Within the fast-paced and ever-evolving world of finance, staying forward of the curve is essential for these aiming to affix the ranks of the monetary elite. With the fixed inflow of latest applied sciences and instruments, navigating the ocean of choices could be overwhelming. That’s why now we have compiled a complete listing of the highest 50 finance instruments you should know in 2023.

From cutting-edge funding platforms to superior budgeting apps and analytical software program, this text will equip you with the data and sources to boost your monetary prowess, streamline your operations, and elevate your success within the aggressive realm of finance.

Justification:

Inclusion on our listing of the highest 50 finance instruments in 2023 is a testomony to the distinctive worth and affect these instruments can convey to people striving to be a part of the monetary elite. Every instrument has been rigorously chosen based mostly on its skill to revolutionize monetary methods, streamline processes, and unlock new alternatives for progress and success.

These finance instruments embody a variety of functionalities, catering to numerous points of monetary administration. As an illustration, funding platforms with superior algorithms and machine studying capabilities empower customers to make data-driven funding selections, optimizing portfolio efficiency and maximizing returns. Equally, cutting-edge budgeting apps present real-time monitoring and evaluation of non-public and enterprise funds, enabling customers to make knowledgeable selections, establish saving alternatives, and attain monetary objectives sooner.

Furthermore, the analytical software program featured in our listing equips finance professionals with highly effective instruments to extract invaluable insights from huge datasets, enhancing threat evaluation, forecasting accuracy, and strategic planning. The inclusion of those instruments serves as a testomony to their confirmed observe document, user-friendly interfaces, and skill to empower people in reaching monetary excellence. By incorporating these instruments into their arsenal, aspiring monetary elites can achieve a major aggressive edge and unlock their full potential within the dynamic world of finance.

Mint (private finance administration)

Ranking: 4.5 out of 5

Mint is an distinctive private finance administration instrument that empowers customers to take management of their monetary life with ease and comfort. This all-in-one platform affords an array of options, together with budgeting, invoice monitoring, expense categorization, and credit score rating monitoring, making it an indispensable asset for people in search of a complete answer to their cash administration wants.

With intuitive and user-friendly interfaces, Mint helps customers visualize and perceive their monetary panorama, selling accountable monetary habits and proactive decision-making.

One in all Mint’s coolest options is its seamless integration with varied monetary establishments, enabling computerized synchronization of your financial institution accounts, bank cards, and loans onto a single platform. The actual-time updates on transactions and balances, coupled with the insightful categorization of bills, help you simply observe and analyze your spending habits like a professional! What’s extra, Mint’s goal-setting function injects pleasure and motivation, because it permits customers to create personalised financial savings aims, nudging them in the direction of a safer and fulfilling monetary future. With Mint in your pocket, you may have the ability to steer your funds and obtain your cash objectives with confidence and enthusiasm!

QuickBooks (accounting software program)

Ranking: 4.7 out of 5.

QuickBooks is a flexible accounting software program answer designed to cater to the monetary and organizational wants of small to medium-sized companies. This highly effective instrument streamlines varied points of accounting, similar to invoicing, expense monitoring, payroll administration, and monetary reporting, making it an important useful resource for entrepreneurs and enterprise house owners. Its user-friendly interface spares customers the must be accounting consultants, and sturdy safety measures guarantee delicate monetary information stays protected. QuickBooks boasts seamless integration with third-party apps and affords a cloud-based possibility for these in search of accessibility on-the-go.

One of many coolest options of QuickBooks is its superior invoicing capabilities, fully revolutionizing the best way companies deal with their billing processes. Customers can simply customise professional-looking invoices, arrange recurring funds, and obtain real-time notifications when invoices are considered and paid—in the end simplifying income administration. One other incredible function is the financial institution integration, which effortlessly syncs and categorizes financial institution transactions for fast, correct monetary overviews. Say goodbye to guide information entry and whats up to extra time specializing in rising your enterprise with QuickBooks’ cutting-edge options!

TurboTax (tax preparation software program)

Ranking: 4.5/5

TurboTax is a user-friendly, complete, and dependable tax preparation software program that assists people and companies alike in processing and submitting their tax returns precisely and effectively. Developed by Intuit, TurboTax harnesses expertise to streamline the tax submitting course of, making certain that customers obtain the utmost refund they’re eligible for. The software program affords step-by-step guided help, up-to-date tax legislation modifications, and computerized error detection, making it a preferred alternative amongst those that need a hassle-free tax submitting expertise.

One of many coolest options of TurboTax is its progressive W-2 import performance. With only a snap of a photograph, TurboTax can extract pertinent info out of your W-2 type, eliminating the necessity for guide information entry and minimizing potential errors. One other thrilling function is the Deduction Finder, which makes use of clever algorithms to establish tax-saving deductions and credit tailor-made to every consumer’s distinctive tax scenario. As a bonus, TurboTax affords dwell, on-demand assist with licensed tax professionals to assist reply any urgent questions, making certain a easy and stress-free tax preparation course of. General, TurboTax delivers an intuitive and environment friendly tax submitting expertise by way of its modern interface and cutting-edge options, making it a game-changer on the earth of tax preparation.

PayPal (on-line funds)

Ranking: 5/5

PayPal is a extremely respected and extensively used on-line fee platform that enables people and companies to securely ship and obtain funds throughout the globe. With its user-friendly interface, top-notch safety measures, and intensive service provider assist, PayPal has emerged as a frontrunner within the digital fee panorama catering to the wants of tens of millions of customers worldwide. The platform affords seamless integrations with main e-commerce platforms and helps quite a lot of currencies, making certain accessible and hassle-free transactions for each patrons and sellers. Given its unparalleled service, reliability, and comfort, I’d fee PayPal a stable 5 out of 5.

Now, let’s discuss among the coolest options of PayPal that really set it aside! One exceptional function is the power to create and ship {custom} invoices inside minutes, making it extremely straightforward for freelancers and companies to invoice their shoppers professionally. Moreover, PayPal’s One Contact function allows you to full purchases quickly while not having to re-enter your login info, making certain a swift and easy checkout expertise. Moreover, PayPal.Me, a customized fee hyperlink, allows you to request or settle for funds in a snap by merely sharing your {custom} URL. With such progressive options designed to make your on-line fee expertise as seamless as potential, it’s no marvel PayPal has earned the belief and loyalty of tens of millions throughout the globe.

Stripe (on-line fee processing)

Ranking: 5/5

Stripe is an distinctive on-line fee processing platform that streamlines the best way companies settle for and handle transactions. Designed with highly effective and versatile APIs, Stripe effortlessly integrates with quite a few e-commerce and cell platforms, serving to companies of all sizes to scale effectively. The instrument prioritizes safety by using superior encryption applied sciences, making certain that consumer info and fee information stay protected. Moreover, Stripe’s clear pricing mannequin with aggressive charges appeals to a variety of customers, from startups to established enterprises. General, I’d fee Stripe a stable 5 out of 5 for its reliability, ease of use, and complete options.

Of Stripe’s many cool options, two stand out as exceptionally thrilling! The primary is the benefit with which Stripe could be built-in into nearly any on-line platform. Whether or not you’re utilizing a preferred e-commerce system or custom-built software program, Stripe’s sturdy APIs shortly and seamlessly set up a connection, saving invaluable time and getting companies up and operating very quickly. One other exceptional facet of Stripe lies in its highly effective machine studying algorithms that constantly detect and forestall fraudulent actions from going down. These superior algorithms, coupled with a complete assist system, present companies with an additional layer of safety for his or her fee transactions. Mix these cool options with unmatched effectivity and consumer expertise, and it’s no marvel Stripe is a frontrunner on the earth of on-line fee processing!

