Low-cost places and an costly inventory arrange for a put play in Microsoft (MSFT).

Each the S&P 500 and NASDAQ 100 closed proper at latest highs on Friday. The equally weighted S&P 500 and NASDAQ 100 nonetheless have a approach to go earlier than nearing latest highs, nonetheless.

The mega-cap shares like Apple, Nvidia and Microsoft have been the large outperformers this 12 months which accounts to the divergence between cap weighted QQQ and equal weighted QQQE.

Friday, although, lastly confirmed some struggles for a few of these mega-cap names even with the indices closing greater. Microsoft (MSFT), one of many mega-cap leaders, was really down with each the S&P 500 and QQQ sharply greater.

Has the time arrived to start to fade the rally in these red-hot names? Let’s check out Microsoft utilizing the POWR Choices course of to see if the manic melt-up could also be beginning to stall in MSFT.

POWR Choices likes to make use of a mix of elementary and technical evaluation together with taking a look at implied volatility to uncover commerce concepts which have a probabilistic edge. This fusion strategy helps put the percentages in your favor. No assure (that is buying and selling, in any case) however an edge.

Let’s take a fast stroll via the strategy utilizing Microsoft for instance.

Valuation

Microsoft inventory is getting dear as soon as once more on a valuation foundation. Present Worth/Gross sales (P/S) ratio now stands on the highest degree this 12 months and the best since January 2022.

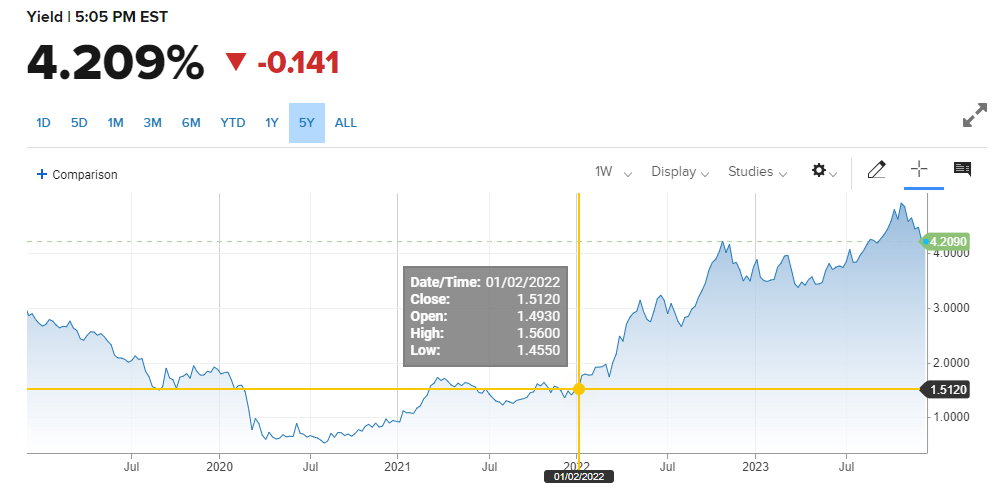

This despite the fact that the 10-year Treasury yield continues to be over 4% and the Fed Funds charge is at 5.25% to five.5%. Again in January 2022 (the final time MSFT carried such lofty multiples) the Federal Reserve hadn’t even begun to lift charges off zero and the 10-year yield was at simply over 1.5%.

To me, such historic will increase in rates of interest ought to dampen valuation multiples in a big means. Plus, a 2.78 trillion greenback market cap firm like Microsoft carrying a virtually 13x P/S ratio is troublesome to justify since development charges will essentially be lessened merely as a result of regulation of huge numbers.

Technicals

MSFT inventory can also be exhibiting some weak spot (lastly) from a technical perspective. Shares are struggling to interrupt previous the $380 space. 9-day RSI reached an excessive at 80 however has since fallen again to 56. Bollinger % B exceeded 100 and is now at 61. MACD additionally reached an excessive however simply generated a promote sign by going unfavorable. A break under the 20-day shifting common may result in additional draw back because it has performed previously.

Implied Volatility

Implied volatility (IV) is hovering on the lowest ranges of the previous 12 months. This implies choice costs are low-cost. A 12 months in the past, the 75-day at-the-money places had been buying and selling at simply over a 30 IV. Now the identical 75-day at-the-money places are buying and selling at only a 23 IV.

To place the places in perspective, the MSFT $255 places had been priced at $13.10 on 12/4/2022 with MSFT inventory at $255.02. Now, comparable $375 places are priced at $14.40 with MSFT inventory at $374.51. So, the 75-day places are solely $1.30 greater now despite the fact that Microsoft inventory is $120 factors greater! The share value of put protection-and put prices-has dropped significantly to say the least. From over 5% a 12 months in the past to beneath 4% now.

That is the commerce concept era course of we use each day for the POWR Choices Portfolio. Mix elementary, technical and implied volatility evaluation in a fusion format.

Buyers and merchants alike might wish to look to purchase places on an overvalued and overbought MSFT inventory. The inventory value hasn’t ever been this costly and the put costs this low-cost in a really very long time.

POWR Choices

What To Do Subsequent?

For those who’re in search of the very best choices trades for in the present day’s market, you need to try our newest presentation The right way to Commerce Choices with the POWR Rankings. Right here we present you the best way to persistently discover the highest choices trades, whereas minimizing threat.

If that appeals to you, and also you wish to be taught extra about this highly effective new choices technique, then click on under to get entry to this well timed funding presentation now:

The right way to Commerce Choices with the POWR Rankings

All of the Finest!

Tim Biggam

Editor, POWR Choices E-newsletter

MSFT shares closed at $374.51 on Friday, down $-4.40 (-1.16%). Yr-to-date, MSFT has gained 57.55%, versus a 21.38% rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Reside”. His overriding ardour is to make the advanced world of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices e-newsletter. Study extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The put up 3 Large Causes Why Microsoft Could Not Be A Purchase After Going To Excessive appeared first on StockNews.com