooled. Shield your hard-earned money by understanding what to search for.

Forms of Financial institution Scams & Methods to Keep away from These Frauds

Preserve your cash secure by understanding these frequent financial institution scams and the best way to keep away from falling for one.

1. Test-Cashing Scams

A distraught stranger is ready outdoors your financial institution as you head inside. They inform you they’ve a verify they actually need to money, however they will’t as a result of they don’t have an account with the financial institution or don’t have their ID on them. They ask you to deposit the verify in your account and withdraw the identical quantity for them in money.

Do you give in to your want to assist a fellow human?

In the event you do, you’ll be taught the verify is a fraud. However since banks need to make funds obtainable earlier than a verify formally clears, it might be days earlier than it bounces. By then, the stranger is lengthy gone along with your cash. Plus, the financial institution might cost you an inadequate funds charge or returned verify charge.

Methods to Keep away from Test-Cashing Scams

Irrespective of how a lot somebody tugs at your heartstrings, don’t money a stranger’s verify for them. There are official methods to money a verify with no checking account. Be at liberty to share them with the stranger when you’re feeling beneficiant.

2. Unsolicited Test Fraud

You get a verify within the mail for a product rebate or account overpayment. You weren’t anticipating it, however free cash is free cash, so that you fortunately money it. No hurt, no foul, proper?

Incorrect. In the event you took a more in-depth have a look at the verify and any letter that got here with it, you’d understand that by signing it, you’re authorizing a recurring fee to your checking account.

In one other situation, you get a verify for a sweepstakes you’ve supposedly gained. It’s yours to money so long as you ship a bit again to the sweepstakes firm for “taxes” or “processing charges.” You’ll quickly be taught the verify isn’t actual, however the cash you’ve despatched to the corporate is.

Methods to Keep away from Unsolicited Test Fraud

Don’t get too excited when you obtain a shock verify within the mail. If it’s from an organization you’ve by no means heard of and by no means executed enterprise with, it’s probably a fraud. If it comes with directions to money it and refund the distinction to the verify author, it’s positively a fraud.

If the verify appears to be from a trusted supply like your financial institution, however you weren’t anticipating it, confirm its authenticity. Name the financial institution or firm’s customer support line — the one in your account statements or the again of your card, not the quantity supplied with the verify. Ask if the verify is legitimate and why you acquired it earlier than you even take into consideration cashing it.

3. Overpayment Scams

Overpayment scams goal on-line distributors, comparable to small companies that promote merchandise on-line and folks promoting gadgets on platforms like Craigslist and Fb Market. The scammer sends you a verify for greater than the acquisition worth, and once you inform them they’ve overpaid, they ask you to only deposit the verify and ship the distinction again to them.

By the point the verify bounces, you’ve already despatched cash out of your checking account to the scammer. You’re out these funds plus the price of any gadgets you despatched them.

Methods to Keep away from Overpayment Scams

Don’t settle for checks for greater than the quantity somebody owes you, interval. Contact the customer and ask them to ship a brand new fee for the correct quantity.

In the event that they’re for actual and made an sincere mistake, comparable to transposing numbers, they’ll be comfortable to ship you the correct amount so the acquisition goes by means of. In the event that they’re not, you gained’t hear from them once more, and you may promote the merchandise to a official purchaser.

4. Computerized Withdrawal Scams

Computerized withdrawal scams lure you in with the promise of one thing engaging.

You get an unsolicited provide for a bank card, which asks you to supply your banking particulars to qualify.

Otherwise you join a free trial, which requires your banking data, though the corporate says it gained’t cost you when you cancel earlier than the free trial ends. You cancel in time, however scammers have already gotten your knowledge and may cost you no matter they need every month shifting ahead.

This might be as a result of the free trial was a rip-off or as a result of they stole your knowledge from a official subscription service with an unsecured web site.

Methods to Keep away from Computerized Withdrawal Scams

Don’t give your checking account data to anybody who contacts you out of the blue. You don’t want to supply it to assert a official prize or freebie or to join a bank card.

Set up safety software program in your laptop, comparable to antivirus and anti-spyware software program, to guard data you enter on-line and warn you to suspicious websites.

Earlier than getting into your checking account or debit card data on-line, look intently on the website. Does it look skilled? Does it look reliable? Is it safe? If the URL begins with “https,” which means it encrypts your knowledge to maintain it secure from third events. If it begins with “http,” it doesn’t.

Lastly, evaluate your financial institution statements month-to-month. If there’s a cost you don’t acknowledge, instantly contact your financial institution to dispute it and revoke authorization for future fees.