Sq. (fee processing)

Ranking: 4.5/5

Sq. (fee processing) is a extremely environment friendly and versatile instrument that allows companies of all sizes to simply accept bank card funds from prospects. It operates easily on each iOS and Android gadgets, making it a preferred alternative for retailers, service suppliers, and different companies requiring seamless transaction processing. The platform affords a user-friendly interface, safe fee processing, and a beneficiant collection of options interesting to totally different enterprise fashions. With its intensive assist for varied varieties of playing cards, together with contactless ones, Sq. is an important instrument for companies trying to modernize their operations and enhance buyer expertise. Ranking: 4.5/5

The good function of the Sq. fee processing instrument must be its skill to generate skilled invoices and receipts very quickly! The Sq. invoicing function permits you to effortlessly create digital invoices, personalized with your enterprise emblem, and ship them to your shoppers through electronic mail or textual content. Your prospects can shortly pay their invoices by way of a safe on-line portal, making the method hassle-free for each events. Moreover, Sq. affords real-time monitoring of bill funds, permitting you to remain organized and keep a wholesome money circulate. The instrument additionally helps contactless funds, accommodating prospects preferring utilizing digital wallets like Apple Pay or Google Pockets. In the end, Sq.’s incredible options simplify enterprise transactions, selling a easy circulate of operations and maintaining each retailers and prospects completely happy.

Venmo (peer-to-peer funds)

Ranking: 4.5 out of 5

Venmo is a extensively in style peer-to-peer fee instrument designed to simplify monetary transactions amongst pals, households, and even small companies. The app affords customers an extremely user-friendly expertise, permitting them to easily ship, request, and obtain cash from their contacts with just some faucets on the display. It stands out for its distinctive social twist, the place customers can publicly or privately share their transactions with a customized message, making it really feel extra linked and gratifying. Owned by PayPal, the instrument is provided with sturdy safety features that present a protected atmosphere for its customers’ monetary info.

One of many coolest options of Venmo is the seamless integration of peer-to-peer fee with an interesting social feed! Customers can add character to their transactions by together with a message, emoji, and even animated stickers, making it really feel extra like a social media feed stuffed with enjoyable interactions. One other incredible function is the Venmo card, which acts as a debit card linked to your Venmo balance-allowing for straightforward spending with out the necessity to switch funds to your checking account. The Venmo card additionally affords personalised cashback offers that cater to your spending habits, placing some a reimbursement in your pocket. Speak about comfort and enjoyable in a single app!

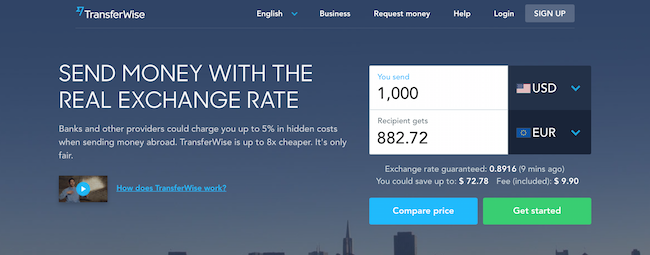

TransferWise (worldwide cash transfers)

Ranking: 4.8/5

TransferWise, now referred to as Clever, is a groundbreaking and progressive monetary expertise (fintech) firm specialised in offering worldwide cash transfers at an impressively low value. This cloud-based answer has quickly gained recognition amongst people and companies globally, in search of an environment friendly different to conventional banking establishments. Clever’s platform is user-friendly, clear, and constantly delivers on its promise to execute swift, safe transactions, which makes it an interesting alternative for customers throughout the board. Primarily based on its efficiency and total consumer expertise, I’d fee Clever 4.8 out of 5.

As for its coolest options, let’s dive proper in! Firstly, Clever stands out for its distinctive transparency, permitting you to see the actual mid-market change charges and the minimal charges it expenses proper upfront, maintaining any disagreeable surprises at bay. Secondly, the Borderless account function is a game-changer, enabling you to carry and handle a number of currencies all below one account. That’s good for freelancers, distant staff, or frequent vacationers who want a seamless method to obtain and ship cash in varied currencies. Lastly, Clever boasts an extremely quick transaction time in comparison with conventional banking methods, that means you now not need to anxiously anticipate days on finish to make sure your cash reaches its vacation spot. It’s no marvel Clever has shortly develop into a fan-favorite for these in search of environment friendly and inexpensive worldwide cash transfers!

Coinbase (cryptocurrency change)

Ranking: 4.5/5

Coinbase is a number one cryptocurrency change that provides its customers an intuitive and user-friendly platform to purchase, promote, and handle varied cryptocurrencies. With a agency dedication to safety, compliance, and stability, Coinbase has established itself as one of the vital dependable and trusted cryptocurrency exchanges worldwide, offering entry to in style digital belongings similar to Bitcoin, Ethereum, Litecoin, and lots of others. Its superior options, aggressive charges, and seamless integration with varied fee strategies make it a perfect alternative for each newbies and skilled merchants to have interaction with the quickly evolving world of digital currencies.

One of many coolest options of Coinbase is its user-friendly and easy-to-navigate interface, which ensures a easy and gratifying expertise for all customers, no matter their prior data or experience in cryptocurrencies. Moreover, because of the sturdy safety measures it employs, similar to two-factor authentication and offline storage of digital belongings, Coinbase ensures that your funds are protected and well-protected always. Additionally, with their Coinbase Professional platform, skilled merchants can take pleasure in superior charting instruments, margin buying and selling, and quite a lot of order varieties to optimize their buying and selling methods. To prime it off, Coinbase additionally affords a complete instructional program known as Coinbase Earn, permitting customers to study extra about varied cryptocurrencies and even earn rewards for finishing quizzes and duties. There’s little doubt that Coinbase actually stands out as a go-to cryptocurrency change!

Robinhood (funding and buying and selling app)

Ranking: 4.5/5

Robinhood is an progressive funding and buying and selling app designed primarily for the trendy retail investor in search of a user-friendly platform to purchase and promote shares, choices, cryptocurrencies, and exchange-traded funds (ETFs). The app’s commission-free buying and selling platform, intuitive design, and mobile-first strategy have attracted a big consumer base, significantly amongst youthful buyers who worth simplicity and quick access to monetary markets. Regardless of some damaging information and outages lately, Robinhood stays a preferred alternative for these trying to start their investing journey or develop their portfolio in an economical method.

As for the best options, Robinhood’s fractional shares buying and selling is a recreation changer! This permits customers to put money into top-tier firms with costly shares, similar to Amazon or Tesla, even when they don’t have the total quantity wanted to buy an entire share. This democratizes investing and opens the door for small buyers to construct a various portfolio with out breaking the financial institution. One other superior function is the app’s consumer interface, which is visually interesting and straightforward to navigate. The actual-time information on inventory costs, customizable watchlists, and academic content material accessible proper inside the app make it completely thrilling for anybody to have the ability of monetary markets at their fingertips. Get able to embrace the age of accessible investing!

Acorns (micro-investing)

Ranking: 4.5/5

Acorns is a novel and progressive micro-investing platform designed to assist customers make investments their spare change right into a diversified portfolio. By rounding up on a regular basis transactions and mechanically investing the distinction, Acorns has opened up the world of investing to customers who might not have thought of it earlier than or felt they lacked the required funds to start. The simple-to-use app offers a easy consumer interface and affords a variety of options, similar to recurring investments, retirement financial savings accounts, and incomes rewards that may be invested in your account. Entry to monetary literacy content material additionally enhances the platform’s enchantment, making it a superb all-in-one investing instrument for newbies and seasoned buyers alike.

One of many coolest options of Acorns is its “Spherical-Ups” that fully revolutionizes the best way we take a look at saving and investing. By seamlessly connecting to your debit or bank card, the app rounds up each transaction to the closest greenback and invests the spare change in a diversified portfolio. The method is nearly invisible, and earlier than you recognize it, your small round-ups will accumulate into a major sum of cash. Moreover, the “Discovered Cash” program permits you to earn rewards from partnered manufacturers, that are mechanically invested into your account, offering a bonus to your progress potential. And should you’re trying to study extra about private finance, Acorns’ Develop Journal affords invaluable insights and recommendation that will help you make knowledgeable monetary selections in an interesting and easy-to-understand language. Isn’t it incredible to have a instrument that simplifies funding and turns it right into a enjoyable, every day expertise!

Betterment (robo-advisor)

Ranking: 4.5/5

Betterment is a top-tier robo-advisor designed to streamline and optimize the investing course of for customers of all experience ranges. By leveraging superior algorithms, Betterment creates tailor-made funding portfolios that meet every consumer’s monetary objectives and threat tolerance. As a low-cost different to conventional monetary advisors, Betterment affords extremely aggressive pricing and has a user-friendly platform with a seamless expertise that enables shoppers to create accounts, set monetary objectives, select the specified degree of threat, and deposit funds. I’d fee this instrument a 4.5 out of 5 for its exceptional options, ease of use, and affordability.

