Budgeting is a great technique for anybody who’s focused on paying payments effectively, saving cash, and paying down debt.

Irrespective of the place you might be in life, budgeting is a good follow. Nonetheless, there are lots of of strategies to finances and hundreds of platforms to make use of. Some folks want to finances electronically.

Excel and Google Spreadsheets are viable choices to trace, however there are on-line platforms as nicely. Mint is extraordinarily in style for private budgeting. Wave and Quicken are nice for enterprise budgeting. Nevertheless it’s vital handy write a finances on a chunk of paper.

Handwriting your finances permits for just a few issues. First, you create a kinesthetic connection to your finances, which boosts your sense of connectedness and accountability.

Second, you may change it as essential. Let’s say that your revenue adjustments by a penny or two. You possibly can account for that on a bodily piece of paper utilizing finances templates with out a lot problem.

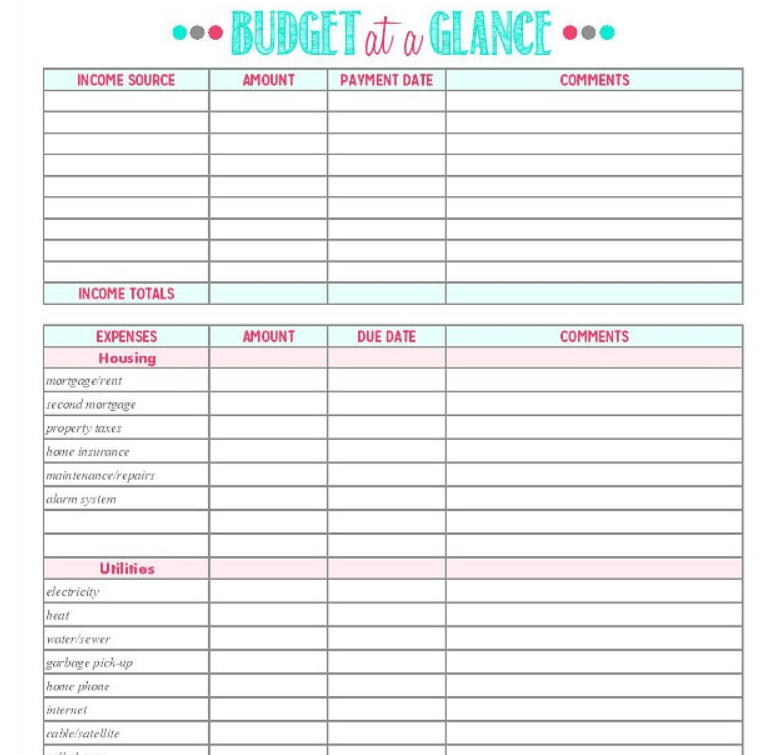

The Finest Free Fairly Printable Funds Planners, Templates and Worksheets

Let’s have a look at a few of the greatest free printable finances worksheets on the market.

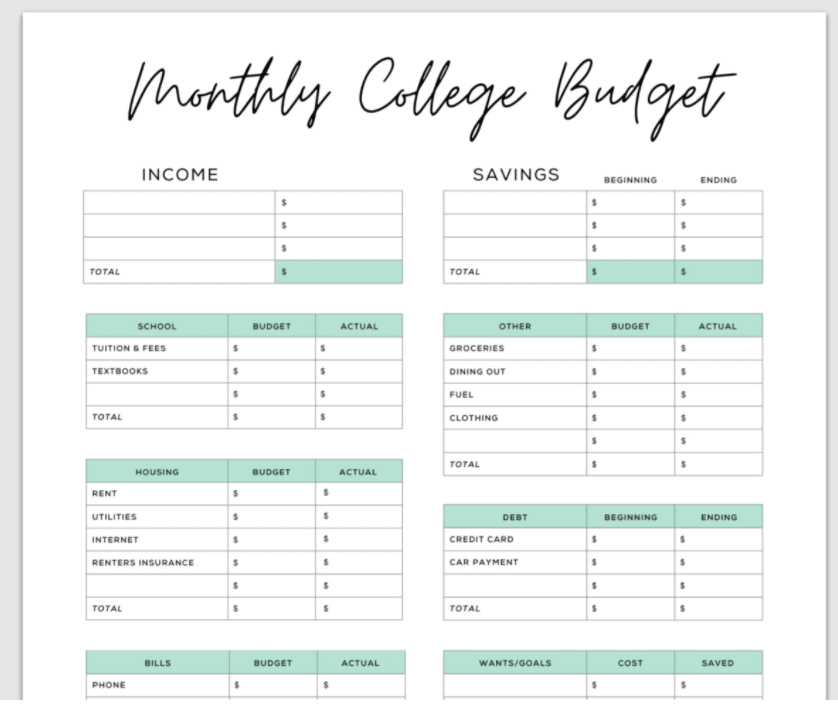

Printable finances worksheet for school college students

Budgeting as a university pupil is tough. I’ve two school college students and one who already graduated. There are such a lot of components that fluctuate, nevertheless it’s additionally the primary actual try at adulting.

