40 12 months funding professional Steve Reitmeister has a extra balanced view of whether or not the long run is bullish or bearish. This does not imply to sit down in your palms ready for an consequence as there are certainly methods to actively make investments at the moment to prime the S&P 500 (SPY). Get Steve’s most up-to-date market outlook, buying and selling plan and prime picks within the commentary beneath.

The S&P 500 (SPY) is close to useless even week over week. And but there may be an fascinating theme enjoying out as we glance again the previous month.

On one hand it’s fairly bullish. And then again really bearish.

Which means that altogether it’s fairly complicated. So we’ll do our greatest to make sense of all of it within the recent market commentary that follows…

Market Commentary

OK…what’s so bullish about motion the previous month?

Straightforward to say it is as a result of the S&P 500 is up +3.3% in that span. Plus, we’re flirting with the latest highs present in early February just below 4,200.

Cool…so what’s bearish about that?

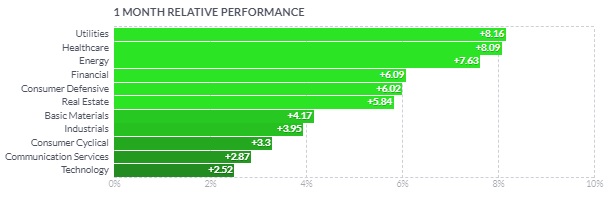

The Danger Off nature of the teams which can be main the way in which. The following 2 efficiency charts for the previous month factors out the problem in spades:

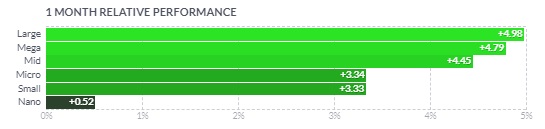

Bullish occasions are typically marked by buyers taking up a bit extra threat to get pleasure from extra upside. So that’s when smaller shares outperform. Plus buyers will bid up the extra development oriented industries like Shopper Cyclical and Know-how.

CLEARLY NOT THE CASE NOW

As you possibly can see the bigger the shares the upper the returns. And Danger Off sectors like Utilities, Healthcare and Shopper Defensive are main the cost.

Once more…sort of bullish once you see inexperienced arrows throughout the board. However kinda bearish with buyers in Flight to Security mode.

Meredith Margrave of our POWR Shares Below $10 service had another fascinating concepts on this entrance:

“That brings me again to my earlier level that “the inventory market” is doing nicely, and never “shares.” You see, “shares” aren’t actually doing that nice.

Various analysts are involved that this rally is far more susceptible than it seems to be. A part of that’s as a result of market breadth has been weak. As of final Friday, lower than half (45%) of Russell 3000 shares had been buying and selling above their 200-day shifting averages. That matches up with information that this rally has largely been carried by a handful of mega-cap shares like Microsoft and Apple.

We’re additionally seeing low volatility – VIX is at its lowest because the starting of the 12 months – which may imply buyers are presumably too complacent and shares could possibly be heading for a selloff.”

Till there’s something blatantly bearish taking place shares will seemingly proceed to drift increased as much as resistance on the February excessive of 4,200. Serving to issues within the brief run is that earnings season is best than low expectations…however not tremendous spectacular both.

What clearly confirmed up early within the outcomes was that the large banks benefited from the banking disaster as deposits rushed out of smaller regional and group banks to the “too huge to fail” establishments.

All in all, earnings season is rather like all the things else…not bearish, however probably not bullish both. This retains limbo in place till a brand new catalyst comes alongside to have folks recalibrate the percentages of recession making them both extra bearish or extra bullish.

Trying on the financial calendar there will not be many catalysts that matter till ISM Manufacturing on 5/1 and the subsequent could be the ISM Providers and Fed fee hike resolution on 5/3 after which winding up the week with Authorities Employment on 5/5.

The catalysts to turn out to be bearish will probably be apparent. That being clear reduce proof of a recession unfolding with shares tumbling to the October low of three,491 and certain decrease.

The humorous factor is that the catalysts to the upside could also be fairly delicate. Merely the ABSENCE of dangerous information = excellent news = shares transfer increased.

That is what Goldman Sachs was sort of saying of their write up that this inventory market appears “bullet proof“. And the principle purpose why is the robustness of the employment market which refuses to buckle. With that being the case then revenue is in place which begets spending and financial development. This is the reason we hold avoiding recession.

This has me shifting down odds for a future recession and extension of the bear market as soon as once more. I might say its about 50/50 at the moment. As such I’ve been growing my publicity to the inventory market with emphasis on the very best shares due to the benefit in our POWR Rankings mannequin.

I do know some would favor that I had higher certainty…like there’s something incorrect with me.

No mates. I’ve an Economics background and might say with full confidence it’s an inexact science. That’s the reason the common recession varieties when lower than 50% of economists predicting that consequence.

I say 50/50 NOT as a result of I’m flakey or afraid to make a name. It’s as a result of at one time I used to be 80% certain of recession and with it not taking place many times…I’ve to understand that odds are decrease. BUT these recessionary odds nonetheless very a lot exist.

Thus, I’ll proceed to sleep with 1 eye open for its potential return. Till that actually comes on the scene, then I’ll proceed to extend my allocation to engaging shares.

What To Do Subsequent?

Uncover my balanced portfolio method for unsure occasions. The identical method that has crushed the S&P 500 by a large margin to this point in April.

This technique was constructed primarily based upon over 40 years of investing expertise to understand the distinctive nature of the present market atmosphere.

Proper now, it’s neither bullish or bearish. Moderately it’s confused…risky…unsure.

But, even on this unattractive setting we are able to nonetheless chart a course to outperformance. Simply click on the hyperlink beneath to begin getting on the suitable aspect of the motion:

Steve Reitmeister’s Buying and selling Plan & High Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Whole Return

SPY shares fell $0.17 (-0.04%) in after-hours buying and selling Friday. 12 months-to-date, SPY has gained 8.20%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Steve Reitmeister

Steve is best identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Whole Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The publish 50% Bullish vs. 50% Bearish appeared first on StockNews.com