Now, let me share with you a few of Betterment’s coolest options! Firstly, their tax-loss harvesting and tax-coordinated portfolio methods are completely game-changing, doubtlessly saving shoppers vital cash on taxes. Secondly, they provide personalised recommendation for exterior accounts which works above and past simply managing the belongings on their platform. And maybe probably the most thrilling function is their fractional shares buying and selling, permitting shoppers to optimize their portfolios as a result of each greenback invested is absolutely utilized. Betterment’s array of superior options and their dedication to constantly innovating and enhancing the funding expertise make it an extremely engaging robo-advisor alternative for optimizing your monetary future!

Wealthfront (robo-advisor)

Ranking: 4.5/5

Wealthfront is an progressive and dependable robo-advisor platform that delivers personalised, complete monetary planning providers to a broad vary of shoppers. As the primary robo-advisor to supply direct indexing, Wealthfront has an easy, user-friendly interface that makes funding administration easy for each novice and skilled buyers. The platform’s sturdy algorithm-driven recommendation takes tax effectivity, threat tolerance, and monetary objectives into consideration, making certain that shoppers obtain their aims with a tailor-made strategy. Wealthfront’s low advisory charges and account minimums additional improve its enchantment, making it accessible to many customers. General, I’d fee Wealthfront a stable 4.5 out of 5.

Wealthfront is full of wonderful options that set it other than its competitors! One of many coolest and most original options is its Tax-Loss Harvesting, which lets you maximize returns by strategically promoting investments to offset taxable positive factors. This basically optimizes your portfolio for tax effectivity, liberating up more money so that you can make investments. One other exceptional function is the Time-Weighted Return calculator, which retains you knowledgeable about your investments’ efficiency by offering a breakdown of your returns in a transparent, visually interesting method. The Path instrument can be a fan-favorite, providing customizable wealth planning recommendation that will help you meet your objectives, whether or not it’s about shopping for a home or saving for retirement. The incredible options simply hold coming with Wealthfront, making it an thrilling robo-advisor to check out!

E*TRADE (on-line brokerage)

Ranking: 4.5 out of 5.

E*TRADE is a cutting-edge on-line brokerage platform that provides a complete suite of instruments and sources for buyers and merchants of all expertise ranges. This intuitive platform offers superior charting, analysis capabilities, buying and selling instruments, and a user-friendly interface that streamlines the investing course of. E*TRADE has achieved broad recognition for its easy-to-navigate design, environment friendly commerce execution, and complete instructional sources that cater to each novice and skilled customers, making it a strong all-in-one answer for contemporary buyers. E*TRADE’s dedication to innovation and buyer satisfaction has solidified its place as one of many prime on-line brokerage platforms within the {industry}.

Now let’s discuss E*TRADE’s coolest options! With E*TRADE, you get entry to its extraordinary Energy E*TRADE buying and selling platform, which affords superior charting, threat evaluation, and greater than 100 technical research, permitting you to make data-driven selections with ease. Their progressive Snapshot Evaluation instrument allows you to conduct a fast but in-depth analysis of potential investments, supplying you with a transparent perception into firm efficiency and market tendencies. The cherry on prime? E*TRADE’s top-notch cell app, which lets you monitor and handle your portfolio from nearly wherever. Harnessing the ability of cutting-edge expertise and a user-friendly strategy, E*TRADE locations your entire inventory market at your fingertips, offering an unparalleled benefit for buyers and merchants alike.

Vanguard (funding administration)

Ranking: 4.5 out of 5.

Vanguard, a famend funding administration software program/instrument, brings a complete strategy to managing monetary portfolios seamlessly. Providing a wide selection of providers, together with retirement planning, wealth administration, and investor training, this platform is designed to cater to particular person buyers, monetary professionals, and establishments alike. Its user-friendly interface and robust emphasis on cost-efficiency makes it a dependable alternative for varied funding wants. Vanguard is well-respected within the {industry} for its collection of aggressive index funds and ETFs, personalised recommendation, and dedication to transparency.

Now, let’s dive into the best options of Vanguard! For starters, Vanguard boasts a superb lineup of low-cost ETFs and mutual funds, that are good for each seasoned buyers and newbies in search of a diversified, cost-effective funding technique. One other incredible function is their retirement planning instruments, which make it extremely straightforward and stress-free for customers to make essential selections about their retirement financial savings. To not point out, Vanguard Private Advisor Companies, the place the platform pairs you with a devoted monetary advisor who crafts a tailor-made funding plan based mostly in your distinctive objectives and preferences. With Vanguard’s highly effective instruments and providers, navigating the world of funding has by no means been extra thrilling and empowering!

Constancy (funding administration)

Ranking: 4.5 out of 5

Constancy is an distinctive funding administration software program and gear designed to supply a complete suite of providers to cater to an enormous array of buyers. It covers all the things from inventory buying and selling, mutual funds, ETFs, and retirement accounts like IRAs to superior investing instruments and sources. Constancy’s well-organized interface, top-notch analysis capabilities, and round the clock buyer assist contribute to an optimum consumer expertise that appeals to each newbies and seasoned buyers alike.

Let’s dive into a few of Constancy’s coolest options that make investing an absolute breeze! One standout is its cutting-edge analysis instruments that offer you entry to professional insights and evaluation, serving to you make knowledgeable selections backed by stable information. Moreover, the Lively Dealer Professional platform unlocks a formidable suite of superior investing instruments that allow you to observe the markets, execute trades, and handle your portfolio with ease – how superior is that? And, we merely can not overlook about Constancy’s commission-free buying and selling on U.S. shares, choices, and ETFs, which makes it one of the vital cost-effective platforms within the recreation. With all of those wonderful options, Constancy empowers you to unlock your full investing potential!

Charles Schwab (funding administration)

Ranking: 4.5/5

Charles Schwab is a outstanding funding administration instrument that provides a complete suite of providers catering to particular person buyers, companies, and establishments. This platform has gained vital repute on account of its aggressive pricing, distinctive customer support, and intensive vary of funding choices, together with shares, bonds, mutual funds, and ETFs. Among the many instrument’s most noteworthy options are user-friendly interfaces, sturdy analysis instruments, and seamless integration with cell and desktop gadgets, all of which contribute to its widespread enchantment on the earth of monetary administration.

On the subject of Charles Schwab’s coolest options, one should positively rave about its progressive and cutting-edge expertise, making the funding expertise environment friendly and gratifying. The StreetSmart Edge, their superior buying and selling platform, affords customizable charts, highly effective analysis instruments, and a formidable diploma of personalization, permitting customers to effectively monitor the market, handle their investments, and develop efficient buying and selling methods. Moreover, Schwab’s buying and selling app for cell gadgets takes comfort to an entire new degree, permitting on-the-go investing and account administration. To finish the package deal, the corporate has additionally integrated an intensive community of branches and 24/7 telephone assist, making certain each consumer’s wants are catered to and that professional assistance is at all times accessible.

Ally Financial institution (on-line banking)

Ranking: 5/5

Ally Financial institution is an progressive and safe on-line banking platform that provides a variety of monetary providers and merchandise to its customers. As an solely digital financial institution, Ally Financial institution offers prospects with handy entry to their accounts, aggressive rates of interest, and an intuitive consumer interface, making it straightforward for customers to handle their cash successfully. Their banking providers embody financial savings and checking accounts, CDs, funding choices, loans, and extra. With distinctive customer support, intensive digital instruments, and no month-to-month upkeep charges or minimal steadiness necessities, Ally Financial institution stands as an distinctive alternative for people preferring a streamlined digital banking expertise. I’d fee Ally Financial institution a stable 5 out of 5 for its complete set of options and user-friendly system.

One of many coolest options that Ally Financial institution affords is its industry-leading financial savings charges, permitting prospects to develop their cash sooner than with different conventional banks. Ally Financial institution can be recognized for its versatile cell app with spectacular functionalities like depositing checks by way of the app by taking photos, straightforward account administration, and sturdy monetary monitoring and budgeting instruments. Furthermore, Ally Financial institution’s consumer expertise is enhanced by their 24/7 buyer assist, making certain that every one prospects obtain immediate help each time wanted. Lastly, Ally Financial institution has uniquely built-in the favored Zelle® cash switch service, enabling customers to ship and obtain cash shortly and securely inside their platform. All these progressive options reinforce the prevalence of the Ally Financial institution expertise, making it a top-choice for anybody in search of a dependable and feature-rich on-line banking platform.

