Heaps has occurred previously two weeks and it has actually been a bumpy experience for the S&P 500 (SPY). Simply when it appeared like hotter-than-expected information factors have been pushing us towards a 50-bps price hike, we noticed two banks collapse seemingly out of the blue in a single week. Now the Federal Reserve has two massive issues on his fingers… Learn on to search out out what we are able to do about it.

(Please get pleasure from this up to date model of my weekly commentary initially revealed March 14th, 2023 from the POWR Development e-newsletter).

For anybody who has been ignoring the information the previous few days — as a result of that’s the solely means you’ll have missed this story — Silicon Valley Financial institution collapsed, sending your complete market right into a panic as everybody puzzled whether or not this may be an industry-wide drawback.

That panic continued Monday, when many came upon that authorities regulators had closed a second main financial institution (Signature Financial institution) over the weekend.

And whereas we did not see any extra banks go beneath yesterday, we did see buying and selling halted on almost two dozen banks.

SVB and Signature Financial institution have been the second- and third-largest financial institution failures, respectively, in U.S. historical past. So, even when it does not transform a systemic subject throughout the total financial institution {industry}, it is nonetheless form of a giant deal.

Particularly for those who’re Fed Chair Jerome Powell.

You see, Powell is now in a little bit of a pickle. Right now’s CPI numbers put inflation at 6%, which continues to be effectively above the Fed’s chosen 2% goal stage.

For the previous year-plus, the Fed has used rate of interest hikes as its weapon of option to curtail inflation. However rising charges are the perpetrator behind SVB’s sudden collapse.

As of this weekend, combating inflation is now not the Fed’s sole focus… it additionally wants to contemplate general monetary stability and lending circumstances.

A pause in price hikes could be finest for serving to stabilize banks… however as February’s CPI report reminded us this morning, inflation just isn’t dying out rapidly, which suggests there is a compelling case to proceed elevating charges.

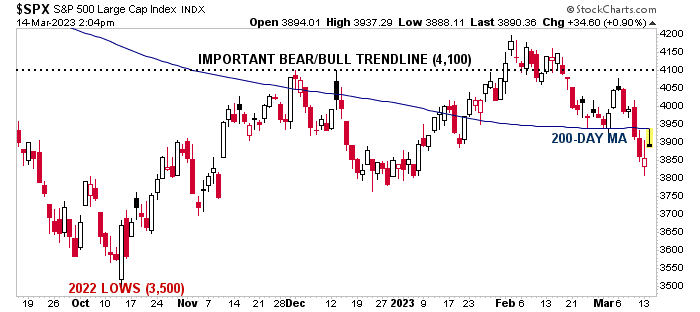

As will be seen for the under chart of the S&P 500 (SPY), shares at the moment are buying and selling again under the 200-day shifting common, which has been a relentless framework for bullish and bearish motion all through the Fed’s latest rate-hiking program.

What to do… what to do…

Personally, I am glad to not be in his footwear.

The subsequent Federal Reserve assembly is scheduled for March 21 and 22, and that may probably be the following massive market mover.

A pause could be good for banks however dangerous for the battle in opposition to inflation. A 50-bps hike could be good for the battle in opposition to inflation however dangerous for banks.

I anticipate they will break up the distinction and we’ll find yourself with a 25-bps hike, which would not do a lot for inflation and would put banks in a good tighter spot. So, form of the worst of each worlds.

On that observe, I need to take a step again in order that we are able to take a step ahead.

POWR Development operates on a particular constitution. Our purpose is to search out and personal the very best progress shares, with assist from the POWR Scores system. That is an important technique, and one which’s been worthwhile for a few years. It is an important piece of a well-balanced portfolio.

Nevertheless, it doesn’t provide a lot flexibility in occasions of market uncertainty. Our greatest hedge in opposition to a bear market or recession might be (1) sustaining a considerable amount of money and (2) looking for the expansion shares outperforming in a tricky surroundings.

There are different companies in our arsenal which are constructed for versatility. If that is one thing you are searching for, I like to recommend testing Tim Biggam’s POWR Choices, which might revenue from each ups and downs available in the market utilizing places and calls.

There’s additionally Reitmeister Whole Return, which seeks to generate optimistic returns regardless of the market circumstances utilizing U.S. shares, in addition to ETFs monitoring gold, bonds, inverse efficiency… sky is the restrict.

Now, I am not saying it is inconceivable for us to generate a revenue on this market with out entry to those self same instruments.

THIS IS NOT A WHITE FLAG OF SURRENDER.

However I do need to make certain we’re all on the identical web page with what this technique can and might’t do. And proper now, resulting from unfavorable market circumstances, we’re buying and selling with one hand behind our again.

Conclusion

I do know; we’re closing out a giant chunk of our portfolio right this moment. That wasn’t by design and even essentially intent. It is simply what I am seeing wanting on the information, every inventory’s basic outlook, and looking out on the worth motion.

It is attention-grabbing that this strains up remarkably carefully with our two hedge actions — shifting to majority money and discovering the outperformers in a tricky surroundings.

Regardless of what we’re up in opposition to, I am at all times looking out for progress shares so as to add to our portfolio, and really simply began wanting right into a recent decide.

Assuming my analysis does not reveal any main headwinds, we must be placing a few of our money to good use within the subsequent 24 hours.

What To Do Subsequent?

See my prime shares for right this moment’s market contained in the POWR Development portfolio.

This unique portfolio will get most of its recent picks from our confirmed “Prime 10 Development Shares” technique which has produced stellar common annual returns of +46.85%.

And sure, it continues to outperform by a large margin even in these tough and tumble markets.

If you need to see the present portfolio of progress shares, and be alerted to our subsequent well timed trades, then take into account beginning a 30 day trial by clicking the hyperlink under.

About POWR Development e-newsletter & 30 Day Trial

All of the Finest!

Meredith Margrave

Chief Development Strategist, StockNews

Editor, POWR Development Publication

SPY shares have been buying and selling at $385.61 per share on Wednesday afternoon, down $6.12 (-1.56%). 12 months-to-date, SPY has gained 0.83%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Meredith Margrave

Meredith Margrave has been a famous monetary professional and market commentator for the previous 20 years. She is presently the Editor of the POWR Development and POWR Shares Beneath $10 newsletters. Be taught extra about Meredith’s background, together with hyperlinks to her most up-to-date articles.

The put up 2 Large Issues the Feds Need to Overcome… appeared first on StockNews.com