Many buyers are pointing to the degrees north of 4,200 for the S&P 500 (SPY) because the promised land. That is as a result of it will signify a 20% enhance from the October 2022 lows that “technically” represents a brand new bull market. Sadly 40 12 months funding professional Steve Reitmeister factors out why its not as simple because it sounds. Get his market outlook, buying and selling plan and prime picks within the commentary under.

The soften up for inventory costs continues as buyers discover fewer causes to promote as of late due to financial institution disaster headlines fading within the rear-view mirror.

+ inflation is clearly coming down.

+ early earnings season outcomes are higher than anticipated

So, does this imply we’re able to coronate the brand new bull market?

Not so quick!

The remainder of the story is shared under on this week’s…

Market Commentary

It seems that the soften as much as earlier highs close to 4,200 is firmly in place barring some stunning headline like one other banking collapse. You may simply see that there’s just about no resistance to going increased of late and the way on the finish of most classes we virtually at all times tack on some further good points.

The final time the S&P 500 (SPY) market fell greater than 1% was again on March 22nd. Since then, 12 of the final 18 classes have been in constructive territory with a powerful whole achieve of +5.5%.

This all feels fairly bullish. However earlier than loading up the truck on shares, please understand there’s critical resistance overhead at 4,200. That’s the place we bought stopped out in early February. But in addition above that many would think about the beginning of a brand new bull market (20% above the October lows of three,491).

Reity, are you saying that if we breakout above 4,200 then the bear market is useless…lengthy reside the bull market?

I want it have been that simple.