Capital One (banking and bank cards)

Ranking: 5/5

Capital One is a well-established monetary establishment that gives an distinctive suite of providers, together with banking and bank cards, which seamlessly cater to the assorted monetary wants of its customers. With their dedication to buyer satisfaction, Capital One ensures that its software program and instruments successfully streamline their providers, making it straightforward for customers to handle their accounts, pay payments, and plan their monetary budgets. The platform boasts an intuitive interface, sturdy safety features, and round the clock buyer assist, making certain a easy and safe expertise for its patrons. Primarily based on its ease of use, excellent providers, and reliability, I’d fee Capital One 5 out of 5.

Now, let’s dive into among the coolest options Capital One has to supply! One of the vital incredible points of the software program is its AI-driven assistant, Eno, which actively displays your accounts to maintain you knowledgeable about potential fraud, duplicate expenses, and assists with on-time invoice funds. Additionally, the CreditWise function is a game-changer for these trying to monitor and enhance their credit score scores with entry to insightful suggestions and updates. Moreover, the power to lock your bank card with a single faucet on the app offers an unmatched degree of safety and management within the palm of your hand. Capital One’s sturdy suite of monetary instruments mixed with these killer options makes it a best choice for customers, maintaining their funds in test and hassle-free!

Chase (banking and bank cards)

Ranking: 4.7 out of 5

Chase financial institution affords an environment friendly, user-friendly software program/instrument for its banking and bank card providers. As an all-in-one monetary administration platform, it permits customers to simply entry their accounts, pay payments, switch funds, and handle their bank cards with just some clicks. The software program additionally affords a cell app, which is appropriate with each iOS and Android gadgets, offering the utmost comfort to prospects whereas they’re on the go. Safety is a prime precedence for Chase, because the software program is provided with a number of layers of safety to make sure the protection of customers’ information and monetary sources. General, I’d fee the Chase banking and bank card software program/instrument a stable 4.7 out of 5.

I can not assist however really feel obsessed with among the coolest options of this instrument! One of the vital notable options is the Chase Final Rewards program, which lets credit score cardholders earn factors on each buy made. The factors could be redeemed for present playing cards, journey, and even money again, making it an thrilling bonus for many who use their bank cards often. One other wonderful function is the real-time fraud monitoring and immediate transaction alerts, making certain that customers have full management over their monetary actions and might take quick motion in case of any suspicious exercise. Moreover, the budgeting and spending abstract instruments show to be extraordinarily useful in maintaining customers on observe with their monetary objectives, serving to to make smarter selections with their cash. It’s no marvel that the Chase banking and bank card software program/instrument has develop into a preferred alternative amongst savvy customers!

American Specific (bank cards)

Ranking: 4.5/5

American Specific, popularly referred to as Amex, is a worldwide monetary providers supplier well-known for its top-notch bank card choices. The corporate’s bank cards are geared in the direction of quite a lot of customers, from frequent vacationers to small enterprise house owners, catering to their distinctive wants with an intensive vary of options and advantages. With a strong rewards program, Membership Rewards, American Specific cardholders can earn and redeem factors for journey, merchandise, present playing cards, and extra. The unparalleled customer support, fraud safety, and extra perks grant customers a seamless and safe expertise, maintaining them loyal to the model.

The good options about American Specific bank cards are undeniably the unimaginable rewards program and the distinctive extra advantages! As an Amex cardholder, you’ll be able to rack up factors shortly with Membership Rewards, because of their accelerated incomes charges on varied classes like journey and eating. Redeeming your rewards is equally thrilling with choices like reserving flights, procuring on-line, and even transferring factors to airline and resort companions. However that’s not all – American Specific goes above and past with their additional perks similar to entry to unique occasions, complimentary airport lounge entry, journey insurance coverage, and spectacular reductions at choose retailers. All of those incredible options actually elevate the cardholder expertise, leaving you feeling like a VIP whereas spending and saving concurrently!

NerdWallet (private finance recommendation)

Ranking: 4.5/5

NerdWallet is an distinctive private finance recommendation software program/instrument designed to assist customers make knowledgeable selections relating to their cash. Offering professional recommendation on quite a lot of monetary matters similar to bank cards, loans, mortgages, investing, and financial savings accounts, NerdWallet arms customers with the data and understanding they should handle their private funds with confidence. By using data-driven suggestions, NerdWallet permits customers to check monetary merchandise and decide the perfect choices based mostly on their distinctive circumstances, making it a dependable supply of knowledge for anybody in search of monetary steerage. Primarily based on its huge array of options and complete steerage, I’d fee NerdWallet a stable 4.5 out of 5.

Now, let me inform you about among the coolest options which have left customers raving about NerdWallet! Their suite of calculators alone is nothing in need of wonderful – mortgage, scholar mortgage reimbursement, retirement planning, and even bank card payoff calculators, to call just some. NerdWallet’s side-by-side monetary product comparability function is a incredible useful resource that enables customers to carefully study varied choices and make educated selections based mostly on their distinctive wants. To prime it off, they provide personalised suggestions tailor-made to every consumer’s monetary objectives, making certain that you’ve a specialised roadmap to monetary success. NerdWallet actually goes the additional mile in offering instruments and sources to make private finance administration a breeze!

Credit score Karma (credit score scores and studies)

Ranking: 4.5/5

Credit score Karma is a complete and user-friendly monetary instrument that provides free credit score scores, credit score studies, and seamless monitoring providers. The platform’s easy-to-navigate interface assists customers in understanding their credit score scores, providing personalised insights and suggestions to assist them make smarter monetary selections. With an array of options similar to credit score monitoring alerts, seamless integration with varied monetary accounts, and tax submitting providers, Credit score Karma stands out as an extremely versatile and invaluable private finance instrument.

The good options of Credit score Karma will undoubtedly depart you impressed! For starters, say goodbye to paying for credit score studies as Credit score Karma affords them free of charge, pulling information from two main credit score bureaus, TransUnion and Equifax! Not solely that, however Credit score Karma additionally offers an intuitive Credit score Rating Simulator, permitting you to see how varied monetary strikes might have an effect on your rating, making monetary planning a breeze. Additionally, the app’s progressive Id Monitoring function takes safety up a notch with alerts for potential information breaches and identification theft. Let’s not overlook in regards to the Credit score Karma Tax service! It’s a straightforward, free, and correct method to file your federal and state taxes. In a nutshell, Credit score Karma’s feature-rich platform makes it an indispensable companion in managing and enhancing your monetary well-being!

Zillow (actual property info)

Ranking: 4.5/5

Zillow is a complete actual property platform that provides a variety of providers and instruments to facilitate the method of shopping for, promoting, and renting properties. With an intensive database of over 110 million U.S. houses, Zillow offers customers with up-to-date info on dwelling values, native market tendencies, and an array of associated information. This user-friendly platform caters to householders, patrons, sellers, and brokers by providing distinctive options similar to Zestimate, a house valuation algorithm that estimates a property’s present market worth. General, Zillow deserves a stable 4.5 out of 5 score for its excellent options and ease of use.

Now, let’s dive into Zillow’s coolest options! To start with, Zillow’s 3D Dwelling Excursions current an progressive method to nearly discover properties from the consolation of your house. This immersive expertise permits potential patrons to have a complete view of the property and perceive its structure earlier than deciding to go to in particular person. Subsequent up is the Zillow Presents function, the place Zillow immediately purchases houses from sellers, eliminating the hurdles of conventional dwelling promoting processes. No extra worrying itemizing and negotiation! Furthermore, Zillow’s Mortgage Calculator makes estimating your month-to-month mortgage fee a breeze; simply plug in some fundamental info, and the instrument does the remainder! These thrilling options set Zillow other than different actual property platforms and make the entire means of discovering and shopping for your dream dwelling a really pleasant expertise.

SoFi (private loans and refinancing)

Ranking: 4.5/5

SoFi, quick for Social Finance, is a flexible monetary platform providing private loans and refinancing choices for people in search of to consolidate debt, finance massive purchases, or obtain their monetary objectives. With a streamlined on-line utility course of and aggressive rates of interest, SoFi has positioned itself as an {industry} chief in private finance. Due to its wonderful customer support and a deal with transparency, customers can anticipate a hassle-free expertise when exploring the assorted choices accessible on the platform.