5. Phishing Scams

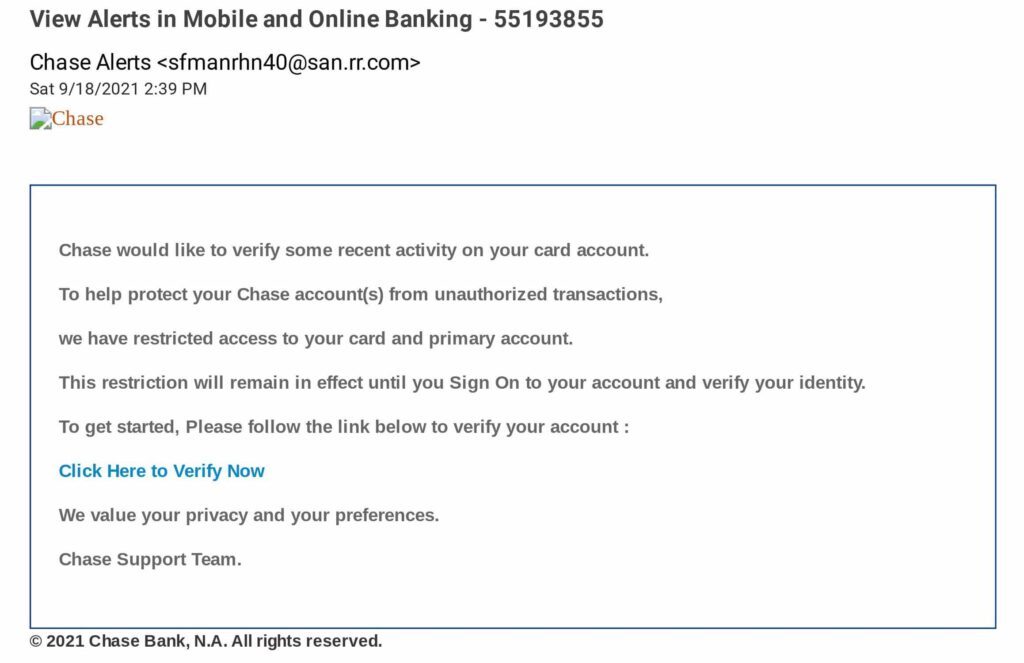

You obtain an official-looking letter or e-mail out of your financial institution telling you your account has been suspended as a result of uncommon exercise. It might even have the official financial institution emblem on the letterhead. There’s a quantity to name or a hyperlink to click on to “re-verify” your account and restore entry. In the event you don’t do that inside a brief interval, the communication says, your account can be deactivated.

The sender isn’t your financial institution however a scammer making an attempt to get your data. They’ll have a area day along with your funds when you present it.

Methods to Keep away from Phishing Scams

In the event you obtain an e-mail purportedly out of your financial institution, do some due diligence. Double-check the sender’s e-mail handle.

Take this e-mail I acquired. Within the messages listing in my inbox, the sender’s show title was “Chase Alerts.” However open the e-mail (or open it up and hover your mouse over the sender title, relying in your e-mail supplier), and also you’ll see it got here from “sfmanrhn40@san.rr.com.” Name me loopy, however I don’t assume that’s an official Chase e-mail handle.

In the event you obtain a letter with a quantity to name to re-verify your account, don’t name it. Discover your financial institution’s official customer support quantity on its web site, the again of your debit card, or your account statements and name that to ask about your account standing.

6. Employment Scams

You reply a Craigslist advert for a private assistant. The employer sends you a verify so you should purchase some present playing cards for them. As quickly as they obtain the playing cards, they use them earlier than you may work out you’ve been scammed.

Or, a secret purchasing firm hires you to judge a wire switch service like Western Union. They ship you a verify to deposit in your checking account and ask you to wire a portion of the funds again to them so you may inform them how the expertise went.

In the event you’ve learn this far, you recognize what occurs subsequent: The verify is faux, however by the point you understand this, you’ve already given the scammer your cash.

Methods to Keep away from Employment Scams

Except you’re engaged on retainer, an employer gained’t ship you cash earlier than you begin working for them. They actually gained’t ship you cash with the caveat that you need to ship a few of it again to them. If a possible employer asks you to do that, say goodbye.

7. ATM Scams

Scammers additionally goal ATMs, utilizing the next ways.

Card Skimming

A scammer locations a tool on an ATM card slot or the cardboard reader that unlocks the doorways to the ATM foyer after hours. If you swipe your card, the gadget reads and copies your card data.

False ATM Fronts

The ATM eats your card, however you may’t do something about it as a result of it’s after enterprise hours. So you allow, planning to name your financial institution once you get house. Little do you know a scammer positioned a false entrance over the ATM designed to seize your card. As soon as you allow the ATM, they detach the false entrance and take your card.