Faculty Life Made Simple has an important printable for school college students. My school college students love the preformatted pattern’s school parts (textbooks, tuition), adulting reminders (renter’s insurance coverage, automotive fee), and lifelike parts (eating out, needs).

Additionally they produce other printables which can be particular to school college students.

RELATED POST: 7 Methods to Save Cash as a Faculty Pupil

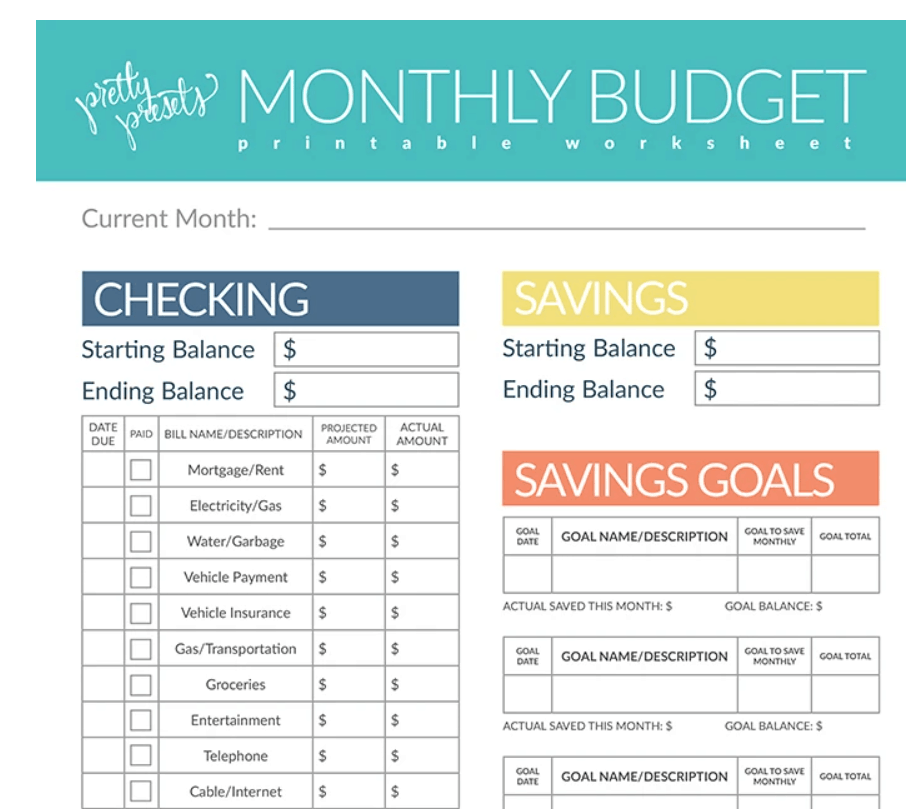

Free finances template for professionals

Professionals have busy lives and little time to spare. They want a no-nonsense finances plan with the entire data in a single place.

Fairly Presets and Actions has an easy (and nonetheless cute) finances printable that features checking and financial savings in addition to financial savings objectives. It’s easy, is sensible, and has all the things you want proper on the web page.

Their web site takes you to a barely intimidating web page while you decide to obtain. Don’t freak out. It’s nonetheless free.

They’ve extra printables out there as nicely.