The good options of SoFi are undoubtedly the aggressive charges, versatile phrases, and extra advantages they provide to their customers! With mounted and variable rates of interest starting from 2.99% to six.28% for private loans and refinancing choices, making certain inexpensive choices for varied monetary wants. Furthermore, SoFi affords mortgage phrases between 5 to twenty years, giving debtors the liberty to discover a reimbursement plan that matches their price range. However that’s not all! SoFi additionally offers member-exclusive advantages similar to unemployment safety, profession teaching, monetary planning, and networking occasions, actually showcasing SoFi’s dedication to serving to customers succeed each financially and professionally!

LendingClub (peer-to-peer lending)

Ranking: 4.5/5

LendingClub is an progressive peer-to-peer lending platform that connects debtors with buyers, providing a streamlined mortgage utility course of and aggressive rates of interest. This on-line market empowers people and companies by offering financing options tailor-made to their particular wants whereas providing buyers the chance to diversify their portfolios and earn stable returns. LendingClub’s clear charge construction and dedication to buyer satisfaction have contributed to its standing as a frontrunner within the quickly evolving fintech {industry}.

LendingClub is full of among the coolest options that make it a user-friendly and environment friendly platform! One of many prime options is their proprietary credit score grading system, which ensures investor confidence and helps debtors get decrease rates of interest based mostly on their credit score scores. Moreover, LendingClub’s Auto Make investments instrument permits buyers to mechanically diversify their funds by investing in a {custom} mixture of loans, saving effort and time on manually deciding on particular person loans. Final however not least, the platform’s intuitive consumer interface permits a seamless borrowing and investing expertise, with simple monitoring and administration capabilities accessible at your fingertips. With these state-of-the-art options, LendingClub is revolutionizing the peer-to-peer lending panorama and is the go-to answer for each debtors and buyers!

Quicken (private finance software program)

Ranking: 4.5/5

Quicken is a flexible private finance software program designed to assist customers successfully handle their monetary life with ease. It affords highly effective instruments to remain on prime of bills, investments, and invoice funds multi function built-in platform. Appropriate with each Home windows and Mac working methods, Quicken is a well-designed software program that’s trusted by tens of millions for its skill to simplify advanced monetary duties, making it an indispensable instrument for people and small companies alike.

Now let me inform you about among the coolest options of Quicken that make it stand out from different private finance software program! Firstly, you’ve received the extremely helpful budgeting and spending monitoring, which lets you set spending objectives and monitor your progress effortlessly. Its complete funding monitoring function allows you to hold a detailed eye in your portfolios and make knowledgeable selections from its built-in market comparisons. And let’s not overlook the power to synchronize your monetary information with over 14,000 monetary establishments, making certain seamless integration along with your financial institution accounts, bank cards, and different monetary merchandise. Cheers to Quicken for revolutionizing the best way we handle our cash!

YNAB (You Want a Funds – budgeting software program)

Ranking: 4.5/5

YNAB, or You Want a Funds, is an progressive budgeting software program designed to assist people and households achieve management over their funds and obtain monetary stability. This intuitive and user-friendly instrument adapts to your distinctive monetary scenario, connecting immediately along with your financial institution accounts to import transactions and observe your spending habits. By using its “4 Guidelines” methodology, YNAB encourages customers to take proactive steps in the direction of monetary safety, similar to allocating earnings in the direction of particular bills and constructing an emergency fund. It’s accessible on a number of platforms, making it simply accessible for customers on the go or at dwelling.

Now, let’s discuss among the coolest options of YNAB that set it other than different budgeting software program! Firstly, the “Age of Cash” metric is an progressive manner of figuring out how lengthy your hard-earned {dollars} have been in your possession earlier than being spent. This encourages customers to save cash and break the paycheck-to-paycheck cycle. Moreover, YNAB’s seamless synchronization throughout a number of gadgets ensures that you would be able to hold observe of your price range anytime, wherever – whether or not in your telephone, pill or laptop. The software program additionally offers extremely visible and easy-to-understand studies and graphs, giving customers a transparent perception into their monetary progress. With YNAB’s lively and supportive group, full with instructional sources and workshops, you may have all the things you should take management of your monetary future!

Morningstar (funding analysis)

Ranking: 4.5/5

Morningstar is a strong and complete funding analysis instrument, designed to streamline the method of analyzing shares, funds, industries, and worldwide economies. Extremely regarded amongst monetary professionals and informal buyers alike, Morningstar affords a wealth of knowledge, together with totally researched information, professional evaluation, and insightful instruments that present customers with the data they should make well-informed, assured selections in in the present day’s fast-paced market. Boasting a user-friendly interface and an intensive database, Morningstar constantly delivers up-to-date, correct content material that caters to a large spectrum of customers’ funding wants.

Now, let’s discuss among the coolest options Morningstar has to supply! For a begin, their Portfolio X-Ray instrument is totally wonderful, permitting you to dive deep into your investments and scrutinize your total efficiency, publicity, threat, and potential diversification. Moreover, the Morningstar Scores for shares, mutual funds, ETFs, and closed-end funds make it straightforward so that you can reduce by way of the noise and shortly establish top-performing securities. Maybe probably the most thrilling half is the wealth of expert-written articles and up-to-date information, maintaining you well-informed on market happenings, funding tendencies, and alternatives! Morningstar actually goes above and past, incorporating quite a lot of progressive components to create an indispensable useful resource for anybody concerned on the earth of investing.

Bloomberg Terminal (monetary information and analytics)

Ranking: 5/5

The Bloomberg Terminal is a cutting-edge monetary information and analytics software program that gives customers with an intensive array of knowledge on various monetary markets and devices. Designed particularly for finance professionals, this highly effective instrument combines real-time information streaming, in-depth market intelligence, and execution capabilities right into a complete answer tailor-made to the wants of merchants, portfolio managers, and analysis analysts. Leveraging Bloomberg’s huge community and experience, the Terminal ensures fast and seamless entry to an enormous pool of monetary information, analysis, and analytical instruments that allow customers to make knowledgeable selections on this fast-paced and ever-changing {industry}. General, I fee the Bloomberg Terminal a stable 5 out of 5 for its spectacular vary of options, wonderful consumer interface, and unparalleled market entry.

In an enthusiastic tone: Get able to be blown away by the best options of the Bloomberg Terminal! The Terminal’s data-rich atmosphere empowers customers with lightning-fast and correct real-time information on shares, bonds, commodities, and currencies – all displayed in modern, customizable charts and graphs. Keep forward of the sport with Bloomberg’s top-notch information and analytics, and achieve invaluable insights from {industry} titans, in addition to unique Bloomberg studies, that will help you make smarter funding methods. Furthermore, the Terminal’s sturdy integration capabilities permit seamless reference to different instruments for maximized productiveness. Whether or not you’re a seasoned monetary professional or a newcomer, the Bloomberg Terminal is the last word one-stop-shop for all of your monetary analytics wants – making certain you keep on prime of the markets always!

Zoho Books (accounting software program)

Ranking: 4.5/5

Zoho Books is an all-inclusive, cloud-based accounting software program designed to cater to the monetary wants of small and medium-sized companies. With a user-friendly interface and a variety of options, this software program streamlines and automates every day monetary operations, together with invoicing, expense monitoring, and financial institution reconciliation. It even handles tax compliance and offers insightful monetary studies, providing a complete answer for managing your funds. The seamless integration with different Zoho functions, third-party apps, in addition to its cell availability, highlights the software program’s adaptability to cater to various enterprise calls for. General, Zoho Books deserves a stable score of 4.5 out of 5.

Now let’s discuss among the coolest options that make Zoho Books an impressive accounting instrument! The software program’s refined automation capabilities are genuinely awe-inspiring, because it dramatically reduces guide work – this implies, bye-bye to information entry nightmares! The time monitoring and challenge billing options are absolute game-changers, permitting you to trace your workers’ billable hours with ease and invoice shoppers accordingly. The multi-currency performance is a godsend for companies with a worldwide clientele, making foreign money conversions a breeze! Lastly, the {custom} reporting function might be one in all our favorites, because it allows you to create personalised studies, empowering you to research the monetary information that issues probably the most to your enterprise. So, why wait? Stage up your organization’s monetary administration with Zoho Books in the present day!