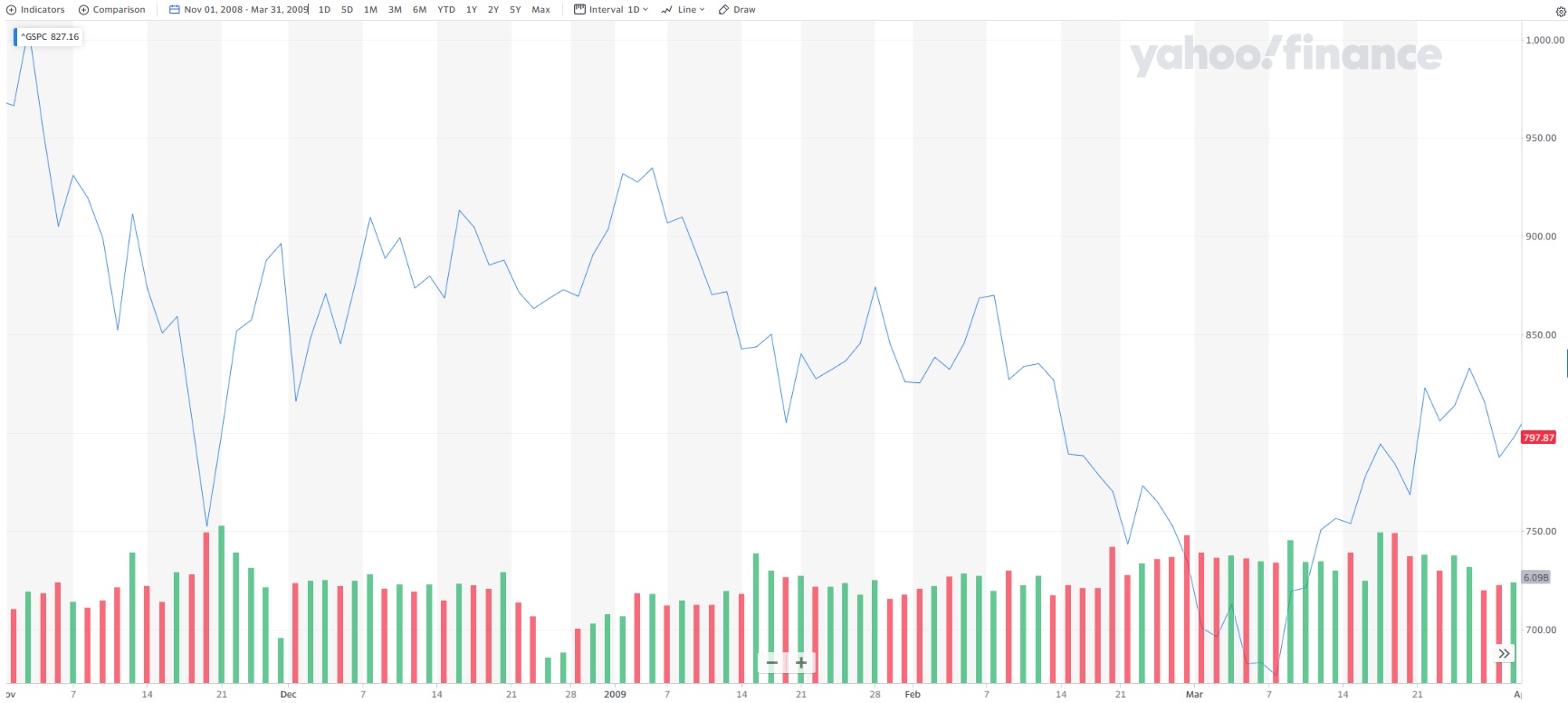

For instance, under is a chart going again to the Nice Recession. In late November 2008 via early January 2009 the market rallied over 20% to be known as a brand new bull market. But that was a false constructive because it rapidly gave solution to a brand new spherical of promoting discovering a lot decrease lows by March.

So, if a breakout above 4,200 will not be an “all clear” sign…then how does somebody make investments proper now?

So long as the Fed stays hawkish it leaves the door open to a future recession. That’s as a result of conserving charges increased for longer is akin to stepping on the brakes of the financial system.

Shares won’t ever race forward into clear bull market till the Fed lets off these brakes and the worry of recession fades. This limits upside for now.

What is going to create renewed draw back is that the fears of recession change into actuality. That principally will likely be seen from a mix of unfavorable GDP and job loss. Thus, it pays to maintain an in depth eye on the GDP Now mannequin from the Atlanta Fed to watch one of the crucial confirmed fashions for predicting financial progress or decline.

Then on the employment entrance, many individuals will wish to see the ache within the Authorities Employment Scenario report which comes out the primary Friday of every month. Nevertheless, main indicators of what exhibits up there may be discovered by monitoring weekly Jobless Claims each Thursday. The nearer that will get to 300,000 per week…the extra doubtless that job loss is happening and the unemployment charge will transfer increased.

Clearly, a contemporary spherical of unfavorable headlines on the banking sector would have us rapidly in unload mode. That’s as a result of shockwaves there’ll additional restrict entry to credit score which is one other type of stepping on the brakes of the financial system rising the chances of recession. Let’s not overlook that the earlier FOMC Minutes confirmed that many members are more and more anxious that the financial institution occasions to this point are already sufficient to result in recession by years finish.

Whenever you add it altogether it’s honest to say we’re in a state of limbo. May very well be bullish. May very well be bearish. However most undoubtedly is unsure.

What To Do Subsequent?

Uncover my balanced portfolio strategy for unsure occasions. The identical strategy that has overwhelmed the S&P 500 by 29.7% up to now in April.

This technique was constructed primarily based upon over 40 years of investing expertise to understand the distinctive nature of the present market setting.

Proper now, it’s neither bullish or bearish. Slightly it’s confused…risky…unsure.

But, even on this unattractive setting we will nonetheless chart a course to outperformance. Simply click on the hyperlink under to begin getting on the fitting facet of the motion:

Steve Reitmeister’s Buying and selling Plan & High Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Complete Return

SPY shares fell $0.02 (0.00%) in after-hours buying and selling Tuesday. Yr-to-date, SPY has gained 8.72%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Steve Reitmeister

Steve is best identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Study extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The submit 4,200 = New Bull Market? appeared first on StockNews.com