Sadly, we’re again to our ol’ 2022 sample of “wait and see,” the place the S&P 500 (SPY) type of churns sideways till the following massive CPI report or Fed assembly. However there are three issues I am awaiting over the following few weeks. Learn on to search out out what they’re.

(Please take pleasure in this up to date model of my weekly commentary initially printed February 10th, 2023 within the POWR Shares Underneath $10 e-newsletter).

Market Commentary

Every of those may make a significant distinction within the route the market strikes subsequent.

Essential Technical Assist/Resistance Ranges

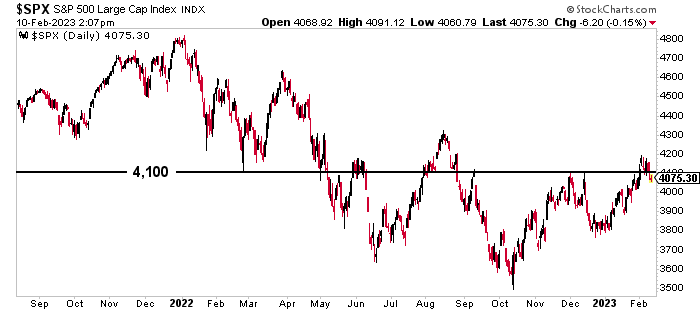

Since September, the S&P 500 (SPY) has been making an attempt to interrupt again above the 4,100 stage. This value has been an vital assist/resistance stage for the index since February 2022 (and even additional again, relying on who you speak to).

After breakouts failed in September, November, and December, we lastly had a big break above this stage in February…

…just for issues to crash again beneath after this week’s promoting.

Each time we fail to efficiently break above and STAY ABOVE this stage, the psychological resistance will get even stronger and subsequent breaks/failures develop into much more significant.

This doesn’t imply we’re going to see a speedy selloff (perhaps some mild promoting) subsequent week, however it does imply this stage will doubtless stay our ceiling till March’s FOMC assembly except we get a giant shock.

January CPI Report

…which we may doubtlessly get as quickly as subsequent week.

That is going to be crucial report to look at, and will probably be launched early on Tuesday morning. (Transfer over, Valentine’s Day.)

Hopefully, traders will LOVE the outcomes and our bull market will get some extra foundational assist as an alternative of the semi-exuberance that appears to have propelled the market within the first month of the 12 months.

Analysts are at the moment anticipating a small decline in inflation. The Fed has began acknowledging encouraging traits within the newest information releases, as nicely. (I discussed a few of this again in my January 13 evaluation of the December CPI report.)

However there’s an opportunity the information received’t be as reassuring as we hope. Sure power costs like crude are not declining, and wage progress and the labor market have each remained sturdy.

The massive wild card can be “shelter,” which has the most important single weighting within the CPI report, which has analysts blended on whether or not that can be larger or decrease.

Both means, the main points will present us whether or not Powell’s issues are deserved and whether or not we’ll get many extra price hikes on the subsequent few FOMC conferences. Which brings us to…

CME FedWatch Software

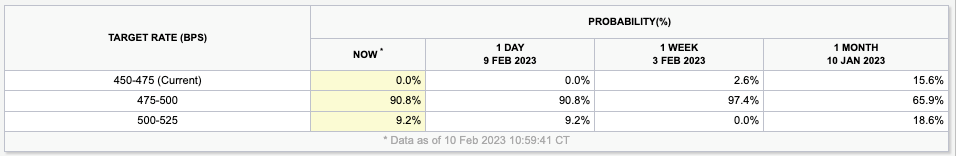

This can be a actually neat software that I’m certain a few of you might be already conscious of. It’s the CME FedWatch Software, and it reveals you precisely what’s “priced in” to the market by way of future price hikes.

And with the market hanging on the Fed’s each phrase, it’s one of the vital risk-assessment instruments we’ve got at our disposal.

…in different phrases, we’ve got a real-time take a look at what number of price hikes merchants are literally anticipating over the following 12 months, primarily based on the value motion we’re seeing in fed funds futures.

So, proper now, we will see that 100% of merchants imagine we’re going to get some type of price hike on the Fed’s March 22 assembly. The overwhelming majority of merchants imagine we’ll get one other 25-bps hike, whereas about 10% imagine we may see a 50-bps hike.

However what’s actually fascinating is that it additionally reveals what merchants had been considering at some point in the past, one week in the past, and one month in the past. Discover that, again on January 10, as many as 15% of merchants thought there was an opportunity that we might have NO price hike in March.

However after Powell’s February 1 press convention (the place he emphasised there was nonetheless extra work to be carried out) and the surprisingly sturdy January labor report, that quantity had dropped to solely 2.6%.

As soon as folks had just a little extra time to digest that information, the quantity dropped to 0%.

It’s no surprise the market rally has moderated. We’re nonetheless working beneath the concept that there’s a ceiling stopping any type of continued bull breakout for so long as we proceed to see rising rates of interest.

These numbers completely correspond to what we’re seeing out there…

January: “Hey, we would even be carried out with this complete price hike factor by March! Let’s get together!”

altering to

Feb. 3: “Hmmm, we’re in all probability going to get some type of price hike in March, however DEFINITELY not a giant one. Possibly I ought to cease shopping for a lot.”

altering to

Final Week: “Properly, we’re DEFINITELY going to get a 25-bps hike in March… and perhaps even a 50-bps hike. Possibly I ought to take a few of these January positive aspects off the desk…”

Possibly that’s just a little Monday morning quarterbacking, however you’ll be able to’t deny that the market’s greatest driver has been (and nonetheless is) financial coverage and the way excessive and the way lengthy the Fed goes to hike charges.

We’ve been speaking for months concerning the disconnect between what Powell says and the way the market acts and this software helps you monitor that in actual time.

Conclusion

I do know this commentary feels fairly bearish, however it’s really extra about being cautious. I believe there’s nonetheless an opportunity that we’re by the thick of it and we’ve got extra up in our future than down, however that’s not a certain factor but.

So we’re going to play issues protected for now… and kit up for subsequent week!

What To Do Subsequent?

In the event you’d prefer to see extra high shares beneath $10, then you must take a look at our free particular report:

What offers these shares the precise stuff to develop into massive winners, even on this brutal inventory market?

First, as a result of they’re all low priced corporations with probably the most upside potential in in the present day’s unstable markets.

However much more vital, is that they’re all high Purchase rated shares in line with our coveted POWR Scores system they usually excel in key areas of progress, sentiment and momentum.

Click on beneath now to see these 3 thrilling shares which may double or extra within the 12 months forward.

All of the Finest!

Meredith Margrave

Chief Development Strategist, StockNews

Editor, POWR Shares Underneath $10 E-newsletter

SPY shares closed at $408.04 on Friday, up $0.95 (+0.23%). Yr-to-date, SPY has gained 6.70%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Meredith Margrave

Meredith Margrave has been a famous monetary skilled and market commentator for the previous 20 years. She is at the moment the Editor of the POWR Development and POWR Shares Underneath $10 newsletters. Study extra about Meredith’s background, together with hyperlinks to her most up-to-date articles.

The submit 3 Key Indicators for the Week Forward appeared first on StockNews.com