Wave (small enterprise accounting)

Ranking: 4.5/5

Wave is an progressive small enterprise accounting software program that provides a broad vary of options designed to streamline and simplify monetary administration for entrepreneurs and house owners. This cloud-based answer offers a number of easy-to-use functionalities together with bill creation, expense monitoring, receipt scanning, and payroll processing, making it a perfect alternative for companies trying to effectively keep correct monetary information. Its user-friendly interface and considerate integrations assist small enterprise house owners save time and keep organized, permitting them to deal with rising their enterprise.

Ranking: 4.5 out of 5

Wave’s coolest options actually set it other than the competitors, making monetary administration a breeze for enterprise house owners! Its slick bill customization permits you to create fashionable, skilled invoices that may be simply tailor-made to fit your model’s identification. The built-in receipt scanning instrument is an absolute recreation changer – merely snap an image of your receipts and watch as Wave mechanically extracts and organizes the related info. Moreover, Wave’s seamless financial institution connections allow real-time transaction updates, eliminating the necessity for guide information entry and making certain correct monetary information. Wave’s fusion of fashion, innovation, and value actually delivers a top-notch small enterprise accounting expertise for its customers!

Xero (cloud accounting software program)

Ranking: 4.5/5

Xero is an progressive cloud-based accounting software program designed to simplify the administration and monitoring of enterprise financials for small to medium-sized enterprises. This sturdy instrument makes it straightforward for customers to watch their money circulate, generate studies, problem invoices, and handle payroll seamlessly. Xero is user-friendly, providing an aesthetically pleasing interface and dashboard, coupled with a variety of helpful integrations, making it a one-stop answer for enterprise house owners who have to effectively keep their monetary information. General, I’d fee Xero a stable 4.5 out of 5 for its performance, ease of use, and complete financial-management options.

Now let’s discuss among the coolest options of Xero that really set it aside! One of many standout options that customers adore is the financial institution reconciliation course of. Xero’s sensible auto-reconciliation system makes it a breeze to synchronize your checking account transactions with the software program, decreasing guide information entry and potential human errors. Not solely that, however Xero’s real-time dashboard vastly improves decision-making, as customers have immediate entry to their monetary place at any given time. Must handle bills on the go? No worries! Xero’s cell app allows you to handle invoicing, reconciliation, and different monetary duties proper out of your cell gadget. Moreover, Xero’s multi-currency assist is a game-changer for companies working in world markets, permitting for seamless transactions in varied foreign currency echange. With all these options and extra, Xero is undoubtedly an important instrument for any fashionable enterprise.

FreshBooks (small enterprise invoicing)

Ranking: 4.5/5

FreshBooks is an intuitive and complete invoicing and accounting software program designed particularly for small companies and freelancers. The platform simplifies the invoicing course of by offering customizable templates, computerized reminders, and seamless integration with varied fee gateways to facilitate easy transactions. Moreover, it optimizes monetary administration with its time-tracking, expense monitoring, and reporting instruments that allow customers to achieve higher perception into their enterprise efficiency. The user-friendly interface coupled with an enormous array of options has made FreshBooks an important instrument for managing funds effectively, permitting small enterprise house owners extra time to deal with core enterprise duties.

One of many coolest options of FreshBooks is its skill to streamline your workflow by automating important duties, similar to recurring invoices, expense categorization, and fee reminders! With FreshBooks, you’ll be able to even snap images of your receipts and have the delicate expense monitoring module categorize them with unparalleled accuracy. And, let’s not overlook how FreshBooks simplifies collaboration by way of its challenge administration instruments, permitting you to ask staff members, shoppers or contractors to your initiatives to maintain everybody on the identical web page. If you happen to’re at all times on the go, the cell app is a lifesaver, offering you with the pliability to trace your time, bills and ship invoices immediately out of your smartphone. Above all, FreshBooks is the embodiment of a contemporary, environment friendly instrument poised to revolutionize the best way small companies strategy their monetary administration!

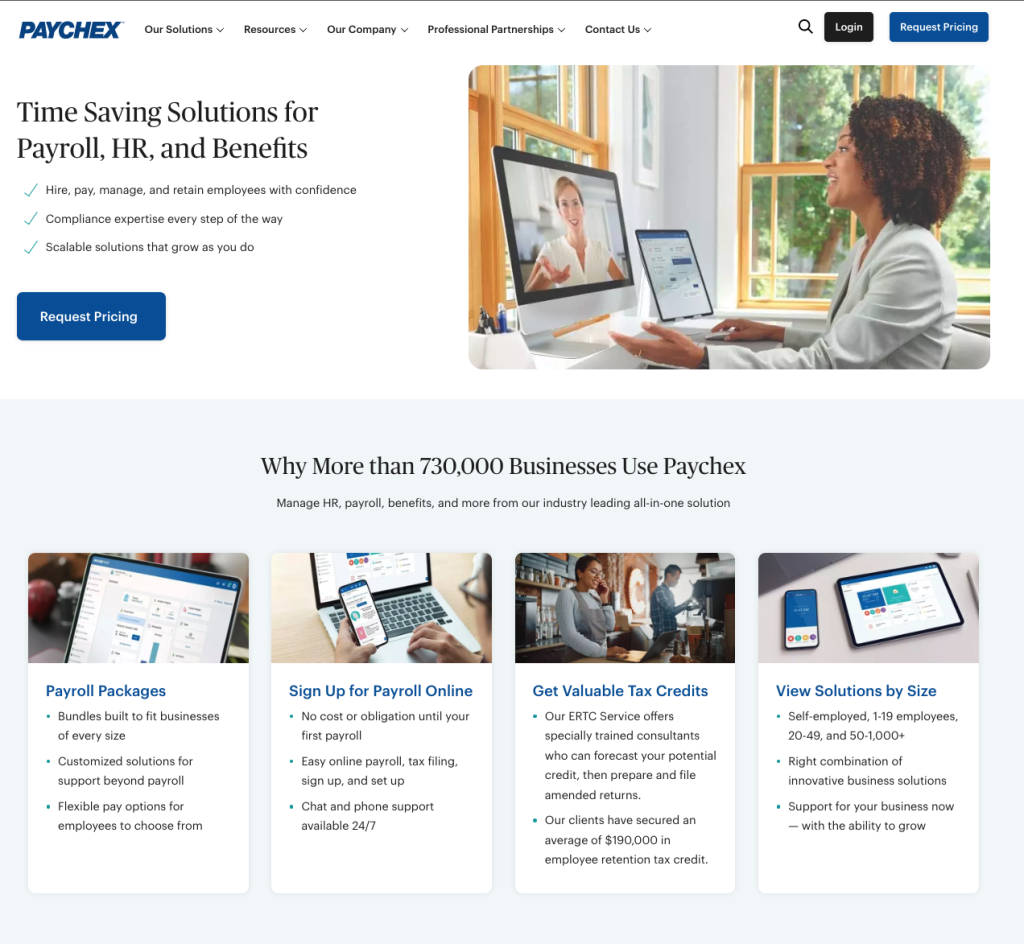

Paychex (payroll and HR providers)

Ranking: 4.5/5

Paychex is a complete payroll and HR providers instrument designed to cater to the wants of companies of varied sizes. Its sturdy platform streamlines payroll processing, tax submitting, and worker advantages administration, whereas additionally providing HR assist and options to boost workforce productiveness. Paychex’s user-friendly interface permits seamless administration of payroll information, together with instruments for monitoring worker hours, integrating with accounting options, and offering real-time analytics for simpler decision-making. Moreover, its distinctive buyer assist ensures that companies obtain well timed help and steerage throughout essential processes. With its feature-rich choices, Paychex earns a well-deserved 4.5 out of 5 score.

One of many coolest options of Paychex must be the cloud-based Paychex Flex platform! Its intuitive dashboard brings collectively all of the important HR options with just some clicks, granting entry to a collection of superior instruments for payroll, tax compliance, workforce administration, worker advantages administration, and worker onboarding. Paychex Flex additionally affords seamless integration with quite a few third-party functions to create a centralized and environment friendly workflow. The cherry on prime is the Paychex Flex cell app, which permits each employers and workers to handle their payroll-related duties on-the-go. Coupled with top-notch buyer assist, Paychex actually revolutionizes the best way companies deal with their HR and payroll capabilities!