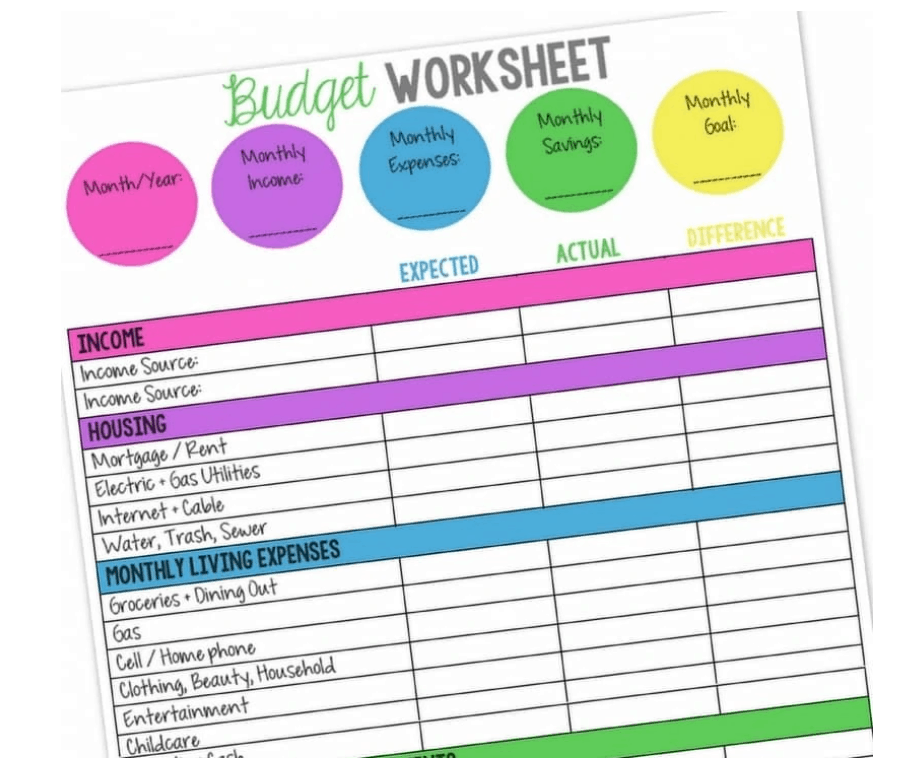

Printable finances worksheet for fogeys

Dad and mom have completely different bills that should be considered. Issues like childcare and diapers should be factored right into a month-to-month finances, nevertheless it’s additionally an important thought to begin directing financial savings towards a university fund or a financial savings account.

A Mother’s Take has an ideal printable for the budget-conscious father or mother. It consists of pre-filled areas that folks want to contemplate.

It’s an important planning software for many who are beginning out budgeting as nicely as a result of it options the three classes early-budgeters want: anticipated, precise, and distinction.

Placing a finances collectively is tough, so this printable offers you an opportunity to make errors.

Their web site consists of different finances printables which can be nice to make use of.

Free finances printable template for retirees/mounted revenue

For those who’re in retirement or on a hard and fast (set) revenue, you have got the identical quantity coming in every month. That quantity must be budgeted, so your variable bills shall be decrease.

Clear and Scentsible has some actually nice choices for these on a hard and fast revenue. Among the choices out there have variable revenue and bills, however this clear, clear instance exhibits regular revenue sources with out the necessity for selection, which isn’t wanted when somebody has their finances discovered extra concretely.

There are plenty of different choices in finances printables apart from this one as nicely.

Finest printable finances planners for novices

Bobbi Printables is no-nonsense. You print their information and go. It’s easy and straightforward to make use of.

Microsoft Workplace has printable budgets in Excel. These are nice as a result of most of them calculate for you, however they don’t have the handwritten factor that’s vital.

How do I select?

Budgeting is one thing that takes time. Preferences change as usually as circumstances change. Print out a number of and check out completely different variations.

Irrespective of which format of budgeting you resolve on, a very powerful acknowledgement is that you simply’re making strides in the direction of budgeting.

What’s a finances?

A finances is a complete plan of the place your cash goes. It begins with a comparability of revenue and bills. Bills are both mounted (the identical month to month) or variable (fluctuate from month to month).

The variable bills are those it’s a must to finances for, which implies you might be estimating the quantity that shall be spent on these bills.

For instance, you may finances to your electrical invoice. You put aside $60 per thirty days to your electrical invoice. Generally, it is perhaps $52.67, and generally, it is perhaps $59.23. Nevertheless it mustn’t exceed $60.

You possibly can regulate your finances, relying on the month and the anticipated utilization. For instance, in the summertime, our family has a better electrical invoice (air-con) and a decrease gasoline invoice (warmth), however these costs reverse within the winter months once we use extra warmth than air. Both approach, we nonetheless should pay the invoice.

Some gadgets that you simply finances for are straightforward to go over. For instance, you may finances $50 every week for groceries. Generally, you may go over that $50. Normally, it’s for a need as an alternative of a necessity. So it’s vital to make use of self self-discipline on the subject of budgeting.

The aim of a finances is to have a better revenue than bills, so you employ these additional funds to pay down debt or save.

Why finances?

Budgeting is a good follow that may result in elevated financial savings. Planning for each penny of revenue and monitoring the place each cent goes awaken our sense of accountability.

If we deliberate out each penny, we is probably not left with extra cash every month, so we really feel liable for monitoring these funds. Moreover, it helps us discover habits and traits that could be costing us some huge cash.

Martha Warner is a author, editor, and educator. As a single mother for a few years, Martha is aware of the worth of cash, work exhausting, and hustle. Her freelance profession began as a facet hustle (to assist her love of journey) and shortly grew into probably the most profitable profession she’s ever had. Martha nonetheless teaches on the college in addition to different on-line and in-person programs, together with Writing to Make Cash, Faculty Scholarship Writing, and Write that Grant. Discover out extra about her on her web site.