Spying Strangers

ATM etiquette says it is best to give the particular person on the machine house to conduct their transaction in privateness. If somebody is just too shut for consolation, it could be as a result of they’re making an attempt to get a glimpse of your PIN, which they will use with a card skimmer to entry your account.

Methods to Keep away from ATM Scams

Look at an ATM earlier than utilizing it. Search for these indicators of a card skimmer or false entrance:

- A cumbersome or unusually huge card slot

- A free card slot or slot that stands proud at a bizarre angle

- A blocked card slot

- A card slot that’s a distinct shade from the remainder of the machine

- A free PIN pad

- Oddly positioned stickers

- Ripped safety tape

In the event you discover any of those after hours, discover an ATM elsewhere and name your financial institution to report what you noticed. In the event you discover these when the financial institution is open, go inside and communicate to a teller.

Additionally, concentrate on your environment when utilizing an ATM. Stand near the machine and canopy the keypad along with your hand as you enter your PIN. If somebody is standing too near you, don’t hesitate to politely ask them to take a couple of steps again. In the event that they get aggravated with you, then you’ve got a stranger aggravated at you for a couple of minutes. That’s higher than shedding cash to a scammer.

Purple Flags of a Financial institution Rip-off

Financial institution scams are available in many varieties however typically share the identical traits. Look ahead to these frequent purple flags to keep away from one.

It Sounds Too Good to Be True

You’ve heard this one earlier than: If one thing sounds too good to be true, it most likely is.

Don’t let your self be blinded by a seemingly golden alternative. Ask your self commonsense questions like:

- Why would an organization randomly ship you cash you’re not anticipating?

- Why would an employer ship you a big verify and belief you to make use of it for a chosen expense?

- Why would you might want to give your checking account quantity to assert a prize?

In case your intestine says one thing feels off, hearken to it.

There’s Stress to Act Now

There’s a motive shops run limited-time-only gross sales. “Act now” ways could make you do belongings you wouldn’t usually do when you had extra time to consider them.

Don’t let a deadline strain you to do one thing rash. Take the time to rigorously evaluate the state of affairs and assume it over rationally.

They Contact You Out of the Blue

I want we lived in a world the place money-making alternatives and sweepstakes prizes materialized from nothing. However in actuality, free cash is never free. In the event you get a verify you weren’t anticipating, be suspicious of it.

There Are Typos, Dangerous Grammar & Bizarre Formatting

Some scammers are fairly lax about trying skilled. Their communications have typos, grammatical errors, randomly capitalized phrases, and clunky language. Your precise financial institution would by no means ship you an e-mail that reads:

You don’t have to be knowledgeable editor to identify the various ways in which e-mail appears to be like janky. (I’m knowledgeable editor, and it hurts each my eyes and my soul.)

It Performs on Your Feelings

The check-cashing scammer hooks you with a tragic story. Unsolicited verify fraud and employment schemes exploit your eagerness (or desperation) to become profitable. When your feelings are excessive, rational considering can exit the window, and scammers realize it.

Don’t let visceral reactions cloud your judgment. Take a look at the state of affairs logically and ask your self when you see any of the purple flags we’ve lined.

Remaining Phrase

In the event you’ve despatched cash to a scammer, you would possibly be capable of get it again by doing the next.

- In the event you deposited a verify that bounced: Chances are high you’re out of luck for any cash you’ve already withdrawn out of your account. However your financial institution is perhaps prepared to waive any charges they’ve charged you when you contact them.

- In case your data has been stolen: Contact your financial institution and the Federal Commerce Fee (FTC).

- In the event you despatched cash by means of the mail: Contact the United States Postal Inspection Service.

- If there are unauthorized automated withdrawals out of your account: Contact your financial institution to cease them.

- In the event you wired cash: Contact the wire switch service to see if they will reverse the switch.

- In the event you despatched a cash order: Contact the cash order firm and ask them to cease fee.

- In the event you despatched a present card: Contact the present card issuer and ask if they will refund your cash.

In the event you take motion instantly, there’s an opportunity you’ll be capable of get your a reimbursement. However be ready to listen to that it’s too late and chalk it as much as a lesson discovered.

In the event you suspect you’ve come throughout a financial institution rip-off, report it promptly to:

- The FTC

- Your state lawyer normal

- The US Postal Inspection Service (for checks despatched by means of the mail)

- Or e-mail spam@uce.gov (for phishing emails)

You won’t have fallen for the rip-off, however there’s a great likelihood another person will. Reporting it will possibly hold it from reaching new victims.