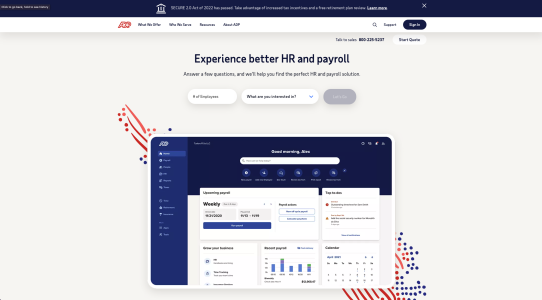

ADP (payroll and HR providers)

Ranking: 5/5

ADP is a complete and sturdy payroll and HR providers software program/instrument that has develop into an integral part for a lot of companies worldwide. This well-designed platform streamlines and automates varied payroll and HR-related duties, similar to worker timesheet monitoring, managing worker advantages, attendance, and tax doc processing. The intuitiveness and effectivity of the consumer interface make it straightforward to navigate and permits companies to deal with their core operations. This software program simply adapts to the distinctive wants of varied industries, offering tailor-made options that assist organizations keep compliant and save time. On a scale of 1 to five, ADP earns a stable 5 for its ease of use, complete options, and wonderful buyer assist.

Now, let’s discuss among the coolest options of ADP! The analytical and reporting capabilities of this instrument are actually next-level, offering you with insights on worker tendencies and actionable information, enabling you to make well-informed HR and payroll selections. One other spectacular function is its seamless integration with different enterprise methods, similar to ERP and accounting software program, which makes the general information administration hassle-free. ADP’s cell app can be a game-changer, because it permits workers and managers to entry essential info and carry out duties on-the-go, fostering flexibility and comfort. The instrument’s fixed updates to remain compliant with tax legal guidelines and laws guarantee companies stay up-to-date with none additional effort. Truthfully, ADP is a game-changing instrument, and its function set is excellent, reworking the best way organizations handle their payroll and HR processes.

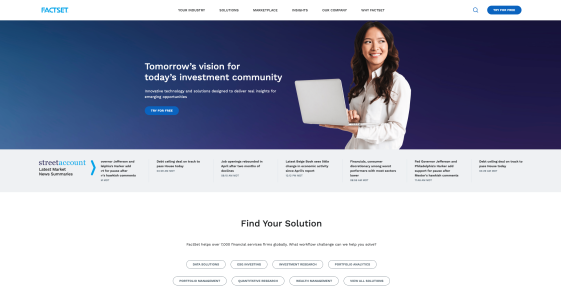

FactSet (monetary information and analytics)

Ranking: 4.5/5

FactSet is a extremely refined monetary information and analytics software program that allows finance professionals to entry, analyze, and share essential information for knowledgeable decision-making. This highly effective instrument offers a complete platform with a wealth of options, together with information feeds and APIs, analysis administration, portfolio evaluation, threat administration, and customizable reporting instruments. With its exceptional capability to combine 1000’s of knowledge sources right into a single, streamlined interface, FactSet has develop into a best choice for asset managers, threat analysts, and monetary analysis consultants in search of actionable intelligence in in the present day’s ever-evolving market panorama.

On the subject of the best options of FactSet, there’s quite a bit to be enthusiastic about! For starters, FactSet’s intensive integration capabilities permit customers to seamlessly mix varied information sources, together with proprietary information and third-party suppliers. This empowers customers with a extra complete view of the monetary panorama and makes it a lot simpler to establish tendencies, dangers, and alternatives. Moreover, the platform’s highly effective analytics engine permits finance professionals to carry out refined quantitative evaluation and modeling utilizing state-of-the-art statistical and machine studying strategies. The interactive and visually participating dashboard additionally permits customers to create personalized visuals and graphics to assist talk essential monetary insights extra successfully. FactSet’s collaborative instruments make it straightforward to share information, evaluation, and studies along with your staff, making certain everybody stays knowledgeable and aligned. With all these wonderful options, it’s no marvel FactSet is an indispensable instrument for finance professionals!

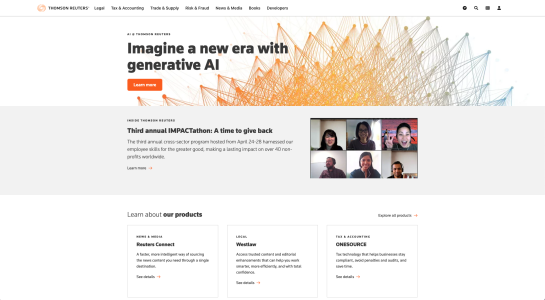

Thomson Reuters Eikon (monetary information and information)

Ranking: 4.5/5

Thomson Reuters Eikon is an progressive and complete monetary information and information platform designed to cater to the wants of pros within the finance {industry}. This highly effective instrument integrates market information, analytics, buying and selling, and messaging capabilities, permitting customers to make well timed and knowledgeable selections based mostly on correct insights. Eikon stands out for its skill to supply a complicated and user-friendly expertise whereas making certain seamless entry to related info. Its compatibility with varied asset courses, together with equities, mounted earnings, international change, and commodities, establishes Eikon as a one-stop answer for monetary information and information dissemination.

Now, let’s delve into the best options that make Thomson Reuters Eikon stand out from the gang! Customers are positive to be thrilled by the cutting-edge visualization instruments which offer placing readability and spectacular presentation of the information. With their highly effective coding capabilities, the Eikon Information API presents countless customization alternatives for superior analysts. The icing on the cake is Eikon’s clever search performance, making it easy to fetch probably the most related info among the many huge databases it has entry to. Moreover, Eikon Messenger is extremely useful, enabling customers to attach with different professionals within the monetary {industry}, fostering collaboration and data sharing. It’s no marvel why Thomson Reuters Eikon is a most well-liked instrument amongst monetary fans and seasoned professionals alike!

Bloomberg Skilled (monetary information and information)

Ranking: 4.5/5

Bloomberg Skilled is a number one monetary information and information software program, designed to supply finance professionals with intensive market info, information analytics, and communication capabilities. This all-inclusive instrument affords wealthy insights into varied asset courses, in-depth analytical devices, and real-time monetary information, enabling knowledgeable decision-making for buyers, merchants, and different market gamers. Bloomberg Skilled streamlines the understanding of monetary markets and tendencies by way of its user-friendly interface and highly effective search capabilities, catering to the wants of its huge consumer base.

Now, let’s discuss among the coolest options of Bloomberg Skilled that undoubtedly make it vital instrument for monetary fans! Firstly, the Launchpad performance permits customers to create absolutely customizable and interactive workspaces, making certain they’ve quick entry to all of the related and very important information they want. And, after all, who might overlook the Bloomberg Terminal Chat function? This thrilling addition makes it potential for professionals to attach, share concepts, and forge important relationships with friends, paving the best way for distinctive real-time collaboration. To not point out, Bloomberg’s highly effective predictive analytics and back-testing lounge assist you dig deeper into funding concepts and make extra exact monetary forecasts – a really indispensable instrument in in the present day’s fast-paced market!

Quodd (real-time monetary market information)

Ranking: 4.5/5

Quodd is an distinctive real-time monetary market information instrument that gives customers with complete, correct, and dependable info on a wide selection of world markets. As an professional reviewer, I discover Quodd to be each user-friendly and extremely versatile, catering to funding professionals, brokers, merchants, and monetary researchers alike. Combining its low-latency infrastructure with state-of-the-art technological developments, Quodd delivers optimum efficiency, making certain its customers keep forward of ever-changing market situations.

Now, let’s discuss Quodd’s coolest options! Standing out from the competitors, Quodd’s UltraCache expertise locations the ability of knowledge manipulation proper at your fingertips. Say goodbye to lagging information as Quodd’s unparalleled low-latency infrastructure retains you in sync with the heartbeat of the market, supplying you with the sting you should make knowledgeable selections. Moreover, Quodd affords customization choices that allow you to craft a knowledge feed appropriate to your distinctive {industry} necessities. However wait, there’s extra! Quodd’s sturdy information providing covers all the things from Stage I & II quotes, full order guide depth, historic information, and far more! Expertise monetary market information like by no means earlier than with Quodd.

Intrinio (monetary information feeds)

Ranking: 4.8/5

Intrinio is an progressive and sturdy monetary information platform designed to cater to the wants of everybody from particular person buyers to massive enterprises, offering a wide selection of knowledge feeds that embody an enormous vary of monetary information. The platform excels in providing high-quality, complete information spanning throughout a number of domains, together with monetary statements, financial information, inventory market information, and extra. What units Intrinio aside is its dedication to accessibility and affordability, making it an ideal alternative for companies of all sizes and people with diverse monetary experience. Primarily based on its versatility, ease of use, and the sheer quantity of knowledge it offers, I’d fee Intrinio 4.8 out of 5.

Intrinio’s coolest options are undeniably its spectacular number of information feeds and seamless integration capabilities! The platform affords greater than 200 information varieties for 1000’s of firms worldwide, empowering customers to entry cutting-edge info on shares, choices, commodities, Foreign exchange, ETFs, and lots of extra. With instruments just like the Excel add-in or an assortment of APIs, customers can conveniently extract the exact information they require and combine it with their present instruments, analytical functions, or software program options. Furthermore, Intrinio’s user-friendly Net App makes it easy to research information on-line and share invaluable insights seamlessly along with your staff or shoppers. Get able to supercharge your monetary evaluation with Intrinio!

Refinitiv (monetary information and infrastructure)

Ranking: 4.5/5

Refinitiv is a cutting-edge monetary information and infrastructure software program that gives customers with an intensive vary of instruments and sources for higher decision-making and enhanced workflow productiveness. This complete platform affords insightful analytics, present and historic monetary information, professional analysis, and highly effective collaboration instruments to streamline the consumer expertise. As an professional reviewer, I’m impressed by the seamless integration of varied options inside the software program and the user-friendly interface, which makes accessing dependable monetary information a simple process. Primarily based on its intensive capabilities, I’d fee Refinitiv a stable 4.5 out of 5.

Now, let’s dive into among the coolest options of Refinitiv which can be positive to blow your thoughts! The software program facilitates detailed evaluation with its Eikon Information API, permitting customers to entry an intensive vary of knowledge with unparalleled pace and accuracy. Furthermore, the platform’s intuitive visualization instruments make information interpretation a breeze, permitting you to beat even probably the most advanced monetary markets. To prime all of it off, Refinitiv’s progressive collaboration instruments and flawless integration with Microsoft merchandise allow customers to share their findings with their staff effortlessly, fostering a seamless and efficient communication channel. With Refinitiv, the sky is the restrict on the subject of discovering unparalleled monetary insights!

Morningstar Direct (institutional funding analysis)

Ranking: 4.8/5

Morningstar Direct is an distinctive institutional funding analysis software program and analytics instrument designed to cater to the wants of asset managers, wealth managers, and asset house owners. It offers a flexible platform that provides an intensive vary of superior analytics, sturdy analysis functionality, and visible presentation options which can be essential for making knowledgeable funding selections. This all-encompassing instrument grants customers entry to complete information on funding autos like shares, bonds, ETFs, and mutual funds, permitting them to research portfolios, display investments, and assess efficiency. Making an allowance for the capabilities and important options that Morningstar Direct affords, I’d fee this instrument at a stable 4.8 out of 5.

Now, let me share among the coolest options that make Morningstar Direct stand out within the funding analysis atmosphere! The software program boasts a modern and customizable consumer interface that enables customers to view funding information and carry out detailed evaluation with ease. One of the vital progressive points of this instrument is the incorporation of Synthetic Intelligence (AI) within the type of the Morningstar Quantitative Ranking, which predicts the longer term efficiency of funds by simulating the selections of professional analysts. Moreover, Morningstar Direct empowers customers to assemble highly effective benchmarks, carry out peer group evaluation, and create visually beautiful advertising and marketing displays to showcase their methods. Certainly, this superior software program not solely simplifies your entire funding analysis course of, but in addition permits customers to achieve invaluable insights and fine-tune their funding methods based mostly on sturdy analysis functionality.

S&P Capital IQ (monetary analysis and evaluation)

Ranking: 4.5/5

S&P Capital IQ is a complete monetary analysis and evaluation instrument that provides an intensive vary of knowledge and intelligence for professionals throughout varied industries together with finance, funding, and company technique. This highly effective platform offers customers with a formidable array of monetary information factors similar to firm financials, market and financial information, valuations, and mergers and acquisitions info. By leveraging predictive analytics, sturdy information visualization instruments, and seamless Excel integration, S&P Capital IQ streamlines the decision-making course of and helps companies make knowledgeable selections backed by stable proof. Ranking: 4.5/5

Now, maintain onto your hats as a result of S&P Capital IQ has some severely wonderful options that can blow your thoughts! This unimaginable platform permits customers to entry a worldwide database of tens of millions of private and non-private firms, in addition to detailed monetary information on varied mounted earnings devices, {industry} metrics, and extra. Are you a fan of customizable charts? Properly, get able to dive right into a plethora of superior charting performance that can make visualizing advanced info a breeze! And let’s not overlook the Excel Plug-in that transforms your spreadsheet right into a supercharged monetary evaluation instrument, permitting you to simply import, evaluate, and analyze huge quantities of knowledge on firms, sectors, and monetary markets. Get able to elevate your monetary evaluation recreation with S&P Capital IQ!

Moody’s Analytics (monetary analysis and threat administration)

Ranking: 4.5/5

Moody’s Analytics is a cutting-edge monetary analysis and threat administration software program designed to supply complete options for each buyers and monetary {industry} professionals. With a robust dedication to innovation and constant information accuracy, this suite of highly effective instruments permits customers to make knowledgeable and well timed selections by leveraging sturdy predictive analytics, credit score threat modeling, and actionable insights into world monetary markets. A product of years of experience in credit score evaluation, Moody’s Analytics helps navigate in the present day’s advanced monetary panorama with pace and effectivity.

Now, let’s dive into the best options of Moody’s Analytics! One of the vital incredible points of this software program is its intensive library of customizable credit score threat fashions, empowering you to construct distinctive analyses tailor-made to your necessities. One other standout function is the award-winning Financial State of affairs Technology system, which lets you simulate and predict potential market outcomes by adjusting varied financial variables. And should you’re a visible learner, you’ll love the interactive world heatmap, providing an at-a-glance synthesis of credit score threat throughout a number of nations and industries. Moody’s Analytics is undoubtedly vital instrument for anybody trying to deal with monetary challenges with confidence and experience!

Riskalyze (threat evaluation software program)

Ranking: 4.5/5

Riskalyze (now rebranded as Nitrogen) is an progressive threat evaluation software program that serves as an indispensable instrument for monetary advisors, offering them with a complete strategy to threat administration. With an intuitive user-interface and sturdy options, the software program successfully empowers advisors to effectively consider their shoppers’ threat tolerance ranges and align their portfolio accordingly. Taking a scientific, quantitative strategy to research threat, Riskalyze generates a novel “Danger Quantity” for every investor, streamlining the method of constructing well-informed funding selections.

If there’s one factor to get enthusiastic about with Riskalyze, it’s the unimaginable coolest options this software program brings to the desk! Firstly, the groundbreaking Danger Quantity system which not solely simplifies threat gradient measurement but in addition permits buyers to mitigate losses with a customized strategy. The Retirement Plans function seamlessly integrates the retirement situation planning course of into the chance evaluation framework, crafting a holistic view of potential retirement outcomes. Moreover, the Compliance Cloud is a game-changer, making certain advisors and their shoppers stay absolutely compliant with ever-evolving regulatory environments. Riskalyze actually stands out as a premier threat evaluation instrument, revolutionizing the best way monetary advisors cater to particular person investor wants.

BlackRock Aladdin (funding and threat administration)

Ranking: 4.5/5

BlackRock Aladdin is a exceptional funding and threat administration software program/instrument that has established itself as an authoritative participant within the finance {industry}. With its state-of-the-art expertise and complicated options, Aladdin directs customers in the direction of making knowledgeable selections and mitigating dangers of their funding portfolios. From asset allocation to complete analytics, the instrument assists in addressing complexity and offering environment friendly insights into funding methods for each institutional and wealth administration shoppers. Contemplating its holistic strategy in the direction of threat administration and funding planning, I’d fee BlackRock Aladdin a stable 4.5 out of 5.